- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, smaller-cap indexes have faced notable challenges, with the S&P 500 experiencing its longest streak of more decliners than gainers since 1978. In this environment, identifying high growth tech stocks becomes crucial as investors seek companies with robust innovation potential and adaptability to thrive amid shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

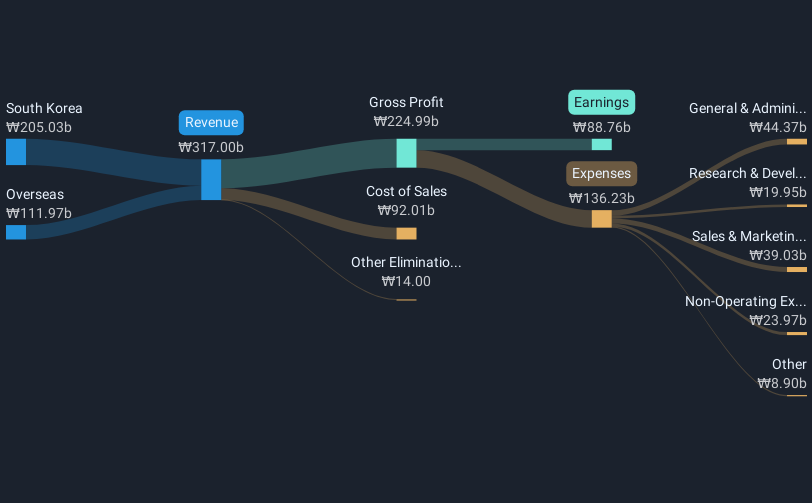

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market capitalization of ₩2.77 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to ₩317 billion.

PharmaResearch continues to outpace the biotech industry, with a remarkable earnings growth of 36.8% over the past year, significantly higher than the industry's average of 7.9%. This performance is underpinned by robust annual revenue growth projections at 24.2%, surpassing Korea's market average of 8.8%. The company has also demonstrated commitment to innovation with substantial R&D investments, which are crucial for sustaining its competitive edge and supporting future growth in a rapidly evolving sector. These financial dynamics are complemented by strategic moves such as the recent private placement that could further bolster its research capabilities and market position.

- Take a closer look at PharmaResearch's potential here in our health report.

Explore historical data to track PharmaResearch's performance over time in our Past section.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

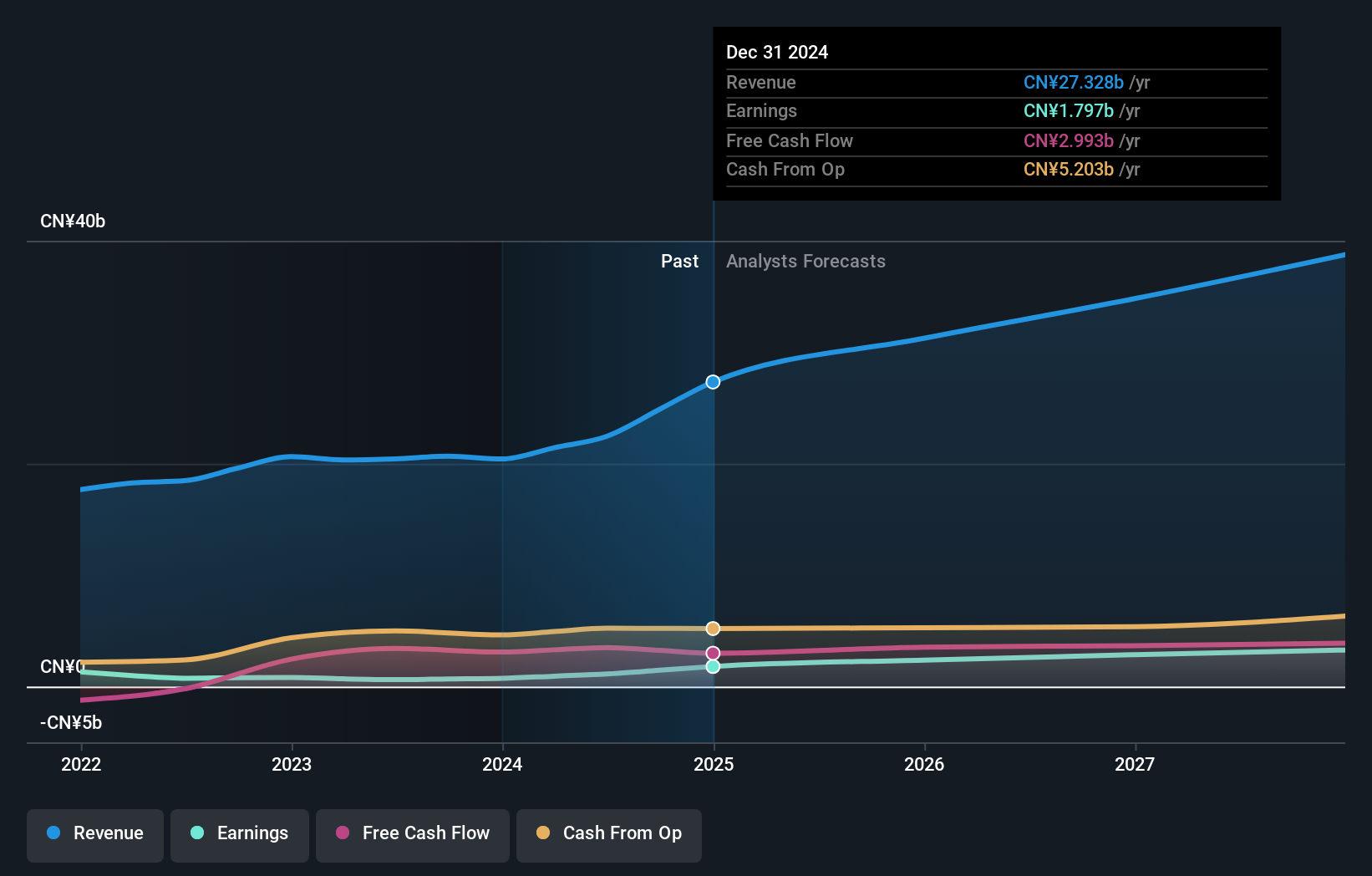

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe with a market capitalization of HK$44.40 billion.

Operations: AAC Technologies Holdings generates revenue primarily from its Acoustics Products and Electromagnetic Drives and Precision Mechanics segments, contributing CN¥7.64 billion and CN¥8.28 billion respectively. The company's diverse product offerings cater to the smart device sector across multiple regions, including Asia, the United States, and Europe.

AAC Technologies recently initiated a share repurchase program, signaling confidence in its financial health and future prospects. This move aligns with its robust earnings growth of 22.2% annually, outpacing the Hong Kong market's average. The company's commitment to innovation is evident from its R&D spending, crucial for maintaining competitive advantage in the fast-paced tech sector. With revenue growth also exceeding market trends at 12.7% annually, AAC stands out for its strategic initiatives and solid financial performance despite not being the top player in high-growth tech sectors.

LUSTER LightTech (SHSE:688400)

Simply Wall St Growth Rating: ★★★★★☆

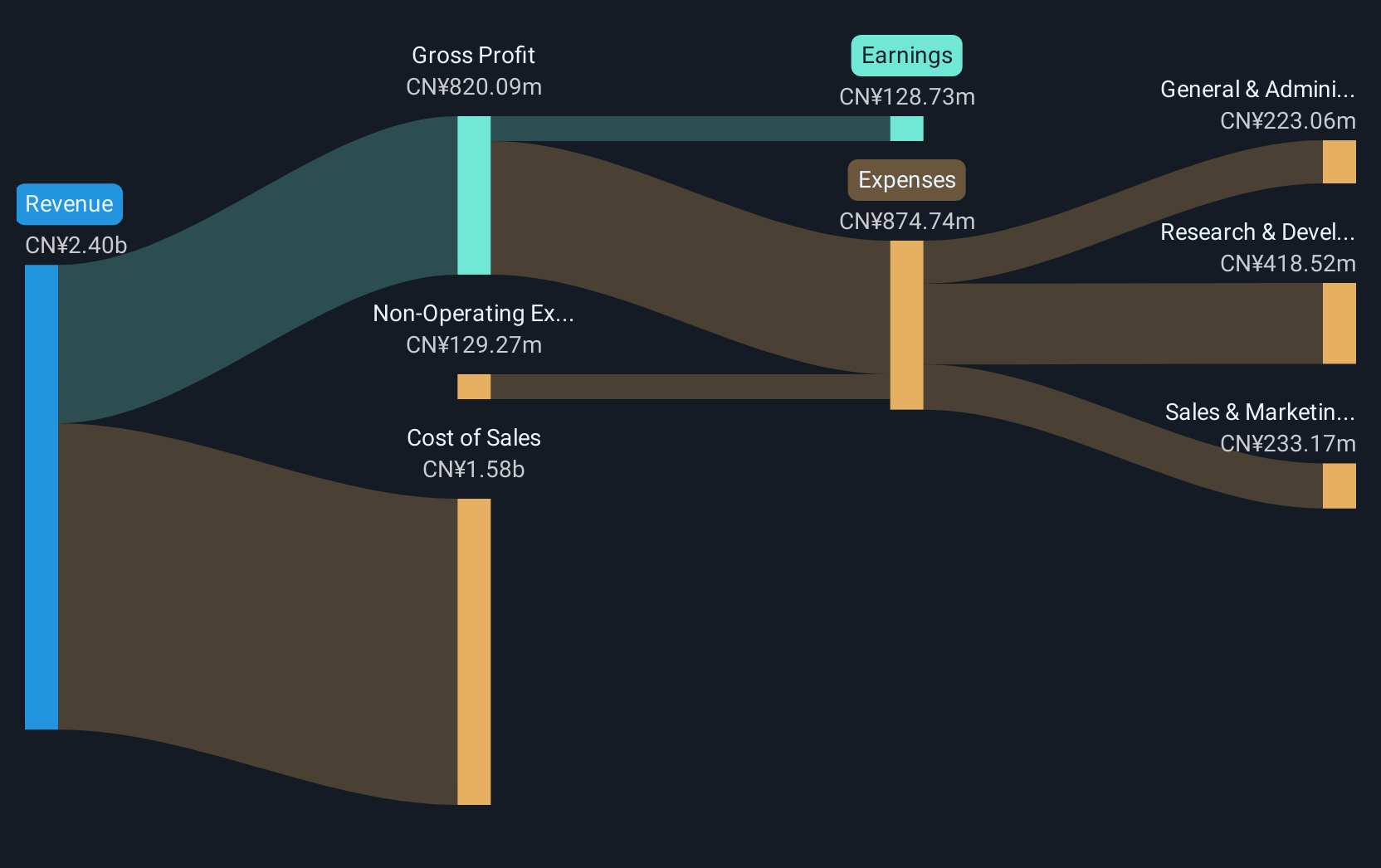

Overview: LUSTER LightTech Co., LTD. engages in the research and development of configurable visual systems, intelligent visual equipment, and core visual devices in China, with a market cap of CN¥10.89 billion.

Operations: LUSTER LightTech specializes in developing advanced visual technology solutions, focusing on configurable systems and intelligent equipment. The company generates revenue through its innovative visual devices tailored for various applications.

LUSTER LightTech's strategic focus on R&D is evident with a significant allocation of resources, underscoring its commitment to innovation in the tech sector. In 2024, the company dedicated a substantial portion of its revenue towards research and development, maintaining a competitive edge in rapidly evolving technological landscapes. This investment aligns with their recent earnings report showing robust growth; revenue surged by 22.3% annually while earnings escalated impressively at 35.7% per year. Additionally, LUSTER has actively returned value to shareholders through recent share repurchases totaling CNY 59.98 million, reflecting confidence in its financial stability and future growth prospects within the high-tech industry.

- Unlock comprehensive insights into our analysis of LUSTER LightTech stock in this health report.

Evaluate LUSTER LightTech's historical performance by accessing our past performance report.

Seize The Opportunity

- Embark on your investment journey to our 1271 High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides solutions for smart devices in Mainland China, Hong Kong Special Administrative Region of the People’s Republic of China, Taiwan, other Asian countries, the United States, and Europe.

Excellent balance sheet with reasonable growth potential.