- South Korea

- /

- Biotech

- /

- KOSDAQ:A293780

Investors in AptaBio Therapeutics (KOSDAQ:293780) from three years ago are still down 78%, even after 10% gain this past week

AptaBio Therapeutics Inc. (KOSDAQ:293780) shareholders should be happy to see the share price up 12% in the last month. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 78% in that time. Arguably, the recent bounce is to be expected after such a bad drop. But the more important question is whether the underlying business can justify a higher price still.

On a more encouraging note the company has added ₩18b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for AptaBio Therapeutics

AptaBio Therapeutics recorded just ₩2,906,176,830 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that AptaBio Therapeutics comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). AptaBio Therapeutics has already given some investors a taste of the bitter losses that high risk investing can cause.

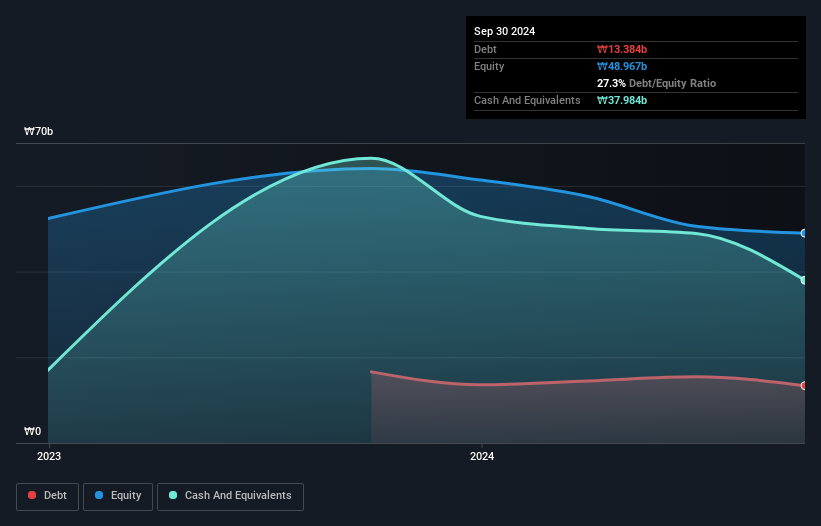

When it reported in September 2024 AptaBio Therapeutics had minimal cash in excess of all liabilities consider its expenditure: just ₩3.6b to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. With that in mind, you can understand why the share price dropped 21% per year, over 3 years. The image below shows how AptaBio Therapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

While the broader market lost about 6.9% in the twelve months, AptaBio Therapeutics shareholders did even worse, losing 17%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand AptaBio Therapeutics better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with AptaBio Therapeutics , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A293780

AptaBio Therapeutics

A biopharmaceutical company, develops platform based drugs for intractable diseases.

Excellent balance sheet very low.

Market Insights

Community Narratives