- South Korea

- /

- Biotech

- /

- KOSDAQ:A298380

Three High Growth Tech Stocks to Watch

Reviewed by Simply Wall St

In a week marked by mixed performances across major stock indexes, growth stocks have notably outperformed value stocks, with the S&P 500 and Nasdaq Composite reaching record highs. Amid this backdrop of economic indicators and market sentiment, identifying high-growth tech stocks that can capitalize on these trends involves looking for companies with strong innovation potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1293 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

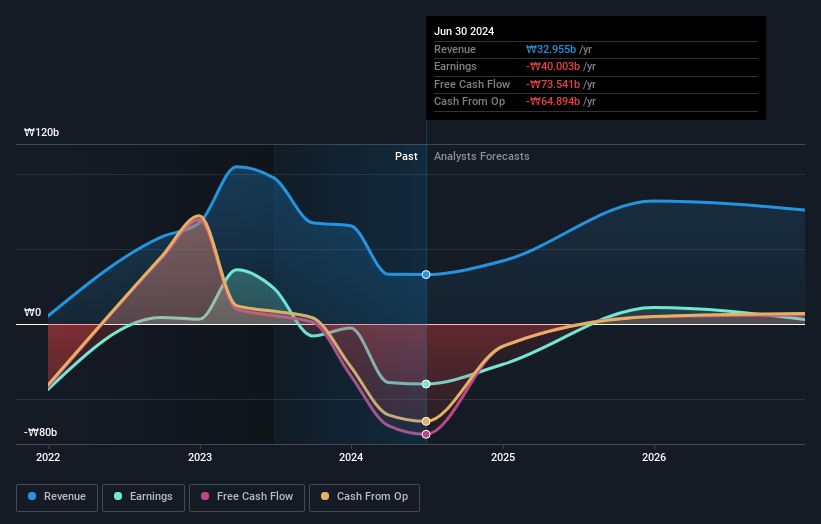

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.43 trillion.

Operations: ABL Bio Inc. generates revenue primarily from its biotechnology segment, particularly focusing on startups, which contributed ₩32.32 billion. The company is involved in the research and development of therapeutic drugs targeting immuno-oncology and neurodegenerative diseases.

ABL Bio, with its recent presentation at the World ADC Conference, underscores its commitment to advancing antibody-drug conjugates, a cutting-edge sector within biotechnology. Despite being unprofitable currently, ABL Bio is poised for significant growth with revenue expected to increase by 25.5% annually, outpacing the Korean market's 8.9%. Additionally, earnings are projected to surge by 50.32% per year. However, it's important to note the company's R&D expenses are substantial as it invests heavily in innovation and development of new therapies. This strategic focus on R&D may well position ABL Bio at the forefront of biotechnological advancements but also reflects a high-risk profile given its current lack of profitability and highly volatile share price.

- Dive into the specifics of ABL Bio here with our thorough health report.

Gain insights into ABL Bio's historical performance by reviewing our past performance report.

Taiji Computer (SZSE:002368)

Simply Wall St Growth Rating: ★★★★☆☆

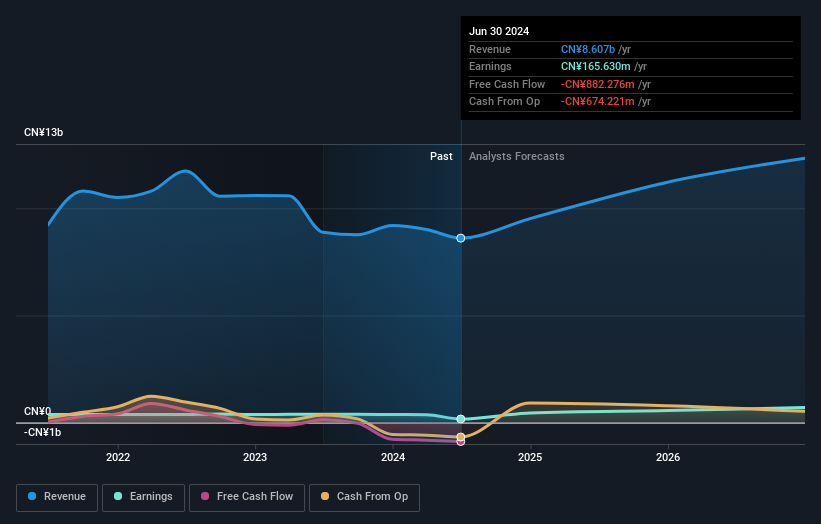

Overview: Taiji Computer Corporation Limited operates as a software and information technology service company with a market capitalization of CN¥16.78 billion.

Operations: The company generates revenue primarily from software development and IT services, focusing on sectors such as government, finance, and energy. It leverages its technological expertise to provide customized solutions tailored to client needs.

Taiji Computer has faced a challenging fiscal period with revenues dropping to CNY 4.34 billion from CNY 5.22 billion year-over-year and swinging to a net loss of CNY 28.28 million from a prior net income of CNY 132 million. Despite these setbacks, forecasts indicate an optimistic turnaround with expected revenue and earnings growth rates of 15.9% and 37.5% per year, respectively, outpacing broader market projections. This growth is underpinned by strategic investments in R&D which are crucial for maintaining competitive edge in the rapidly evolving tech landscape; however, these investments also contribute significantly to current financial strains as reflected in recent substantial losses.

- Click to explore a detailed breakdown of our findings in Taiji Computer's health report.

Assess Taiji Computer's past performance with our detailed historical performance reports.

General Interface Solution (GIS) Holding (TWSE:6456)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: General Interface Solution (GIS) Holding Limited offers touch and display module solutions across various international markets, with a market capitalization of NT$17.23 billion.

Operations: GIS Holding Limited specializes in the lamination process of various touch panels, generating revenue of NT$68.65 billion. The company operates across key markets including the United States, China, Japan, and Taiwan.

General Interface Solution (GIS) Holding Limited has demonstrated resilience with a recent uptick in sales to TWD 18.37 billion, marking an increase from the previous year's TWD 17.39 billion, despite ongoing challenges including a net loss reduction to TWD 55.41 million from a staggering TWD 806.54 million year-over-year. This improvement is pivotal as the company navigates through financial recovery phases, supported by strategic R&D investments which are essential for sustaining innovation and competitiveness in the tech sector. Notably, GIS is poised for future growth with revenue projections increasing at an annual rate of 13.9%, and earnings expected to surge by an impressive 128.1%. These figures underscore GIS's potential turnaround from its current unprofitable status, driven by robust market strategies and operational enhancements that could set new benchmarks within its industry segment.

Key Takeaways

- Take a closer look at our High Growth Tech and AI Stocks list of 1293 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A298380

ABL Bio

A biotech research company, focuses on the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases.

High growth potential with adequate balance sheet.