- South Korea

- /

- Biotech

- /

- KOSDAQ:A217730

Would Shareholders Who Purchased Kang Stem Biotech's (KOSDAQ:217730) Stock Three Years Be Happy With The Share price Today?

Kang Stem Biotech Co., Ltd. (KOSDAQ:217730) shareholders should be happy to see the share price up 14% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 39% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Kang Stem Biotech

Kang Stem Biotech wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

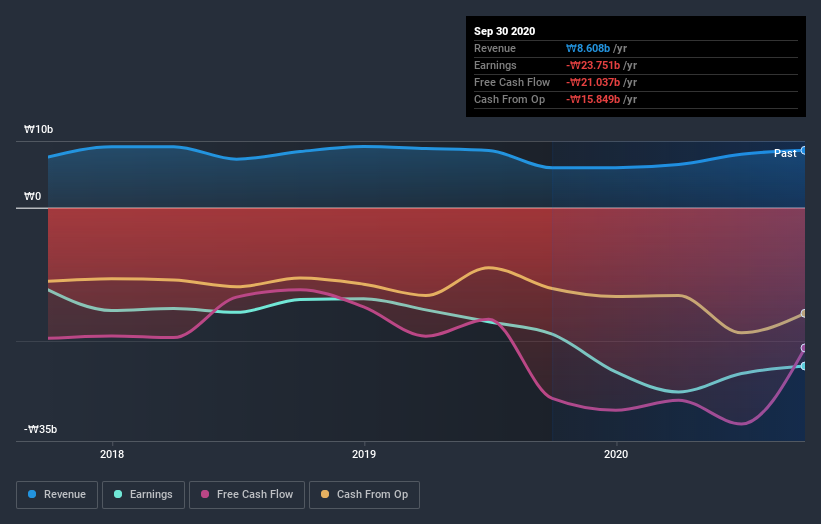

In the last three years Kang Stem Biotech saw its revenue shrink by 5.4% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 12%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Kang Stem Biotech's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Kang Stem Biotech's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Kang Stem Biotech hasn't been paying dividends, but its TSR of -35% exceeds its share price return of -39%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Kang Stem Biotech had a tough year, with a total loss of 4.2%, against a market gain of about 31%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 5% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Kang Stem Biotech is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Of course Kang Stem Biotech may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Kang Stem Biotech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kangstem Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A217730

Kangstem Biotech

A biopharmaceutical company, develops stem cell therapeutic products for rare and incurable diseases.

Flawless balance sheet and slightly overvalued.