The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like KRAFTON (KRX:259960). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for KRAFTON

How Fast Is KRAFTON Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that KRAFTON's EPS has grown 18% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

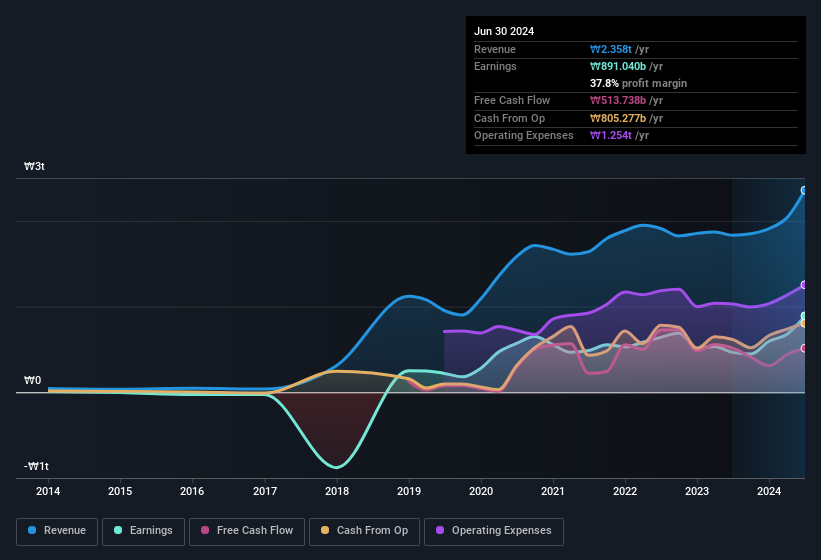

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that KRAFTON is growing revenues, and EBIT margins improved by 4.9 percentage points to 42%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for KRAFTON?

Are KRAFTON Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₩15t company like KRAFTON. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth ₩3.1t. That equates to 20% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

Should You Add KRAFTON To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into KRAFTON's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in KRAFTON's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of KRAFTON. You might benefit from giving it a glance today.

Although KRAFTON certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of South Korean companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if KRAFTON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A259960

KRAFTON

Develops, distributes, and sells mobile game and application software in Asia, Korea, the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives