- South Korea

- /

- Biotech

- /

- KOSDAQ:A166480

CORESTEMCHEMON Inc.'s (KOSDAQ:166480) Popularity With Investors Under Threat As Stock Sinks 25%

CORESTEMCHEMON Inc. (KOSDAQ:166480) shares have had a horrible month, losing 25% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 83% in the last year.

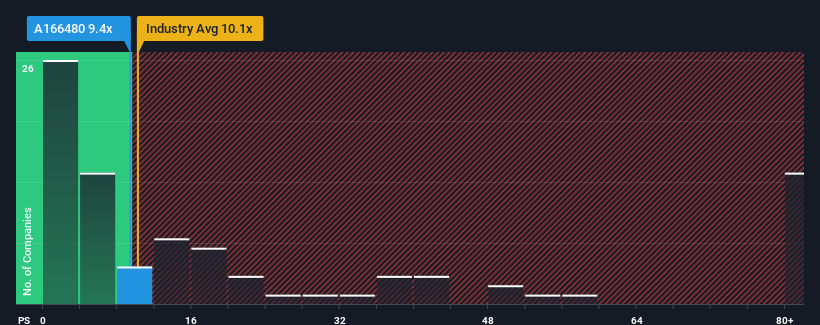

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about CORESTEMCHEMON's P/S ratio of 9.4x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Korea is also close to 10.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for CORESTEMCHEMON

How Has CORESTEMCHEMON Performed Recently?

As an illustration, revenue has deteriorated at CORESTEMCHEMON over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CORESTEMCHEMON will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For CORESTEMCHEMON?

The only time you'd be comfortable seeing a P/S like CORESTEMCHEMON's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. The last three years don't look nice either as the company has shrunk revenue by 3.9% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 46% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that CORESTEMCHEMON's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Following CORESTEMCHEMON's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that CORESTEMCHEMON currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider and we've discovered 4 warning signs for CORESTEMCHEMON (2 are significant!) that you should be aware of before investing here.

If you're unsure about the strength of CORESTEMCHEMON's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A166480

CORESTEMCHEMON

A bio-pharmaceutical company, engages in the development and production of stem cell therapies for the treatment of incurable diseases in South Korea.

Low and slightly overvalued.

Market Insights

Community Narratives