- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As 2024 comes to a close, global markets have experienced mixed signals with U.S. consumer confidence falling and major stock indexes showing moderate gains, particularly driven by large-cap growth stocks in the technology sector. In this environment of fluctuating economic indicators and market sentiment, investors might look for high growth tech stocks that demonstrate strong innovation potential and resilience amidst changing conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1262 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CJ CGV (KOSE:A079160)

Simply Wall St Growth Rating: ★★★★☆☆

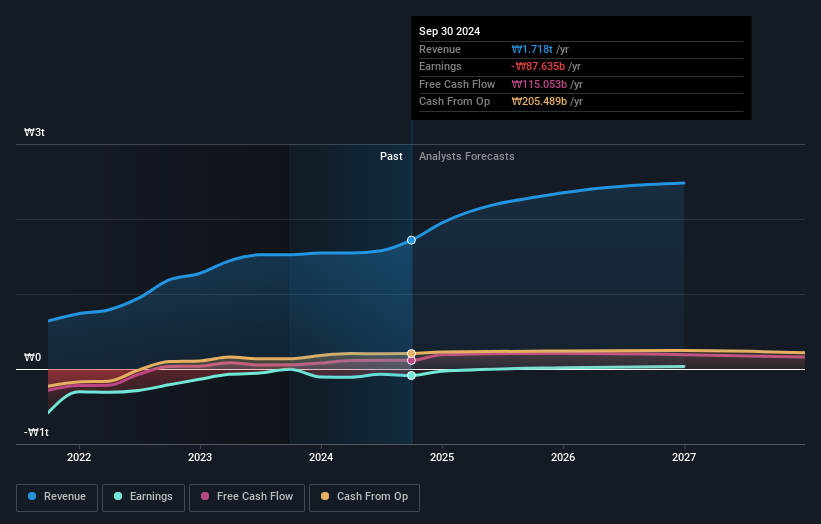

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand name in South Korea, with a market capitalization of approximately ₩875.92 billion.

Operations: The company generates revenue primarily from its Multiplex Operation segment, which contributes approximately ₩1.48 trillion. Additionally, the Technology Special Format and Equipment segment adds around ₩108.28 billion to the total revenue stream.

CJ CGV, a company navigating the challenging terrain of the entertainment industry, has demonstrated resilience with a forecasted annual revenue growth of 15.4%, surpassing South Korea's market average of 8.9%. Despite recent setbacks in profitability, with net income falling to KRW 4.2 billion from KRW 19.4 billion year-over-year for Q3, the firm is expected to pivot into profitability within three years—a significant turnaround given its current unprofitable status. This anticipated growth in earnings by an impressive 120.65% annually underscores CJ CGV's potential to leverage its market position and innovative strategies for future success.

- Get an in-depth perspective on CJ CGV's performance by reading our health report here.

Understand CJ CGV's track record by examining our Past report.

Digital China Holdings (SEHK:861)

Simply Wall St Growth Rating: ★★★★☆☆

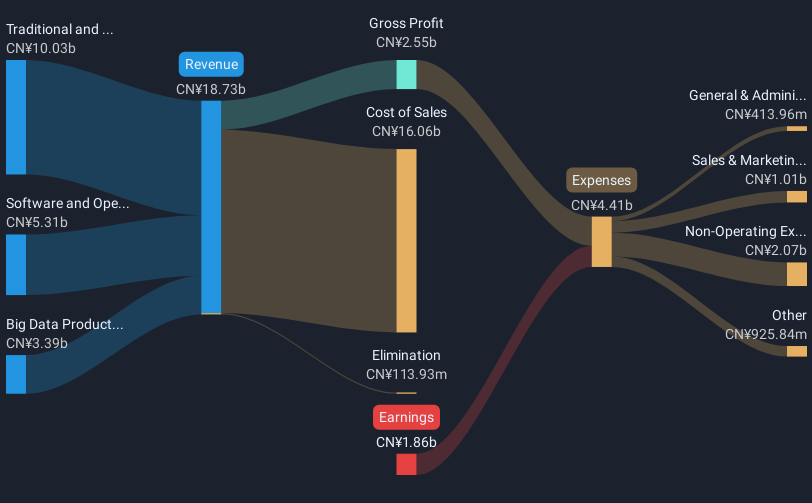

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers mainly in Mainland China, with a market capitalization of approximately HK$5.52 billion.

Operations: The company generates revenue primarily through three segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion). The focus is on providing technology-driven solutions to government and enterprise clients in Mainland China, leveraging a diverse portfolio of services to meet various digital transformation needs.

Digital China Holdings, navigating the competitive tech landscape, is poised for notable growth with a projected annual revenue increase of 8.8% and an earnings surge of 42.1% per year. Despite current unprofitability, the company's strategic emphasis on R&D—investing significantly in innovation—positions it well for future market relevance. With its recent shift towards more sustainable and high-demand tech solutions, Digital China's engagement in these sectors suggests potential for robust industry impact and client value enhancement moving forward.

All Ring Tech (TPEX:6187)

Simply Wall St Growth Rating: ★★★★★★

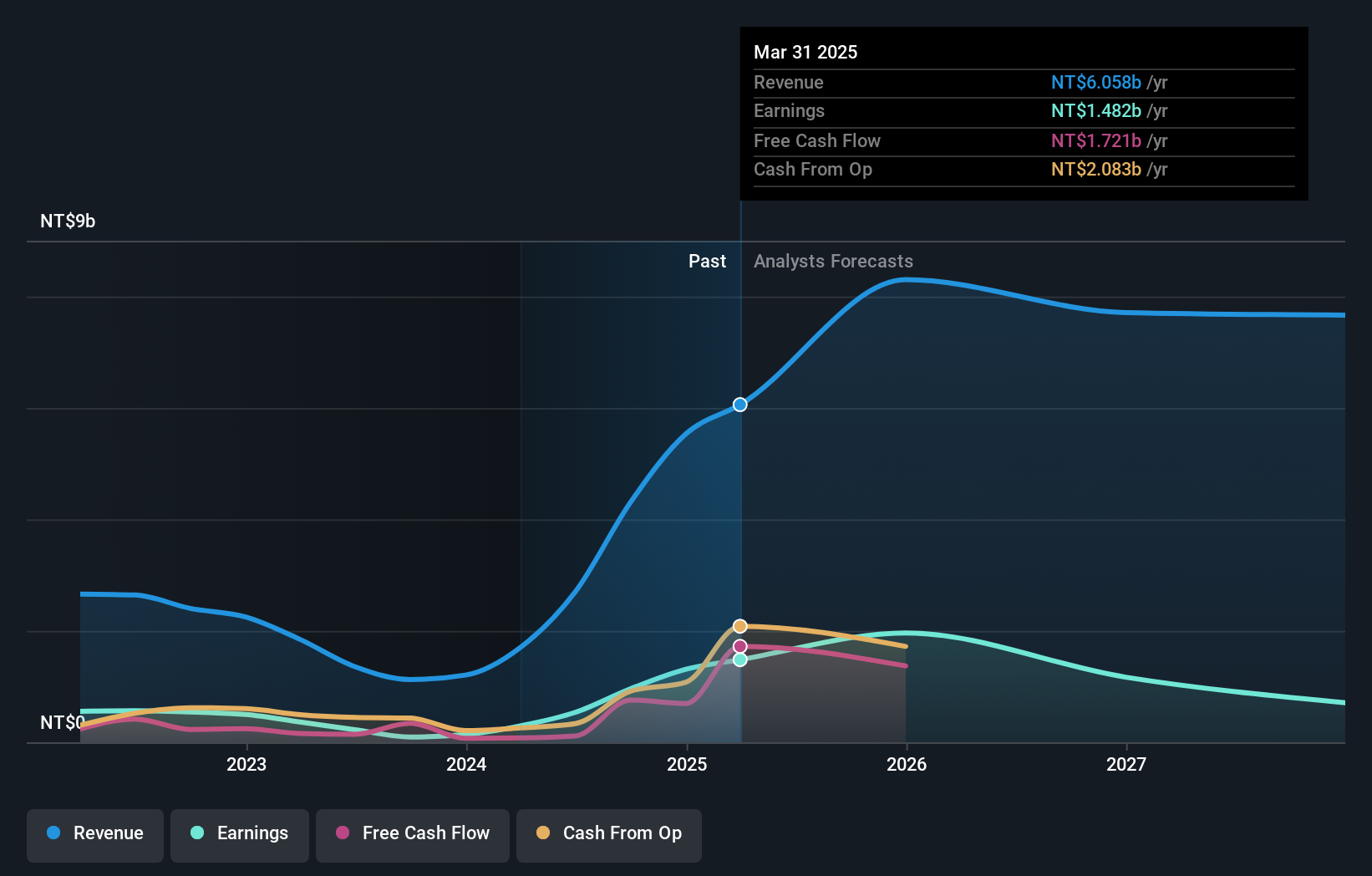

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market capitalization of NT$38.24 billion.

Operations: All Ring Tech generates revenue primarily through its subsidiaries, with All Ring Technology Co., Ltd. contributing NT$4.40 billion and WAN Run Jing Ji Co., Ltd. adding NT$684.53 million to the total revenue stream. The company's operations focus on automation machines across Taiwan and China, reflecting a significant presence in the region's manufacturing sector.

All Ring Tech has demonstrated a remarkable trajectory, with its earnings surging by 906.4% over the past year, starkly outperforming the Electronic industry's growth of 6.6%. This growth is underpinned by significant R&D investments that fuel innovation and maintain competitive edge in rapidly evolving tech landscapes. Recent presentations at high-profile conferences underscore its active engagement with industry leaders and potential for future partnerships. With revenue expected to grow at 21.6% annually, surpassing Taiwan's market average of 12.2%, and earnings projected to increase by 26.3% each year, All Ring Tech is strategically positioned to leverage its technological advancements and market responsiveness for sustained growth.

- Click here and access our complete health analysis report to understand the dynamics of All Ring Tech.

Gain insights into All Ring Tech's historical performance by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 1262 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives