- South Korea

- /

- Entertainment

- /

- KOSE:A036420

ContentreeJoongAng corp. (KRX:036420) Surges 27% Yet Its Low P/S Is No Reason For Excitement

ContentreeJoongAng corp. (KRX:036420) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

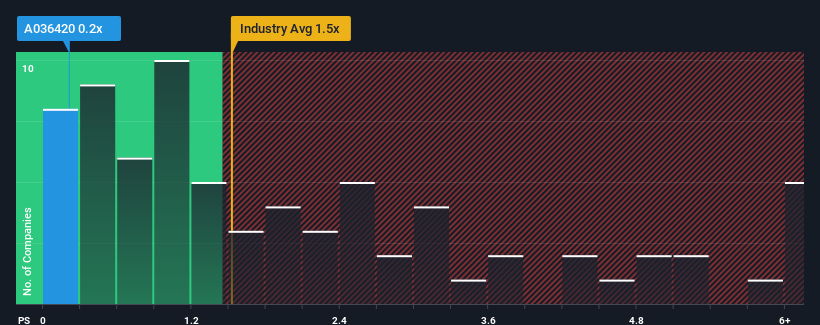

Even after such a large jump in price, considering around half the companies operating in Korea's Entertainment industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider ContentreeJoongAng as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ContentreeJoongAng

What Does ContentreeJoongAng's Recent Performance Look Like?

While the industry has experienced revenue growth lately, ContentreeJoongAng's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on ContentreeJoongAng will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like ContentreeJoongAng's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 71% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 6.8% as estimated by the ten analysts watching the company. That's shaping up to be materially lower than the 15% growth forecast for the broader industry.

With this information, we can see why ContentreeJoongAng is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite ContentreeJoongAng's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of ContentreeJoongAng's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for ContentreeJoongAng that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A036420

ContentreeJoongAng

Operates as an entertainment and media company in South Korea and internationally.

Very undervalued with concerning outlook.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.