- South Korea

- /

- Entertainment

- /

- KOSE:A352820

3 Growth Companies On KRX With Insider Ownership And Up To 64% Revenue Growth

Reviewed by Simply Wall St

The South Korean market has shown stability, remaining flat over the last week and posting a 3.8% increase over the past year, with earnings projected to grow by 30% annually. In this environment, identifying growth companies with significant insider ownership can be crucial as these stocks often align management interests with shareholder value and may capitalize on favorable market conditions.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Park Systems (KOSDAQ:A140860) | 33% | 34.6% |

| Vuno (KOSDAQ:A338220) | 19.4% | 110.9% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Here's a peek at a few of the choices from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.11 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion.

Insider Ownership: 26.6%

Revenue Growth Forecast: 64.2% p.a.

ALTEOGEN is forecast to experience significant growth, with revenue expected to increase 64.2% annually, surpassing the South Korean market average. The company is anticipated to become profitable within three years, with earnings projected to grow 99.46% per year and a high return on equity of 66.3%. Currently trading at 71% below estimated fair value, ALTEOGEN presents potential for strong growth despite recent shareholder dilution and lack of substantial insider buying or selling activity recently.

- Take a closer look at ALTEOGEN's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, ALTEOGEN's share price might be too optimistic.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.99 trillion.

Operations: The company's revenue segment primarily comprises biotechnology startups, generating ₩32.95 billion.

Insider Ownership: 30.5%

Revenue Growth Forecast: 24.7% p.a.

ABL Bio is positioned for substantial growth, with its revenue projected to expand at 24.7% annually, outpacing the South Korean market average. The company is expected to achieve profitability within three years, reflecting above-average market growth. Despite a highly volatile share price recently and a forecasted low return on equity of 13%, ABL Bio's potential for rapid revenue increase remains compelling, with no significant insider trading activity in the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of ABL Bio.

- Insights from our recent valuation report point to the potential overvaluation of ABL Bio shares in the market.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

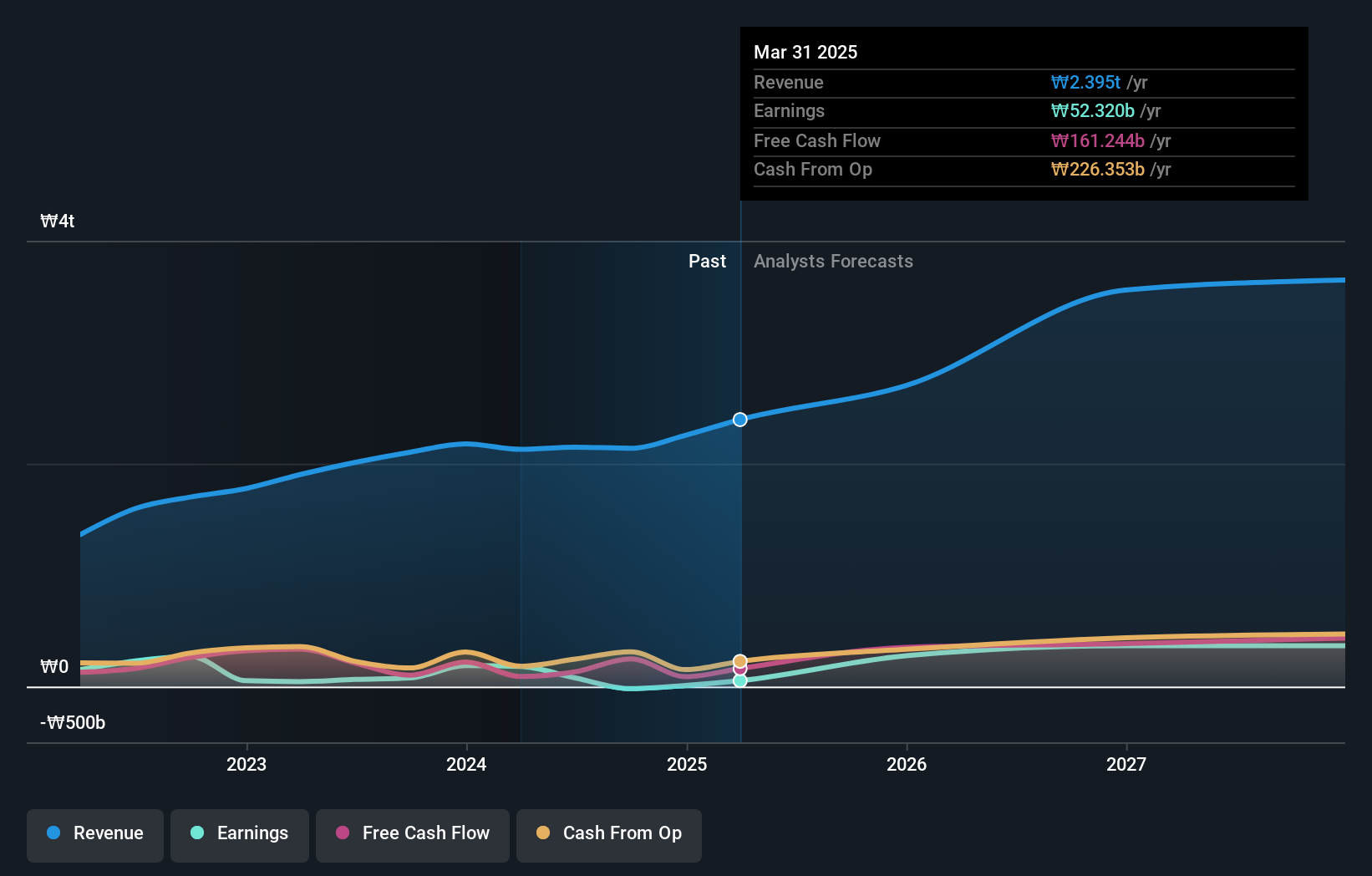

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩7.68 trillion.

Operations: The company's revenue segments include Label at ₩1.28 trillion, Platform at ₩361.12 billion, and Solution at ₩1.24 trillion.

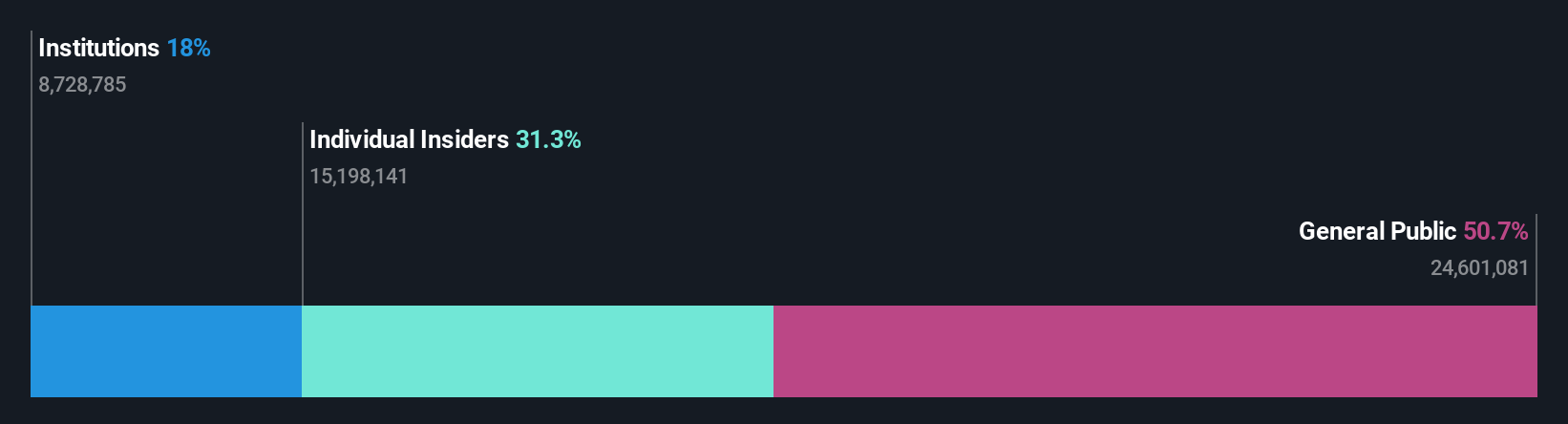

Insider Ownership: 32.5%

Revenue Growth Forecast: 14.0% p.a.

HYBE's growth prospects are strong, with earnings expected to rise significantly at 42.6% annually, surpassing the South Korean market average. Despite recent financial challenges, including a substantial drop in net income and earnings per share compared to last year, revenue is forecasted to grow faster than the market at 14% annually. The company has completed a share buyback of KRW 26.09 billion for price stabilization and trades below its estimated fair value by 22%.

- Dive into the specifics of HYBE here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of HYBE shares in the market.

Turning Ideas Into Actions

- Click here to access our complete index of 86 Fast Growing KRX Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.