- South Korea

- /

- Pharma

- /

- KOSDAQ:A237690

ST Pharm Co.,Ltd.'s (KOSDAQ:237690) Shares Climb 29% But Its Business Is Yet to Catch Up

The ST Pharm Co.,Ltd. (KOSDAQ:237690) share price has done very well over the last month, posting an excellent gain of 29%. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

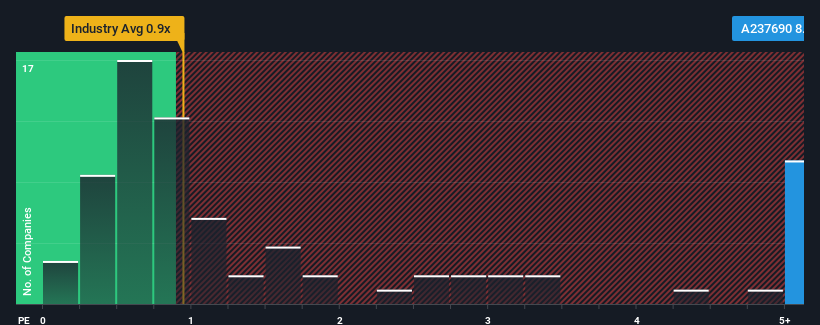

After such a large jump in price, given around half the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider ST PharmLtd as a stock to avoid entirely with its 8.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for ST PharmLtd

What Does ST PharmLtd's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, ST PharmLtd has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ST PharmLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like ST PharmLtd's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 23% per year over the next three years. That's shaping up to be similar to the 24% per annum growth forecast for the broader industry.

With this information, we find it interesting that ST PharmLtd is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On ST PharmLtd's P/S

ST PharmLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given ST PharmLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 3 warning signs for ST PharmLtd you should be aware of.

If you're unsure about the strength of ST PharmLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A237690

ST PharmLtd

Provides custom manufacturing services for active pharmaceutical ingredient and intermediates in South Korea and internationally.

Solid track record with excellent balance sheet.