- South Korea

- /

- Entertainment

- /

- KOSE:A352820

HYBE (KRX:352820) shareholders notch a 37% CAGR over 3 years, yet earnings have been shrinking

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the HYBE Co., Ltd. (KRX:352820) share price has flown 156% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 22% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 21% in 90 days).

Since the stock has added ₩1.4t to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, HYBE failed to grow earnings per share, which fell 38% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Languishing at just 0.06%, we doubt the dividend is doing much to prop up the share price. It may well be that HYBE revenue growth rate of 12% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

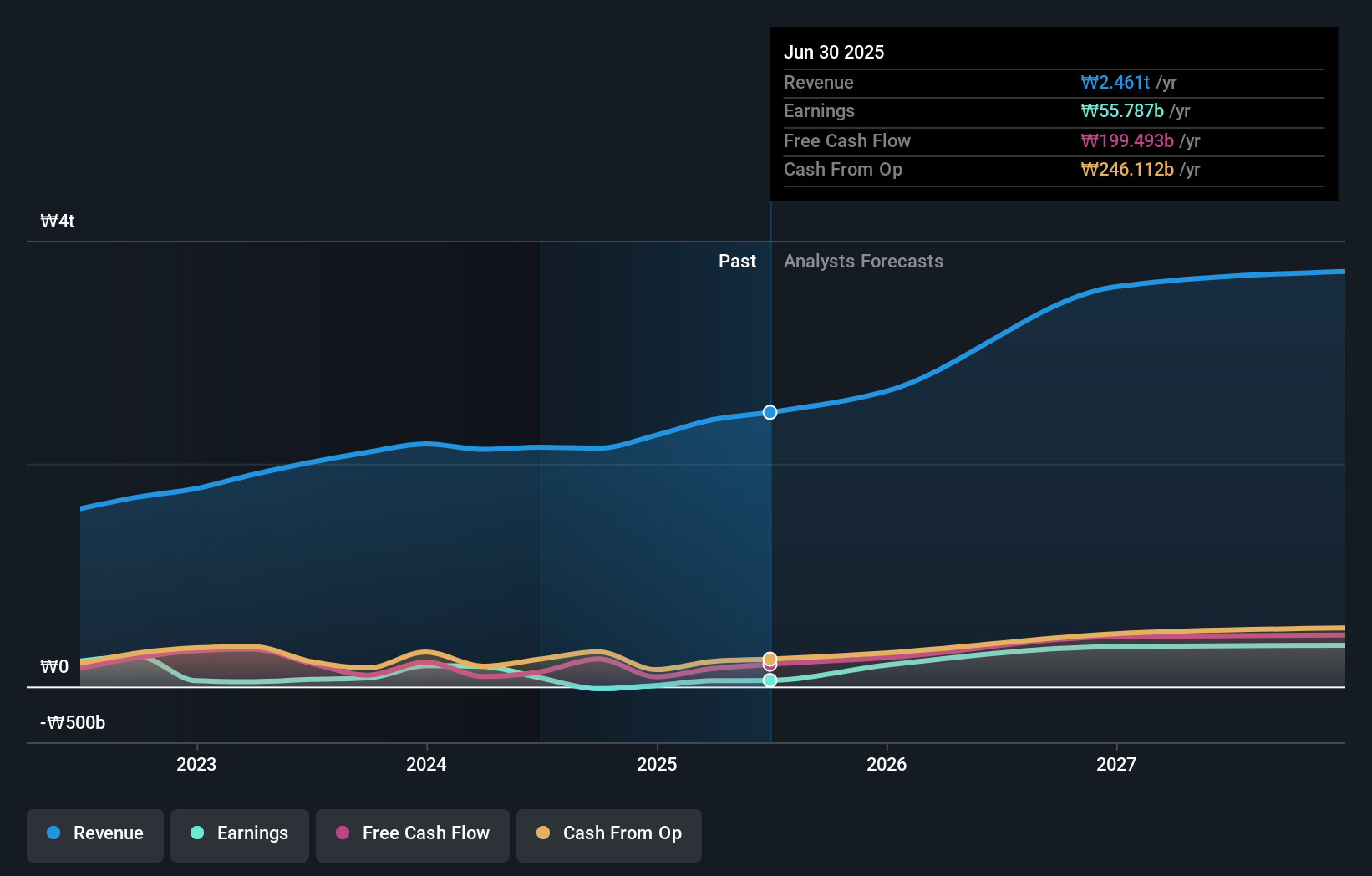

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

HYBE is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling HYBE stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that HYBE shareholders have received a total shareholder return of 59% over the last year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 17%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for HYBE that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives