- South Korea

- /

- Entertainment

- /

- KOSE:A352820

High Growth Tech Stocks in South Korea with Promising Potential

Reviewed by Simply Wall St

The South Korean stock market has experienced fluctuations recently, with the KOSPI index hovering just above 2,580 points amid mixed global market sentiments and concerns over interest rates. In this uncertain environment, identifying high-growth tech stocks requires a focus on companies that demonstrate strong financial health and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 27.44% | 69.62% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 22.96% | 33.25% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market cap of ₩2.42 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which reported ₩296.59 billion. The business operates predominantly within South Korea and focuses on biopharmaceutical products.

PharmaResearch, a South Korean biotech firm, recently announced a private placement issuing over 1.17 million shares, aiming to raise nearly KRW 200 billion by December 2024. This strategic move underscores its robust R&D commitment, evidenced by an R&D expense ratio that has consistently outpaced industry averages. Notably, the company's revenue is projected to grow at 22.3% annually, surpassing the broader KR market's growth rate of 10.3%. Furthermore, PharmaResearch has demonstrated exceptional earnings growth of 63.2% over the past year alone—significantly higher than the biotech industry's average of just over 6%. With an anticipated annual profit growth rate of 22.2%, although slightly below the market average of 29.6%, these figures suggest a strong trajectory for PharmaResearch in harnessing cutting-edge technologies to secure its position in high-growth sectors.

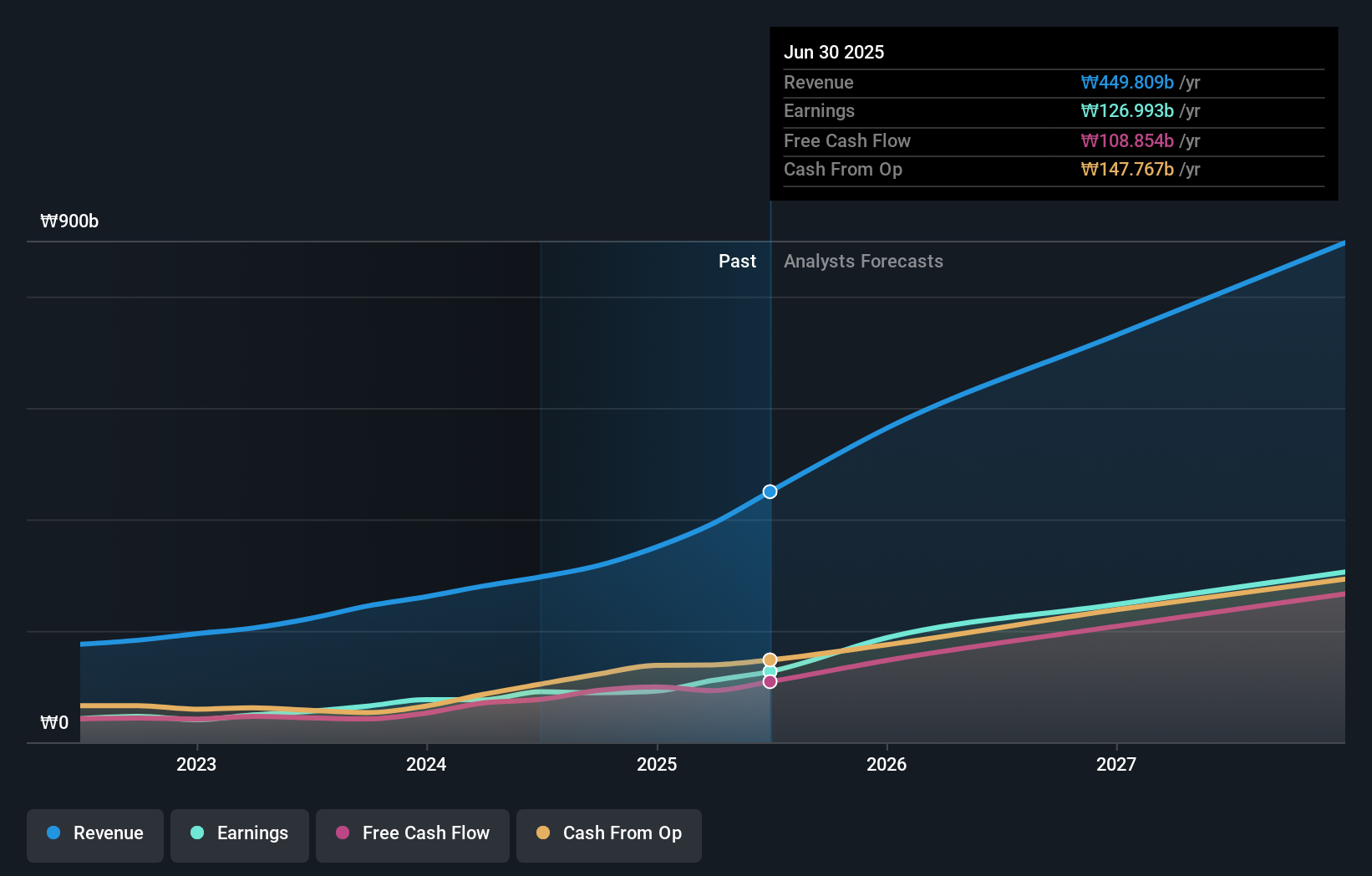

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pearl Abyss Corp. is a company that specializes in software development for games, with a market capitalization of ₩2.30 trillion.

Operations: The company generates revenue primarily from game sales, amounting to ₩330.62 billion. It focuses on the development and distribution of gaming software, contributing significantly to its financial performance.

With a projected revenue growth of 22.9% annually, Pearl Abyss stands out in South Korea's tech sector, surpassing the broader market's average of 10.3%. This growth is complemented by an impressive forecast for earnings to expand by 53.2% each year. The company has strategically focused on enhancing its R&D capabilities, allocating significant resources that underscore its commitment to innovation; last year alone, R&D expenses constituted a substantial portion of their budget, reflecting their dedication to staying at the forefront of technological advancements in gaming and digital entertainment.

- Dive into the specifics of Pearl Abyss here with our thorough health report.

Explore historical data to track Pearl Abyss' performance over time in our Past section.

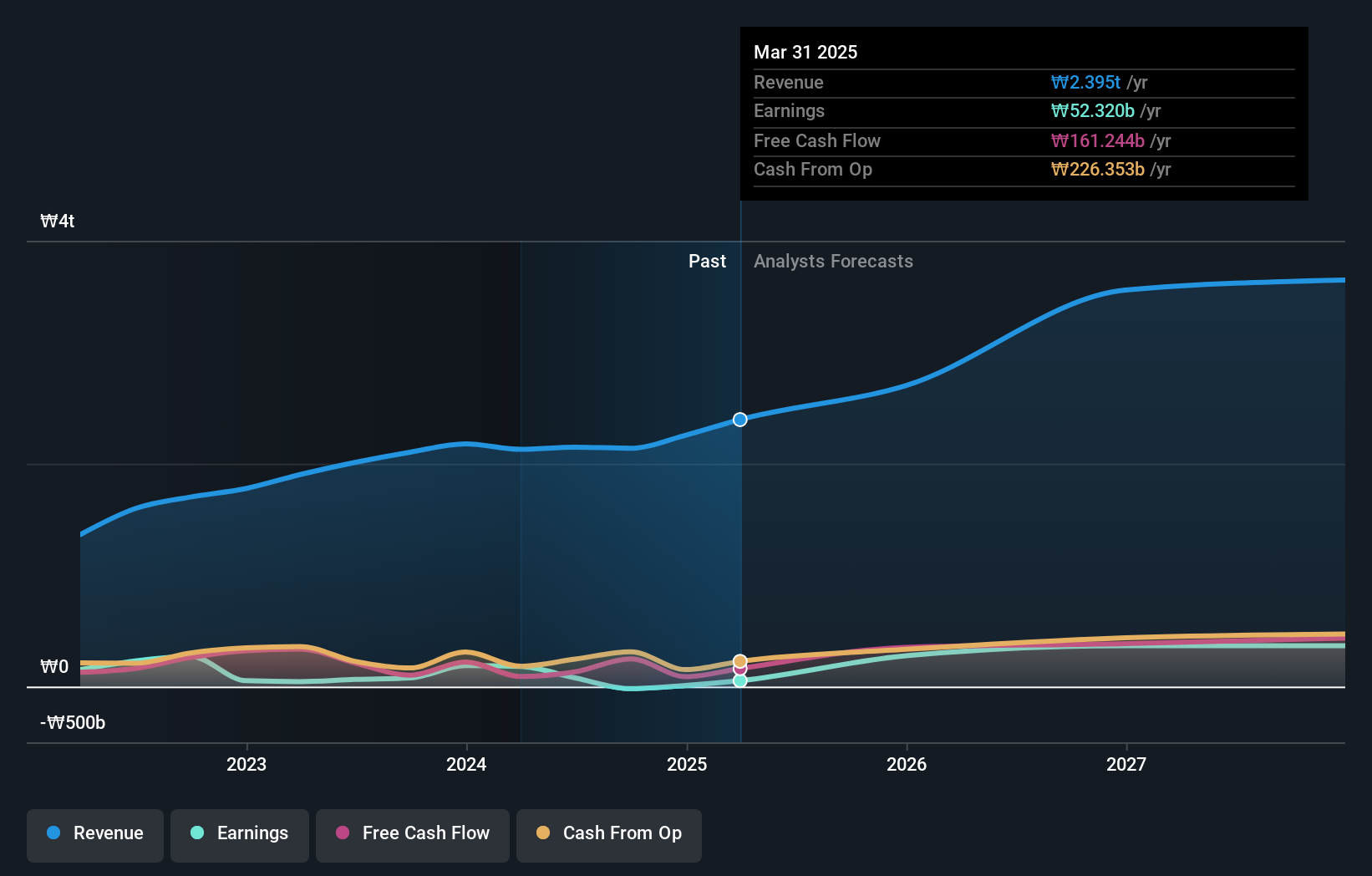

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩8.03 trillion.

Operations: HYBE generates revenue primarily from three segments: Label, Platform, and Solution. The Label segment contributes the largest portion with ₩1.28 trillion, followed by the Solution segment at ₩1.24 trillion, while the Platform segment adds ₩361.12 billion to its revenues.

HYBE's strategic maneuvers in the high-growth tech landscape of South Korea are underscored by its robust R&D investment, which reflects a deep commitment to innovation. In 2024, the company allocated a significant 13.7% of its revenue to R&D, aiming to bolster technological advancements and maintain competitive edge. This focus on development is complemented by a recent private placement aimed at raising KRW 400 billion, showcasing proactive capital management geared towards future growth initiatives. Moreover, HYBE's earnings are expected to surge by an impressive 42.5% annually over the next three years, outpacing the broader market projection of 29.6%, indicating potential for substantial financial growth driven by both creative content and technological enhancements in entertainment solutions.

- Navigate through the intricacies of HYBE with our comprehensive health report here.

Examine HYBE's past performance report to understand how it has performed in the past.

Make It Happen

- Click here to access our complete index of 48 KRX High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives