The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Voronoi, Inc. (KOSDAQ:310210) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Voronoi

What Is Voronoi's Debt?

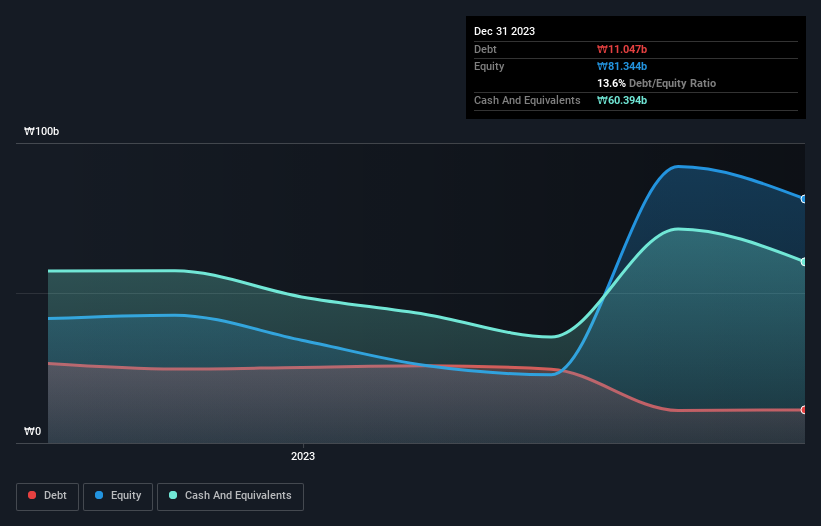

As you can see below, Voronoi had ₩11.0b of debt at December 2023, down from ₩25.2b a year prior. But it also has ₩60.4b in cash to offset that, meaning it has ₩49.3b net cash.

How Healthy Is Voronoi's Balance Sheet?

We can see from the most recent balance sheet that Voronoi had liabilities of ₩12.5b falling due within a year, and liabilities of ₩819.2m due beyond that. Offsetting these obligations, it had cash of ₩60.4b as well as receivables valued at ₩148.0m due within 12 months. So it can boast ₩47.2b more liquid assets than total liabilities.

This surplus suggests that Voronoi has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Voronoi has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Voronoi's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, Voronoi shareholders no doubt hope it can fund itself until it has a profitable product.

So How Risky Is Voronoi?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Voronoi lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through ₩30b of cash and made a loss of ₩37b. However, it has net cash of ₩49.3b, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Voronoi is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A310210

Voronoi

Researches, develops, and discovers small molecule kinase inhibitors in South Korea.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026