David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Huons Co., Ltd. (KOSDAQ:243070) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Huons

What Is Huons's Net Debt?

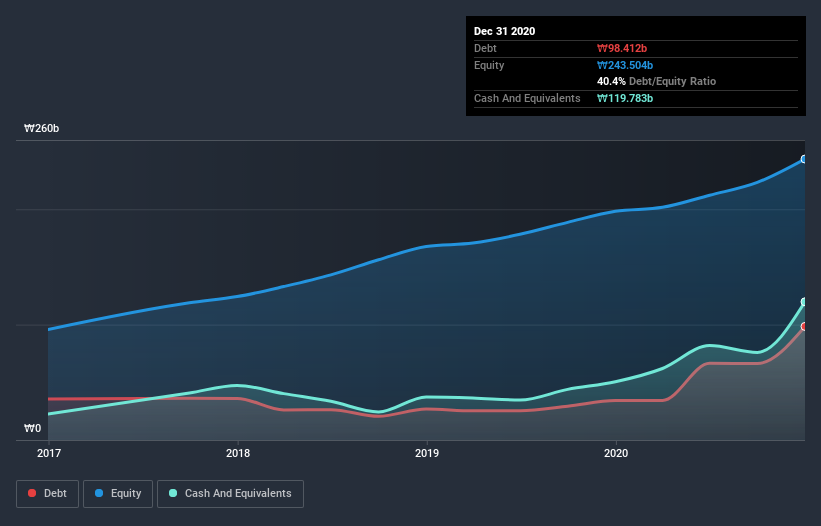

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Huons had ₩98.4b of debt, an increase on ₩34.2b, over one year. However, it does have ₩119.8b in cash offsetting this, leading to net cash of ₩21.4b.

How Healthy Is Huons' Balance Sheet?

We can see from the most recent balance sheet that Huons had liabilities of ₩125.0b falling due within a year, and liabilities of ₩48.0b due beyond that. Offsetting these obligations, it had cash of ₩119.8b as well as receivables valued at ₩79.8b due within 12 months. So it can boast ₩26.6b more liquid assets than total liabilities.

This short term liquidity is a sign that Huons could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Huons has more cash than debt is arguably a good indication that it can manage its debt safely.

Also good is that Huons grew its EBIT at 12% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Huons can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Huons has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Huons's free cash flow amounted to 28% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While it is always sensible to investigate a company's debt, in this case Huons has ₩21.4b in net cash and a decent-looking balance sheet. On top of that, it increased its EBIT by 12% in the last twelve months. So we don't have any problem with Huons's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Huons (1 is significant) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Huons, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Huons, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huons might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A243070

Huons

Provides medical solutions for human health in Korea and internationally.

Excellent balance sheet low.