- South Korea

- /

- Pharma

- /

- KOSDAQ:A204840

Market Participants Recognise GL Pharm Tech Corp.'s (KOSDAQ:204840) Revenues Pushing Shares 25% Higher

GL Pharm Tech Corp. (KOSDAQ:204840) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 81%.

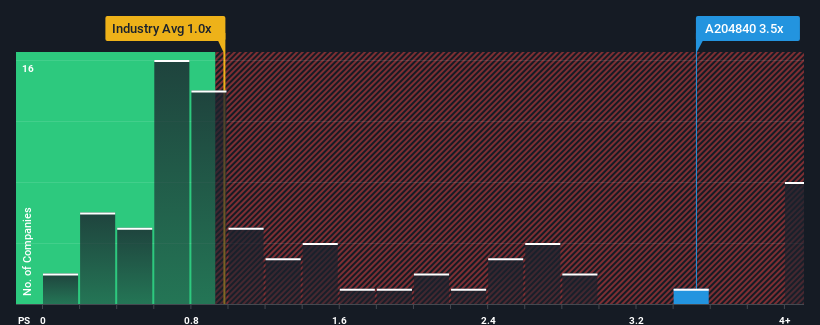

Since its price has surged higher, when almost half of the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 1x, you may consider GL Pharm Tech as a stock not worth researching with its 3.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GL Pharm Tech

What Does GL Pharm Tech's P/S Mean For Shareholders?

Recent times have been quite advantageous for GL Pharm Tech as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for GL Pharm Tech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as GL Pharm Tech's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 73% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 160% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 33% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that GL Pharm Tech's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On GL Pharm Tech's P/S

The strong share price surge has lead to GL Pharm Tech's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that GL Pharm Tech can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for GL Pharm Tech (1 doesn't sit too well with us!) that you need to be mindful of.

If you're unsure about the strength of GL Pharm Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A204840

GL Pharm Tech

Provides generic drugs and incrementally modified drug (IMD) formulation technology to pharmaceutical companies in South Korea.

Mediocre balance sheet low.

Market Insights

Community Narratives