- South Korea

- /

- Biotech

- /

- KOSDAQ:A185490

EyeGene's (KOSDAQ:185490) Stock Price Has Reduced 51% In The Past Five Years

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example the EyeGene Inc. (KOSDAQ:185490) share price dropped 51% over five years. We certainly feel for shareholders who bought near the top. On top of that, the share price is down 11% in the last week. However, this move may have been influenced by the broader market, which fell 4.8% in that time.

See our latest analysis for EyeGene

EyeGene isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

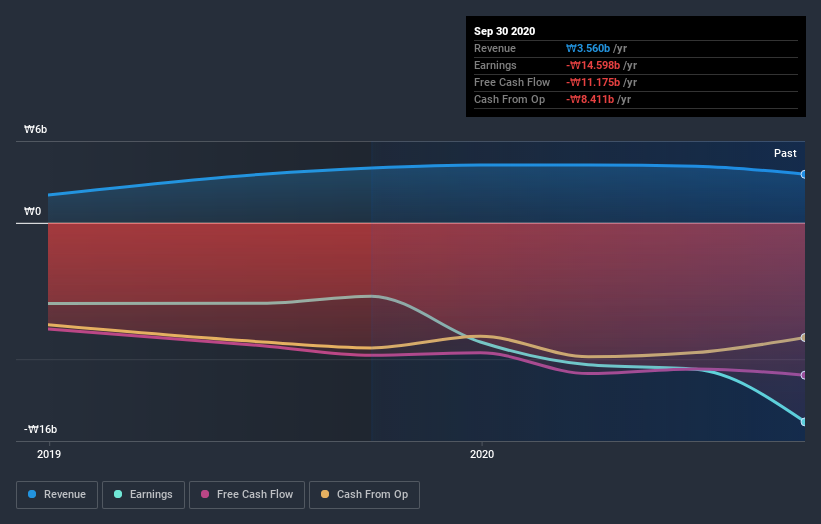

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

EyeGene shareholders gained a total return of 28% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand EyeGene better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with EyeGene (including 1 which doesn't sit too well with us) .

Of course EyeGene may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade EyeGene, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade EyeGene, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EyeGene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A185490

EyeGene

Engages in the research and development of biopharmaceutical drugs for the treatment and prevention of age-related diseases in South Korea.

Flawless balance sheet low.