3 Value Stock Opportunities Estimated At Up To 47.5% Below Intrinsic Worth

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of cautious optimism and volatility, driven by geopolitical tensions, tariff concerns, and fluctuating consumer spending patterns. As major indices show signs of strain amid these economic pressures, investors are increasingly looking for opportunities in undervalued stocks that could offer potential value despite the broader market challenges. In such an environment, identifying stocks trading below their intrinsic worth can be a strategic move for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥1862.00 | ¥3721.49 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK270.00 | SEK535.44 | 49.6% |

| América Móvil. de (BMV:AMX B) | MX$14.89 | MX$29.71 | 49.9% |

| Aoshikang Technology (SZSE:002913) | CN¥29.51 | CN¥58.56 | 49.6% |

| CD Projekt (WSE:CDR) | PLN221.70 | PLN441.47 | 49.8% |

| Food & Life Companies (TSE:3563) | ¥4154.00 | ¥8301.16 | 50% |

| BalnibarbiLtd (TSE:3418) | ¥1067.00 | ¥2117.17 | 49.6% |

| Hanwha Aerospace (KOSE:A012450) | ₩682000.00 | ₩1354744.21 | 49.7% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.69 | CN¥37.15 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16320.00 | ₩32574.92 | 49.9% |

Let's explore several standout options from the results in the screener.

Séché Environnement (ENXTPA:SCHP)

Overview: Séché Environnement SA specializes in the management, recovery, and treatment of waste products for industrial and corporate clients as well as local authorities both in France and internationally, with a market cap of €672.01 million.

Operations: The company's revenue is primarily derived from its Waste Management segment, which generated €1.10 billion.

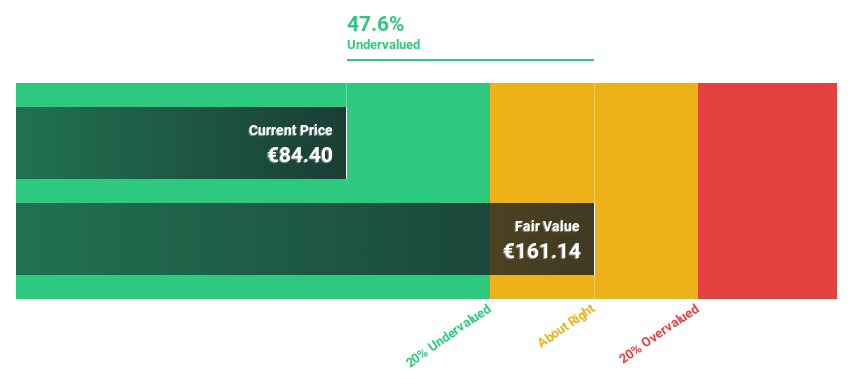

Estimated Discount To Fair Value: 46.7%

Séché Environnement appears undervalued based on cash flows, trading at €86.5, significantly below its estimated fair value of €162.39. Analysts agree on a potential 30.9% price increase, supported by expected annual earnings growth of 32%, outpacing the French market's 12.7%. Despite high debt levels, the company recently secured a 20-year public service contract for waste facility redevelopment in Nantes, enhancing long-term revenue prospects and supporting ecological transition efforts.

- Our expertly prepared growth report on Séché Environnement implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Séché Environnement stock in this financial health report.

Medy-Tox (KOSDAQ:A086900)

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market cap of ₩833.09 billion, focusing on the development and production of medical treatments.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩241.45 billion.

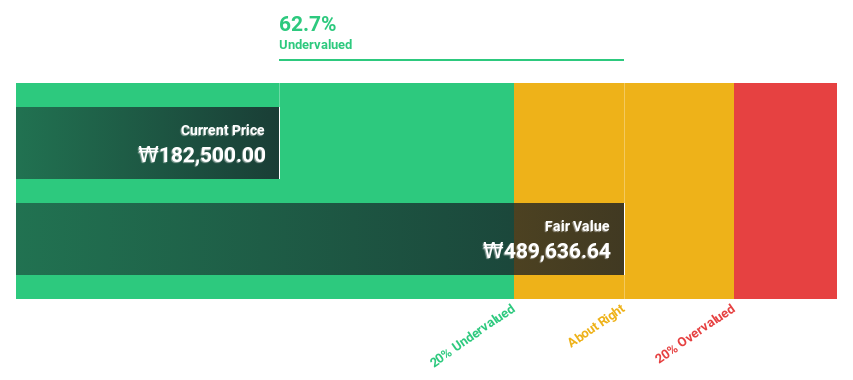

Estimated Discount To Fair Value: 47.5%

Medy-Tox is trading at ₩125,900, significantly below its estimated fair value of ₩239,623.54. Analysts forecast a strong annual earnings growth of 61.33%, surpassing the South Korean market's 25.8%. Despite a low projected return on equity of 11.2% in three years, recent share buybacks totaling KRW 4,832.84 million aim to stabilize stock prices and enhance shareholder value, reflecting strategic efforts to capitalize on its undervaluation based on cash flows.

- Upon reviewing our latest growth report, Medy-Tox's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Medy-Tox with our detailed financial health report.

Hanza (OM:HANZA)

Overview: Hanza AB (publ) offers manufacturing solutions and has a market capitalization of approximately SEK3.50 billion.

Operations: The company's revenue is derived from its Main Markets segment, generating SEK2.86 billion, followed by Other Markets with SEK1.97 billion, and Business Development and Services contributing SEK14 million.

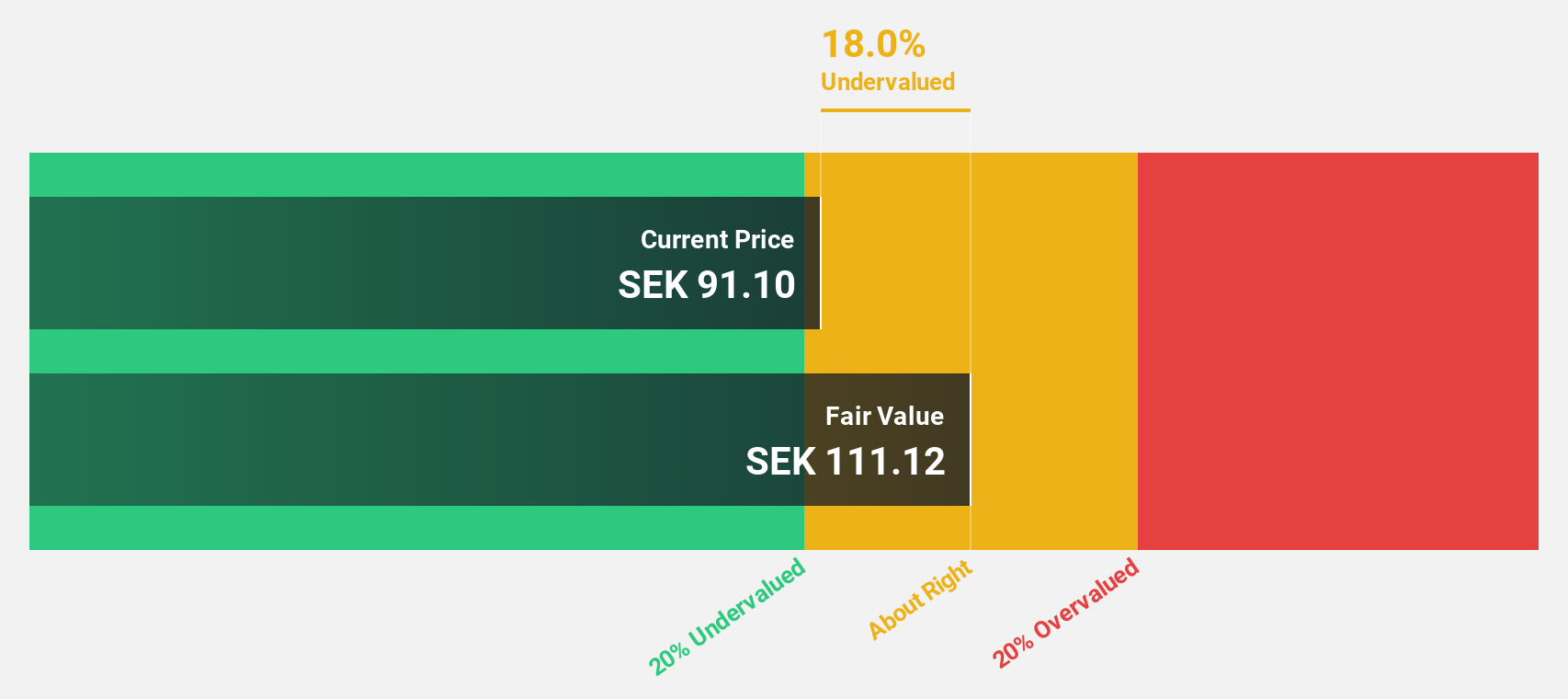

Estimated Discount To Fair Value: 38.7%

Hanza is trading at SEK 80.25, significantly below its estimated fair value of SEK 130.92, presenting an opportunity for investors focusing on undervaluation based on cash flows. Despite a decrease in net profit margin from 5.2% to 2.3%, the company forecasts strong annual earnings growth of 26.8%, outpacing the Swedish market's average growth rate of 9.6%. However, return on equity is expected to remain relatively low at 19.3% over three years.

- Our comprehensive growth report raises the possibility that Hanza is poised for substantial financial growth.

- Take a closer look at Hanza's balance sheet health here in our report.

Summing It All Up

- Click this link to deep-dive into the 916 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives