- South Korea

- /

- Biotech

- /

- KOSDAQ:A086890

Why Investors Shouldn't Be Surprised By ISU Abxis Co., Ltd.'s (KOSDAQ:086890) 26% Share Price Plunge

ISU Abxis Co., Ltd. (KOSDAQ:086890) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

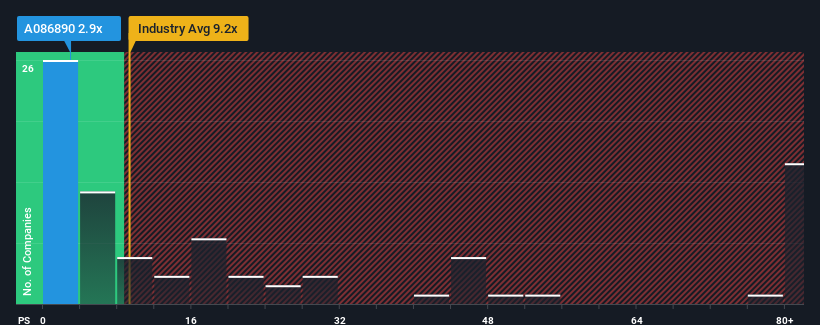

Since its price has dipped substantially, ISU Abxis may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.9x, since almost half of all companies in the Biotechs industry in Korea have P/S ratios greater than 9.2x and even P/S higher than 45x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ISU Abxis

What Does ISU Abxis' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, ISU Abxis has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ISU Abxis.Is There Any Revenue Growth Forecasted For ISU Abxis?

ISU Abxis' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 128% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 27% over the next year. Meanwhile, the rest of the industry is forecast to expand by 40%, which is noticeably more attractive.

With this in consideration, its clear as to why ISU Abxis' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

ISU Abxis' P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of ISU Abxis' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - ISU Abxis has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A086890

ISU Abxis

A biopharmaceutical company, develops and markets products for the treatment of cancer and rare diseases worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives