Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Humedix Co., Ltd. (KOSDAQ:200670) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Humedix

What Is Humedix's Debt?

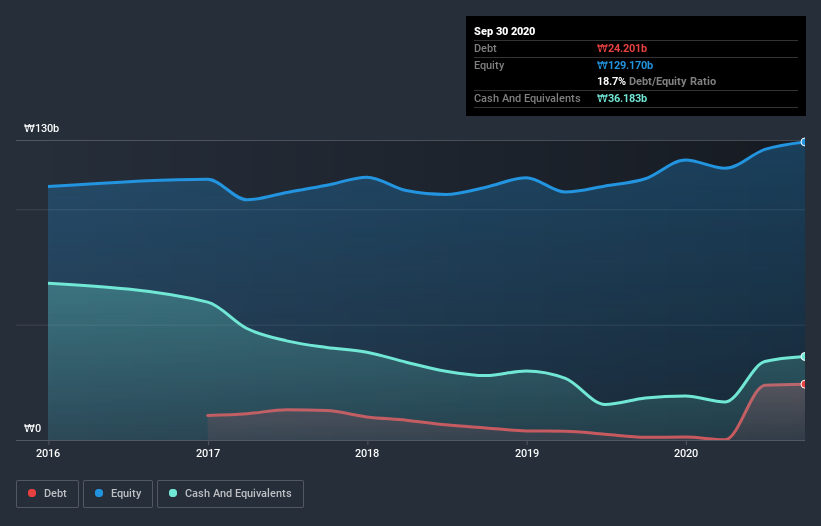

As you can see below, at the end of September 2020, Humedix had ₩24.2b of debt, up from ₩1.18b a year ago. Click the image for more detail. But it also has ₩36.2b in cash to offset that, meaning it has ₩12.0b net cash.

How Strong Is Humedix's Balance Sheet?

According to the last reported balance sheet, Humedix had liabilities of ₩37.8b due within 12 months, and liabilities of ₩3.62b due beyond 12 months. Offsetting this, it had ₩36.2b in cash and ₩24.9b in receivables that were due within 12 months. So it can boast ₩19.7b more liquid assets than total liabilities.

This surplus suggests that Humedix has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Humedix boasts net cash, so it's fair to say it does not have a heavy debt load!

Fortunately, Humedix grew its EBIT by 6.7% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is Humedix's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Humedix has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Humedix's free cash flow amounted to 21% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While it is always sensible to investigate a company's debt, in this case Humedix has ₩12.0b in net cash and a decent-looking balance sheet. On top of that, it increased its EBIT by 6.7% in the last twelve months. So we don't have any problem with Humedix's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Humedix (1 is significant!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Humedix, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Humedix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A200670

Humedix

Engages in the manufacture and sale of various pharmaceutical products in South Korea.

Moderate growth potential and overvalued.