- South Korea

- /

- Pharma

- /

- KOSDAQ:A183490

Positive Sentiment Still Eludes Enzychem Lifesciences Corporation (KOSDAQ:183490) Following 25% Share Price Slump

Enzychem Lifesciences Corporation (KOSDAQ:183490) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

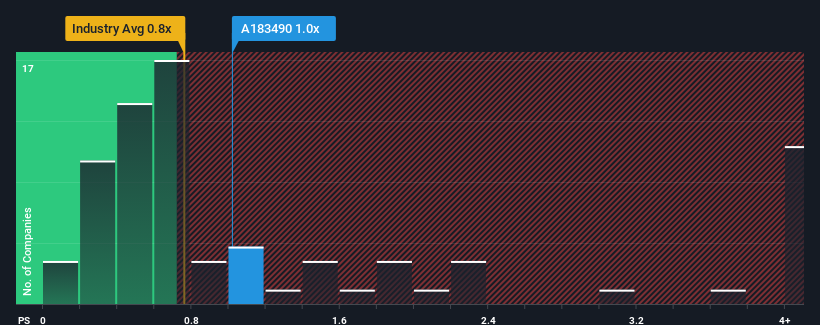

Although its price has dipped substantially, there still wouldn't be many who think Enzychem Lifesciences' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Korea's Pharmaceuticals industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Enzychem Lifesciences

What Does Enzychem Lifesciences' Recent Performance Look Like?

Recent times have been quite advantageous for Enzychem Lifesciences as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Enzychem Lifesciences will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Enzychem Lifesciences will help you shine a light on its historical performance.How Is Enzychem Lifesciences' Revenue Growth Trending?

In order to justify its P/S ratio, Enzychem Lifesciences would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 16%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Enzychem Lifesciences' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Following Enzychem Lifesciences' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Enzychem Lifesciences currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You always need to take note of risks, for example - Enzychem Lifesciences has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Enzychem Lifesciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Enzychem Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A183490

Enzychem Lifesciences

Engages in developing novel small molecule therapeutics for patients with unmet needs for oncology, inflammatory, and severe respiratory diseases in South Korea.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives