- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A114450

Why Investors Shouldn't Be Surprised By Green Lifescience Co., Ltd.'s (KOSDAQ:114450) 27% Share Price Plunge

Green Lifescience Co., Ltd. (KOSDAQ:114450) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

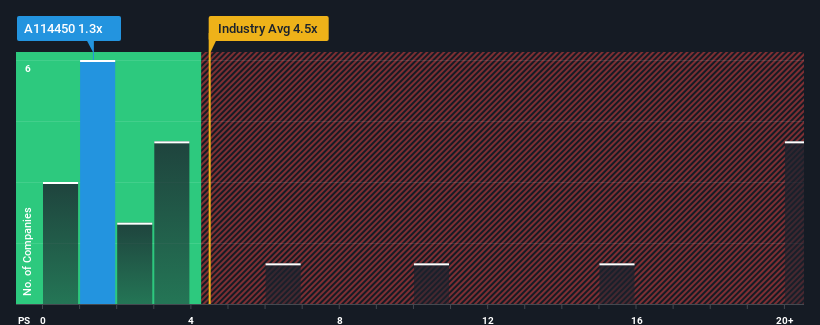

Since its price has dipped substantially, Green Lifescience's price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Life Sciences industry in Korea, where around half of the companies have P/S ratios above 3.1x and even P/S above 9x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Green Lifescience

What Does Green Lifescience's Recent Performance Look Like?

For example, consider that Green Lifescience's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Green Lifescience's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Green Lifescience's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 3.5% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Green Lifescience's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Green Lifescience's P/S

Green Lifescience's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Green Lifescience confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Green Lifescience (1 shouldn't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A114450

Green Lifescience

Engages in development, production, and sale of agrochemical raw materials and pharmaceutical intermediates in South Korea and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives