- South Korea

- /

- Pharma

- /

- KOSDAQ:A000250

Sam Chun Dang Pharm (KOSDAQ:000250) shareholders notch a 40% CAGR over 5 years, yet earnings have been shrinking

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Sam Chun Dang Pharm. Co., Ltd (KOSDAQ:000250) shares for the last five years, while they gained 443%. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 26% gain in the last three months.

The past week has proven to be lucrative for Sam Chun Dang Pharm investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Sam Chun Dang Pharm

We don't think that Sam Chun Dang Pharm's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Sam Chun Dang Pharm can boast revenue growth at a rate of 2.6% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 40% per year, compound, over the period. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

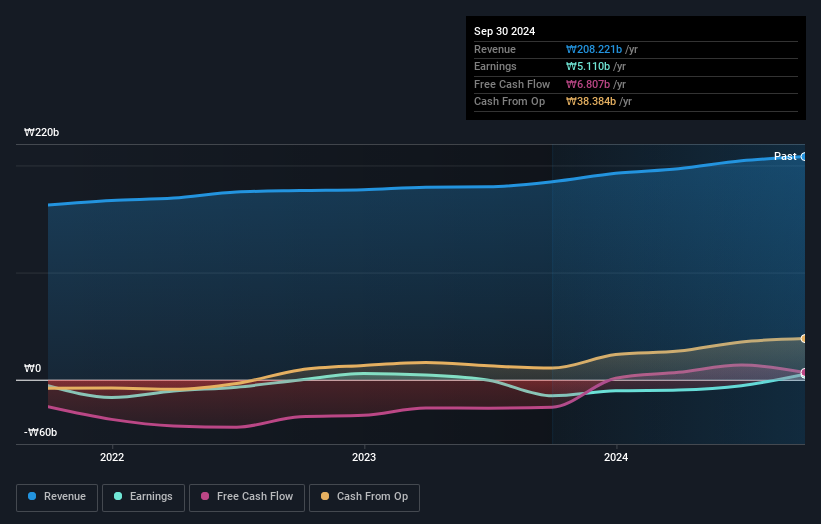

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Sam Chun Dang Pharm's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Sam Chun Dang Pharm has rewarded shareholders with a total shareholder return of 181% in the last twelve months. That's better than the annualised return of 40% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Sam Chun Dang Pharm (of which 2 shouldn't be ignored!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A000250

Sam Chun Dang Pharm

Engages in the manufacturing and sale of pharmaceutical products in South Korea.

Excellent balance sheet low.

Market Insights

Community Narratives