3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 45.9%

Reviewed by Simply Wall St

As global trade tensions escalate due to higher-than-expected tariffs, Asian markets have experienced significant volatility, with many investors concerned about the potential for slower economic growth and heightened inflation. In this uncertain environment, identifying undervalued stocks can be a strategic approach, as these stocks may offer opportunities for long-term value appreciation despite current market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou TFC Optical Communication (SZSE:300394) | CN¥62.73 | CN¥125.35 | 50% |

| Consun Pharmaceutical Group (SEHK:1681) | HK$8.81 | HK$17.39 | 49.3% |

| Taiwan Semiconductor Manufacturing (TWSE:2330) | NT$785.00 | NT$1545.20 | 49.2% |

| Premium Group (TSE:7199) | ¥1814.00 | ¥3627.27 | 50% |

| Mandom (TSE:4917) | ¥1245.00 | ¥2472.90 | 49.7% |

| ULS Group (TSE:3798) | ¥4365.00 | ¥8519.47 | 48.8% |

| Cosel (TSE:6905) | ¥971.00 | ¥1933.76 | 49.8% |

| BuySell TechnologiesLtd (TSE:7685) | ¥2537.00 | ¥4998.16 | 49.2% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.27 | CN¥42.20 | 49.6% |

| Kyushu Financial Group (TSE:7180) | ¥556.90 | ¥1091.65 | 49% |

Here's a peek at a few of the choices from the screener.

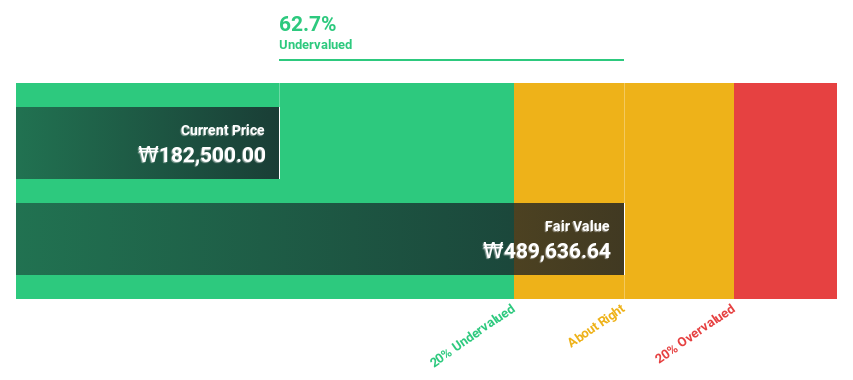

Medy-Tox (KOSDAQ:A086900)

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market cap of approximately ₩912.47 billion.

Operations: Revenue Segments (in millions of ₩): null

Estimated Discount To Fair Value: 41.8%

Medy-Tox is trading at 41.8% below its estimated fair value, with earnings expected to grow significantly over the next three years. Despite a recent decline in sales to ₩3,850.62 million for 2024, net income rose to ₩16,955 million from the previous year. The company completed a share buyback program aimed at stabilizing stock price and enhancing shareholder value, repurchasing shares worth ₩5,310.79 million by March 2025.

- Our expertly prepared growth report on Medy-Tox implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Medy-Tox with our comprehensive financial health report here.

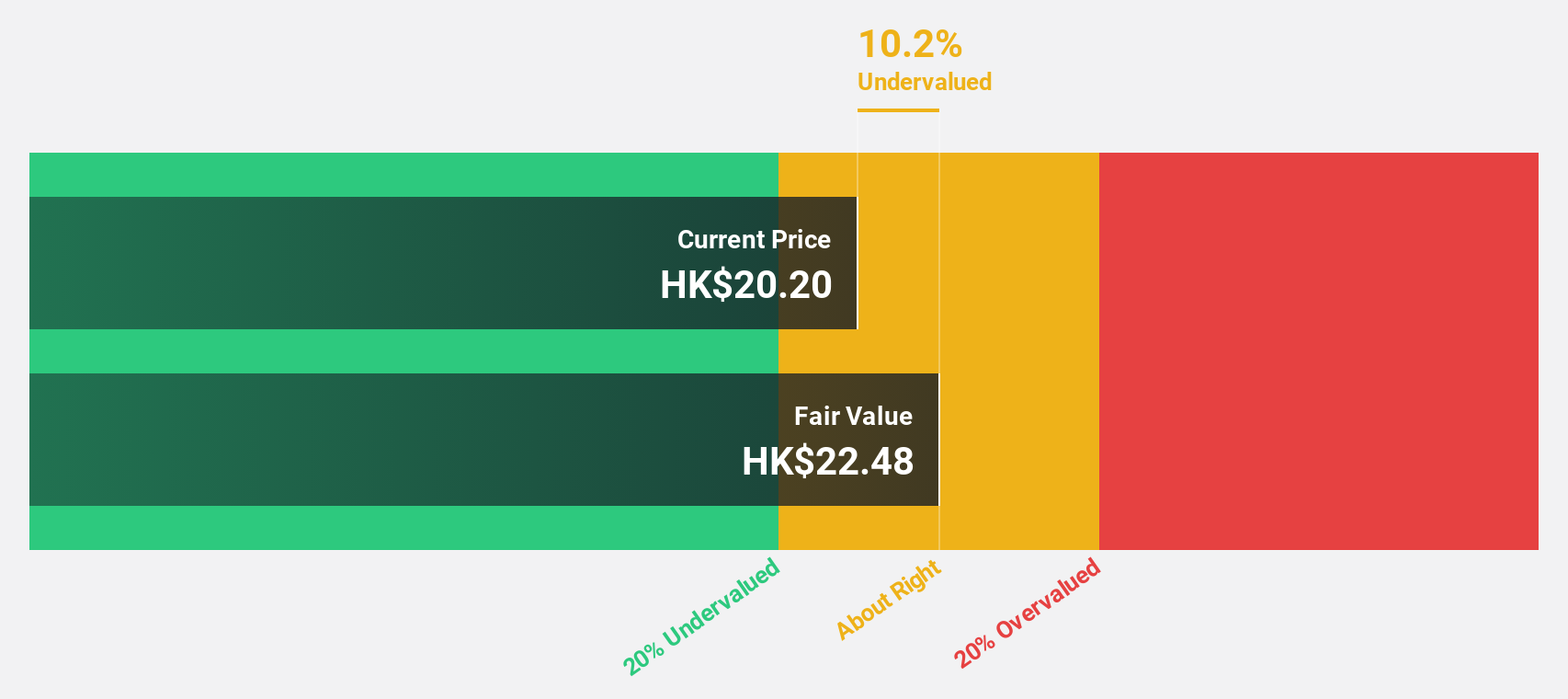

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and other metallic products in China, with a market cap of HK$51.24 billion.

Operations: The company's revenue primarily comes from Gold Operations, generating CN¥10.72 billion, followed by Copper Operations with CN¥376.36 million.

Estimated Discount To Fair Value: 38.4%

Zhaojin Mining Industry is trading at a significant discount to its estimated fair value, with shares priced at HK$15.06 compared to a fair value of HK$24.44. The company reported robust earnings growth of 111.4% last year and forecasts suggest continued strong profit growth of 29.92% annually over the next three years, outpacing the Hong Kong market average. Recent equity offerings raised HKD 1.98 billion, potentially strengthening its financial position further.

- In light of our recent growth report, it seems possible that Zhaojin Mining Industry's financial performance will exceed current levels.

- Click here to discover the nuances of Zhaojin Mining Industry with our detailed financial health report.

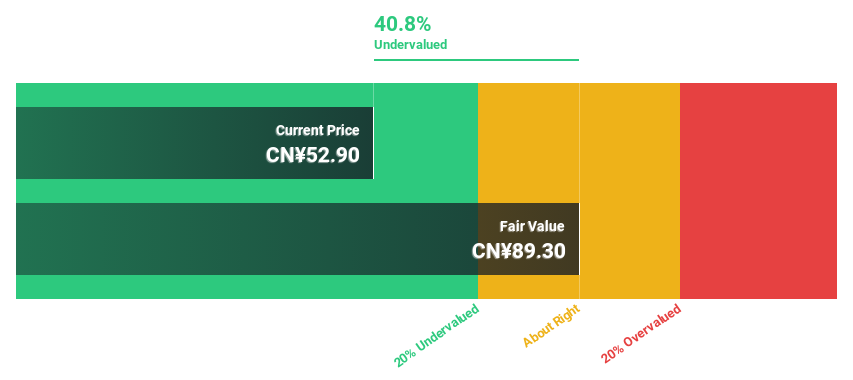

GCH Technology (SHSE:688625)

Overview: GCH Technology Co., Ltd. engages in the research, development, production, and sale of nucleating agents, synthetic hydrotalcites, and composite additives both in China and internationally with a market cap of CN¥6.41 billion.

Operations: The company's revenue comes from its Chemical Raw Materials and Chemical Products Manufacturing segment, totaling CN¥882.05 million.

Estimated Discount To Fair Value: 45.9%

GCH Technology is trading at CN¥48.35, significantly below its estimated fair value of CN¥89.39, indicating it may be undervalued based on cash flows. Despite a forecasted earnings growth of 20.92% per year, its return on equity and revenue growth are expected to outpace the market. However, dividend sustainability is questionable as it's not well covered by free cash flows and debt coverage by operating cash flow remains a concern. Recent annual earnings showed improved sales and net income figures compared to the previous year.

- Insights from our recent growth report point to a promising forecast for GCH Technology's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of GCH Technology.

Make It Happen

- Reveal the 275 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GCH Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688625

GCH Technology

Researches, develops, produces, and sells nucleating agents, synthetic hydrotalcites, and composite additives in China and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives