- South Korea

- /

- Biotech

- /

- KOSDAQ:A166480

CORESTEMCHEMON (KOSDAQ:166480 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 77%

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So spare a thought for the long term shareholders of CORESTEMCHEMON Inc. (KOSDAQ:166480); the share price is down a whopping 77% in the last three years. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 51% in the last year. The falls have accelerated recently, with the share price down 76% in the last three months.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for CORESTEMCHEMON

CORESTEMCHEMON wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years CORESTEMCHEMON saw its revenue shrink by 3.7% per year. That is not a good result. The share price fall of 21% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

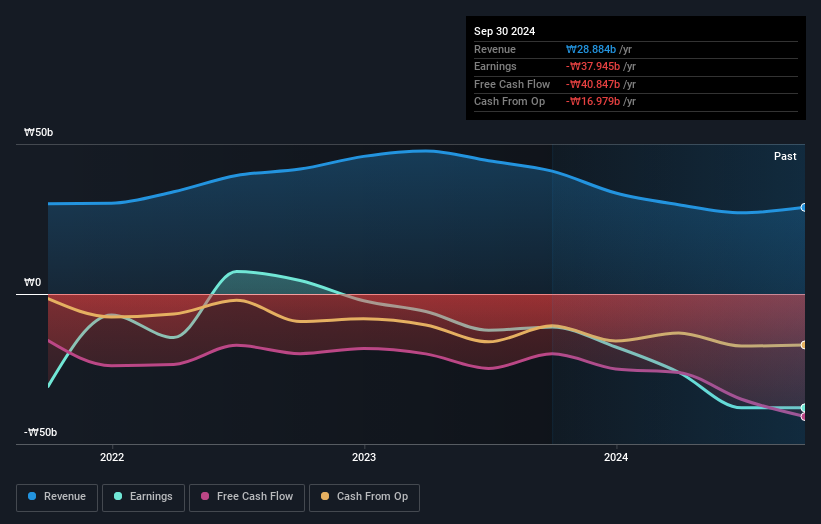

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on CORESTEMCHEMON's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that CORESTEMCHEMON shareholders are down 51% for the year. Unfortunately, that's worse than the broader market decline of 1.9%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with CORESTEMCHEMON (at least 3 which are concerning) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A166480

CORESTEMCHEMON

A bio-pharmaceutical company, engages in the development and production of stem cell therapies for the treatment of incurable diseases in South Korea.

Low and slightly overvalued.

Market Insights

Community Narratives