- South Korea

- /

- Biotech

- /

- KOSDAQ:A228760

Exploring None And Two Other High Growth Tech Stocks For Potential Gains

Reviewed by Simply Wall St

As global markets navigate a landscape marked by stronger-than-expected U.S. labor market data, inflation concerns, and political uncertainties, small-cap stocks have notably underperformed their large-cap counterparts with the Russell 2000 Index dipping into correction territory. Amidst these choppy conditions, investors are keenly observing high-growth tech stocks for potential opportunities; such stocks often demonstrate robust innovation and adaptability—qualities that can be particularly advantageous in uncertain economic climates.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.11% | 32.25% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

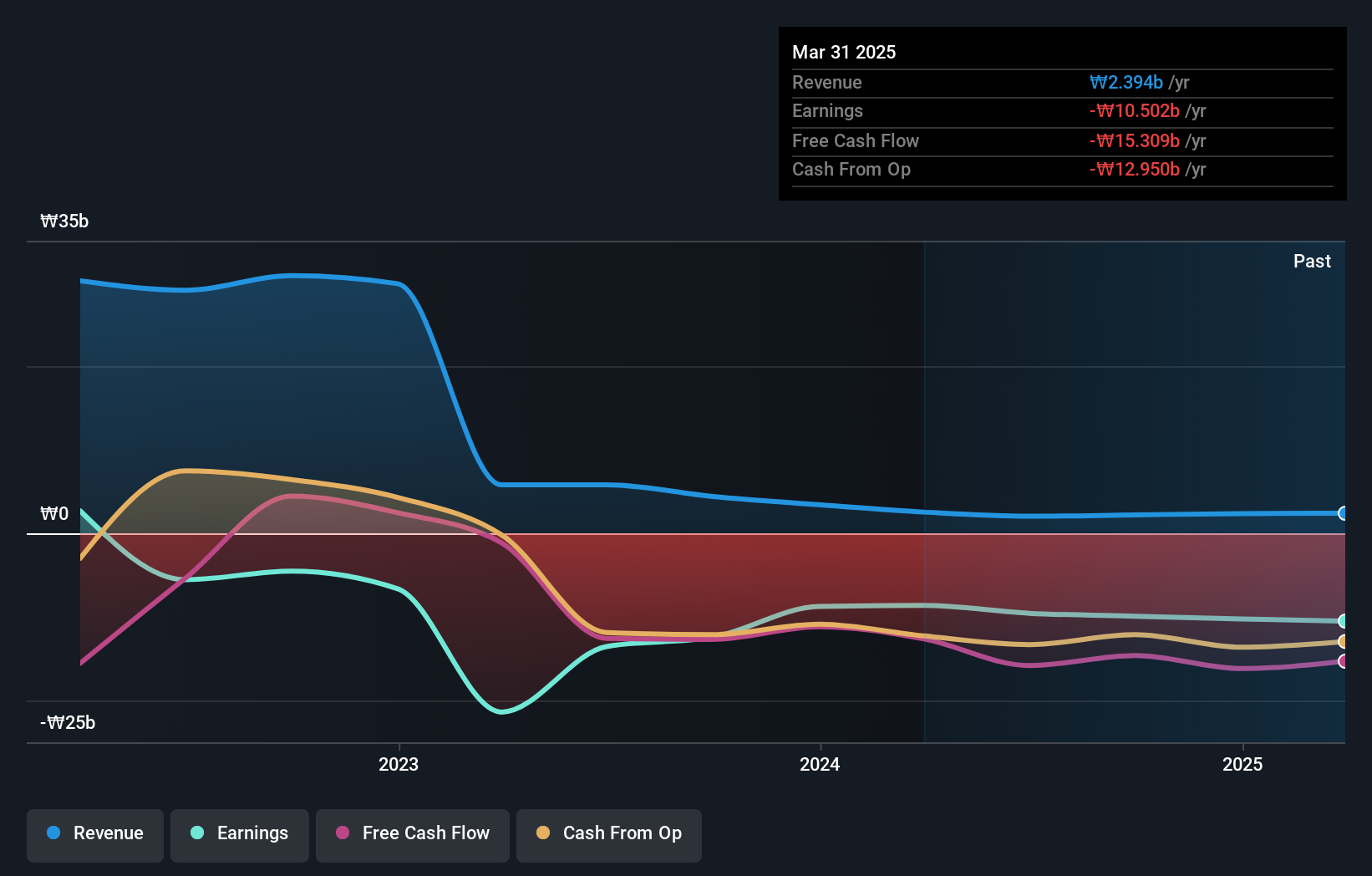

Overview: Genomictree Inc., a biomarker-based molecular diagnostics company, focuses on developing and commercializing products for detecting cancer and infectious diseases, with a market cap of approximately ₩476.92 billion.

Operations: The company primarily generates revenue through its Cancer Molecular Diagnosis Business, contributing ₩2.06 billion, while its Genomic Analysis segment adds ₩144 million.

Genomictree, despite its current lack of profitability and minimal revenue at ₩2B, is poised for significant growth with a forecasted annual revenue increase of 97.8%, outpacing the Korean market's average of 9.3%. The company's earnings are also expected to surge by 115.9% annually. However, it faces challenges with a highly volatile share price and a projected low return on equity at 5.7% in three years. These figures suggest that while Genomictree is navigating early-stage hurdles, its aggressive growth metrics indicate potential for substantial future gains in the biotech sector.

- Delve into the full analysis health report here for a deeper understanding of Genomictree.

Gain insights into Genomictree's historical performance by reviewing our past performance report.

DeNA (TSE:2432)

Simply Wall St Growth Rating: ★★★★☆☆

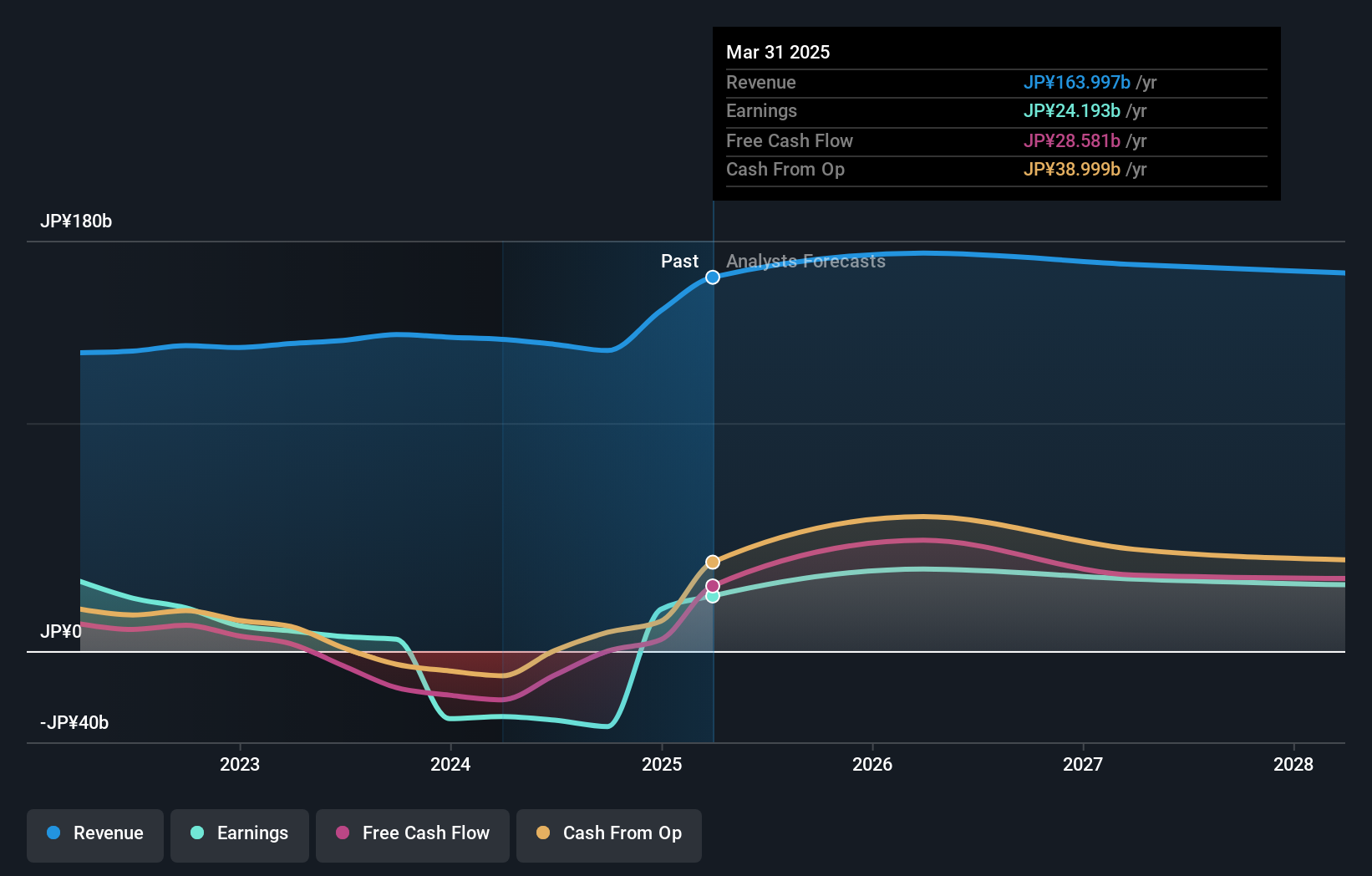

Overview: DeNA Co., Ltd. is a company that develops and operates mobile and online services globally, with a market capitalization of ¥309.51 billion.

Operations: DeNA generates revenue primarily through its Game Business, Sports Businesses, Livestreaming Business, and Healthcare & Medical Business. The Game Business is the largest segment with revenue of ¥50.20 billion, followed by Livestreaming at ¥41.37 billion.

DeNA, navigating through a highly competitive tech landscape, has its revenue projected to grow at 4.6% annually, slightly above Japan's market average of 4.3%. Despite current unprofitability, the company is expected to pivot into profitability within three years with an impressive annual earnings growth forecast at 81.85%. This shift is underpinned by strategic R&D investments that are crucial for sustaining innovation and competitiveness in evolving markets. However, potential investors should be wary of its volatile share price and a forecasted low return on equity at 5.6%, which could suggest challenges in generating shareholder value in the near term.

- Click here and access our complete health analysis report to understand the dynamics of DeNA.

Explore historical data to track DeNA's performance over time in our Past section.

Lotes (TWSE:3533)

Simply Wall St Growth Rating: ★★★★★☆

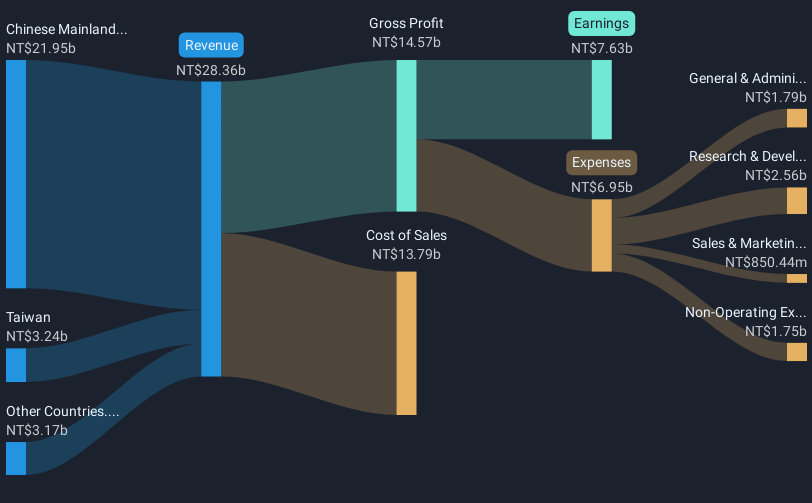

Overview: Lotes Co., Ltd is a company that specializes in designing, manufacturing, and selling electronic interconnect and hardware components across Taiwan, Mainland China, and international markets with a market cap of NT$196.37 billion.

Operations: Lotes generates revenue primarily from its electronic components and parts segment, amounting to NT$28.36 billion. The company operates in Taiwan, Mainland China, and international markets.

Lotes has demonstrated robust growth with a notable 31.8% increase in earnings over the past year, surpassing the electronics industry's average of 6.6%. This performance is underpinned by strategic R&D investments, which have been pivotal in sustaining its competitive edge and innovation. The company’s recent financials reveal a significant rise in sales to TWD 21.79 billion from TWD 17.91 billion year-over-year and an increase in net income to TWD 6.37 billion, up from TWD 4.33 billion, reflecting strong operational execution and market responsiveness. With an expected annual profit growth rate of 20.3%, Lotes is positioned well above Taiwan's market average of 18.9%, indicating potential for continued upward trajectory amidst evolving tech landscapes.

- Take a closer look at Lotes' potential here in our health report.

Assess Lotes' past performance with our detailed historical performance reports.

Taking Advantage

- Delve into our full catalog of 1227 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A228760

Genomictree

A biomarker-based molecular diagnostics company, develops and commercializes molecular diagnostic products for the detection of cancer and various infectious diseases.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026