- South Korea

- /

- Biotech

- /

- KOSDAQ:A298380

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite marking strong annual gains despite recent volatility, investors are keeping a close eye on economic indicators such as the Chicago PMI and GDP forecasts that highlight potential challenges for small-cap companies. In this environment, identifying high-growth tech stocks requires careful consideration of factors like innovation potential and market adaptability, which can offer opportunities even amidst broader market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Com2uS (KOSDAQ:A078340)

Simply Wall St Growth Rating: ★★★★☆☆

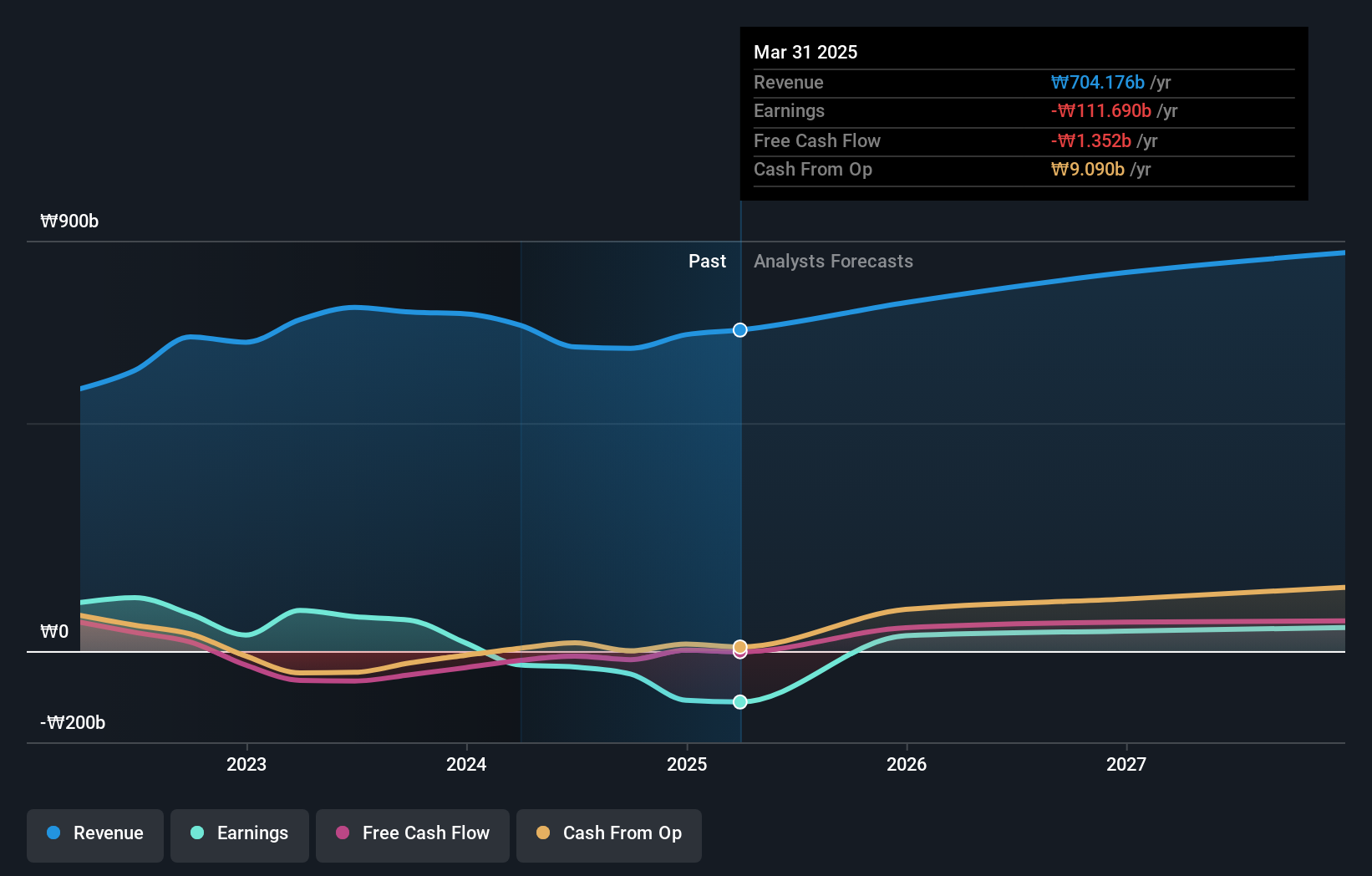

Overview: Com2uS Corporation is a global developer and publisher of mobile games with operations in South Korea, the United States, China, Japan, Taiwan, Southeast Asia, Europe, and other international markets; it has a market cap of approximately ₩524.26 billion.

Operations: The primary revenue stream for Com2uS comes from its mobile games segment, generating approximately ₩549.09 billion. Additional income is derived from the production of broadcast contents and exhibition events, contributing ₩72.22 billion and ₩33.05 billion respectively. The company also engages in VFX and new media activities, adding about ₩9.64 billion to its revenue portfolio.

Com2uS, a player in the mobile gaming sector, is navigating a challenging landscape with mixed financial results. In Q3 2024, despite a slight dip in sales to KRW 172.81 billion from KRW 175.97 billion year-over-year, the company's net income significantly dropped to KRW 3.21 billion from KRW 18.31 billion. However, looking forward, Com2uS shows promise with an expected earnings growth of an impressive 92.58% annually and revenue growth forecasted at 11.9% per year—outpacing the Korean market average of 9.2%. These indicators suggest a potential rebound as the firm continues to innovate and expand its gaming portfolio amidst evolving market dynamics.

- Unlock comprehensive insights into our analysis of Com2uS stock in this health report.

Gain insights into Com2uS' past trends and performance with our Past report.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

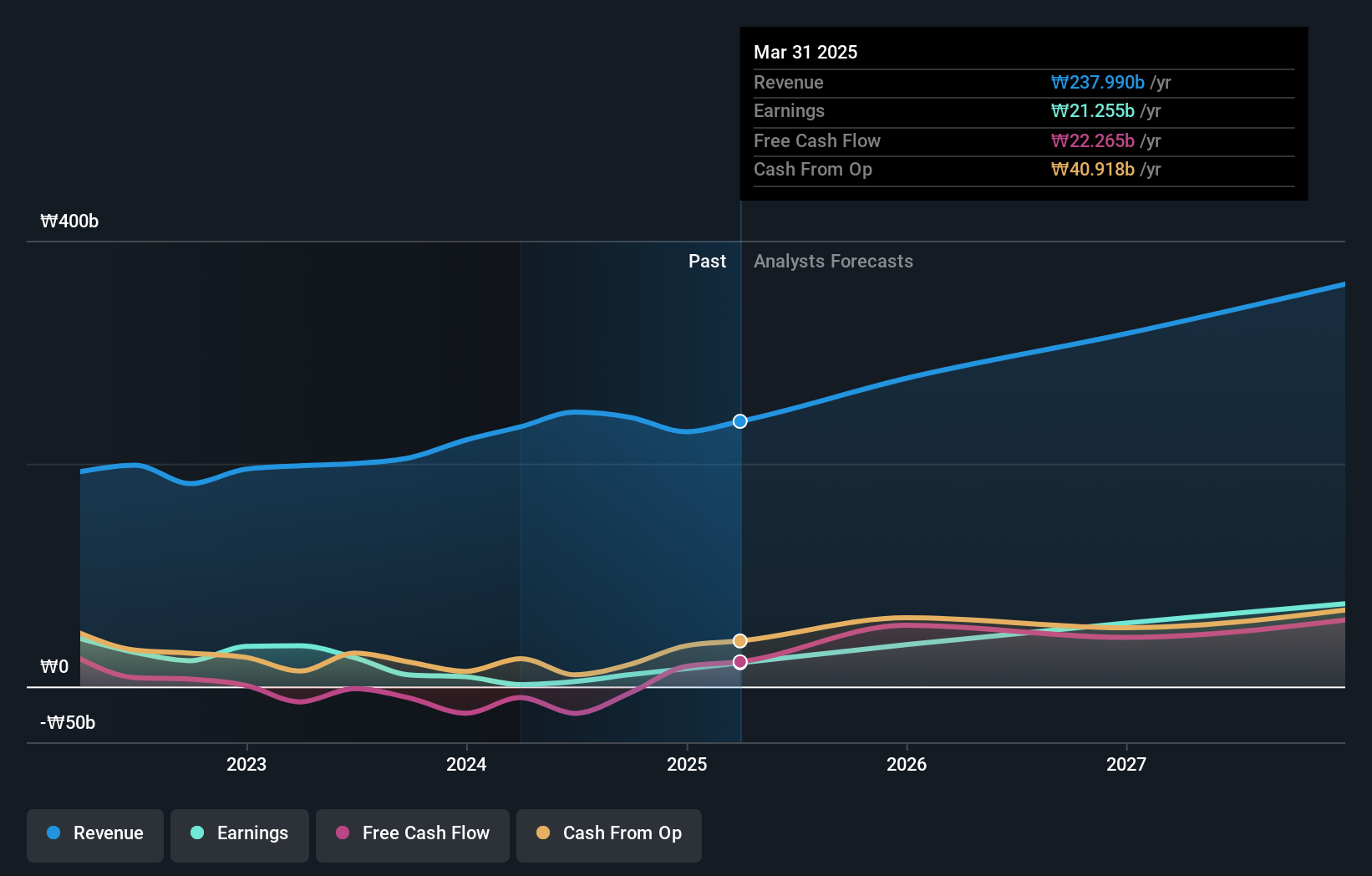

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea with a market capitalization of approximately ₩834.68 billion.

Operations: Medy-Tox Inc. focuses on the biotechnology sector, generating revenue of approximately ₩241.45 billion from this segment.

Medy-Tox, amid a flurry of activity, has recently enhanced shareholder value through strategic share repurchases, buying back 32,232 shares for KRW 4.11 billion. This move dovetails with an impressive turnaround in its financial health; after a period of losses, the company reported a robust net income of KRW 3.81 billion for Q3 2024—a stark contrast to the previous year's loss. Furthermore, Medy-Tox is poised for substantial growth with earnings expected to surge by 63.3% annually and revenue forecasted to grow at 14.2% per year—outstripping the broader Korean market projections of 29.4% and 9.2%, respectively. These figures underscore Medy-Tox’s recovery trajectory and its potential for sustained growth in the biotech sector.

- Click here and access our complete health analysis report to understand the dynamics of Medy-Tox.

Gain insights into Medy-Tox's historical performance by reviewing our past performance report.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

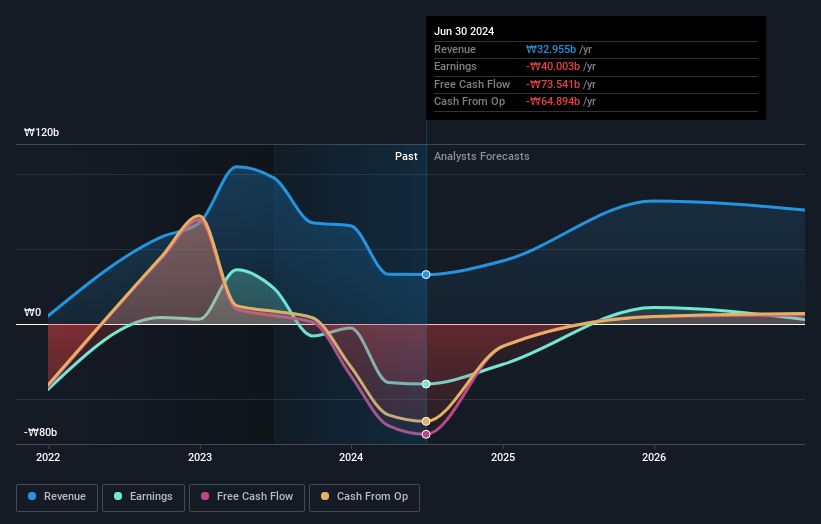

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.44 trillion.

Operations: ABL Bio Inc. generates revenue primarily from its biotechnology segment, particularly focusing on startups, with reported earnings of ₩32.32 billion. The company is engaged in developing therapeutic drugs targeting immuno-oncology and neurodegenerative diseases.

ABL Bio, with its focus on antibody-drug conjugates, showcased innovation at the recent World ADC Conference, highlighting its commitment to advancing cancer treatment. This aligns with a 25.5% annual revenue growth and an anticipated shift to profitability within three years, signaling robust market performance. Moreover, R&D investments remain aggressive as reflected in the company's latest financials, ensuring sustained innovation and potential market leadership in biotech. With earnings expected to surge by 50.3% annually, ABL Bio is strategically positioned for significant industry impact and growth.

- Take a closer look at ABL Bio's potential here in our health report.

Explore historical data to track ABL Bio's performance over time in our Past section.

Key Takeaways

- Access the full spectrum of 1253 High Growth Tech and AI Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A298380

ABL Bio

A biotech research company, focuses on the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives