- South Korea

- /

- Biotech

- /

- KOSDAQ:A086900

High Growth Tech And 2 Other Promising Stocks With Potential Expansion

Reviewed by Simply Wall St

In recent weeks, the global markets have shown mixed performance, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks, as represented by the Russell 2000 Index, experienced a decline after outperforming larger-cap peers in previous weeks. This divergence highlights the importance of identifying stocks with strong growth potential in sectors that are currently gaining momentum, such as consumer discretionary and information technology. For investors looking at high-growth tech opportunities and other promising stocks with potential for expansion, focusing on companies that demonstrate robust fundamentals and adaptability to economic shifts can be crucial in navigating these dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1293 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Eutelsat Group (ENXTPA:ETL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Eutelsat Group, along with its subsidiaries, operates telecommunication satellites and has a market capitalization of approximately €1.52 billion.

Operations: The Group generates revenue primarily from satellite-based video, business and broadband networks, and mobile services, totaling €1.21 billion. The company's net profit margin exhibits notable variation across reporting periods.

Eutelsat Group's recent partnership with Clear Blue Technologies underscores its strategic move to enhance connectivity solutions across Africa, integrating smart energy solutions into its platforms. This collaboration not only expands Eutelsat's service offerings but also positions it to leverage the growing demand for reliable internet access in energy-constrained environments. With a revenue growth forecast of 7.5% per year, surpassing the French market average of 5.6%, and an impressive earnings growth projection at 73.41% annually, Eutelsat is setting a robust trajectory towards profitability within three years. These developments highlight Eutelsat’s proactive approach in adapting to market needs and innovating beyond traditional satellite services, which could significantly influence its financial health and competitive stance in the global market.

- Click to explore a detailed breakdown of our findings in Eutelsat Group's health report.

Understand Eutelsat Group's track record by examining our Past report.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

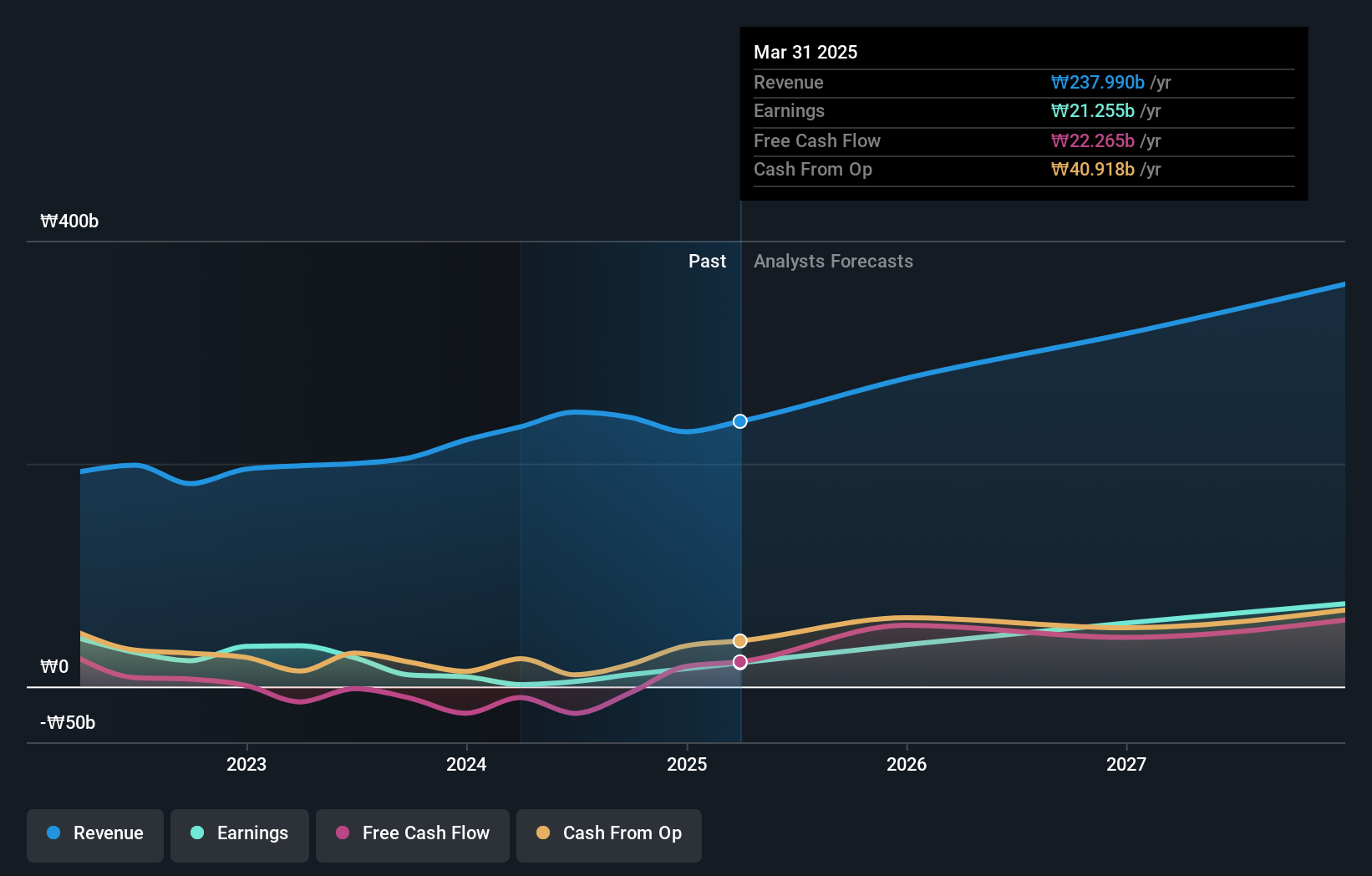

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea with a market capitalization of ₩925.55 billion.

Operations: Medy-Tox Inc. generates revenue primarily from its biotechnology segment, amounting to approximately ₩241.45 billion.

Medy-Tox Inc. demonstrates a promising trajectory in the biotech sector with its recent aggressive share repurchase program, signaling confidence in its financial health and future prospects. The company has recently completed significant buybacks, repurchasing 23,828 shares for KRW 3.11 billion, reflecting a strategic effort to enhance shareholder value amidst market volatility. Furthermore, Medy-Tox is expected to see substantial earnings growth at an annual rate of 63.3%, outpacing the broader KR market's average of 28.7%. This robust forecast is underpinned by a revenue growth prediction of 14.2% per year, significantly higher than the market average of 8.9%, showcasing its potential to outperform in a competitive industry landscape.

- Navigate through the intricacies of Medy-Tox with our comprehensive health report here.

Review our historical performance report to gain insights into Medy-Tox's's past performance.

Asiainfo Security TechnologiesLtd (SHSE:688225)

Simply Wall St Growth Rating: ★★★★☆☆

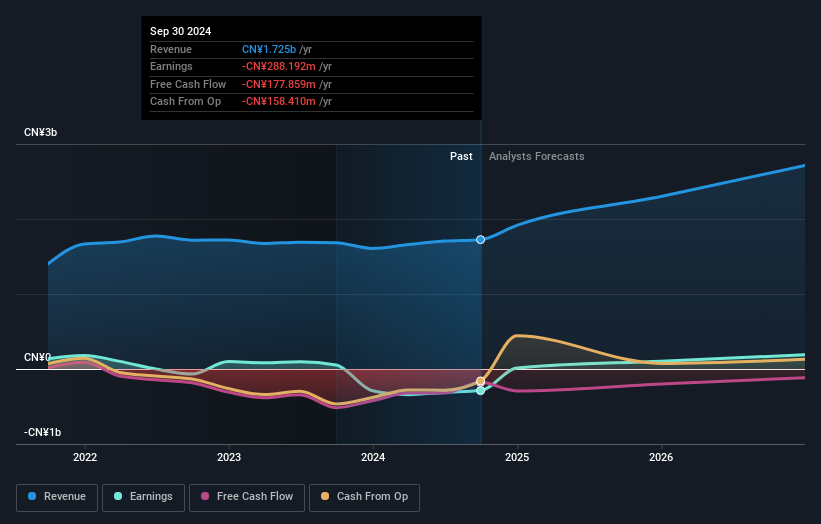

Overview: Asiainfo Security Technologies Co., Ltd. offers network security software solutions both within China and internationally, with a market capitalization of CN¥8.70 billion.

Operations: The company specializes in network security software, generating revenue primarily from software sales and related services. It operates both domestically in China and internationally, focusing on cybersecurity solutions.

Asiainfo Security TechnologiesLtd., amidst a challenging financial landscape, shows potential with its robust revenue growth forecast at 19.6% annually, outpacing the Chinese market's average of 13.7%. Despite current unprofitability, the company is poised for a significant turnaround with earnings expected to surge by 115.2% per year. This growth is underpinned by substantial R&D investments which have been integral in driving innovation and maintaining competitive edge in the cybersecurity sector. The firm's commitment to research has not only fueled advancements but also strategically positioned it for future profitability and industry leadership in a rapidly evolving tech landscape.

Seize The Opportunity

- Delve into our full catalog of 1293 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Medy-Tox, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A086900

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives