- South Korea

- /

- Interactive Media and Services

- /

- KOSDAQ:A389140

4by4 Inc (KOSDAQ:389140) Might Not Be As Mispriced As It Looks After Plunging 33%

4by4 Inc (KOSDAQ:389140) shares have had a horrible month, losing 33% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

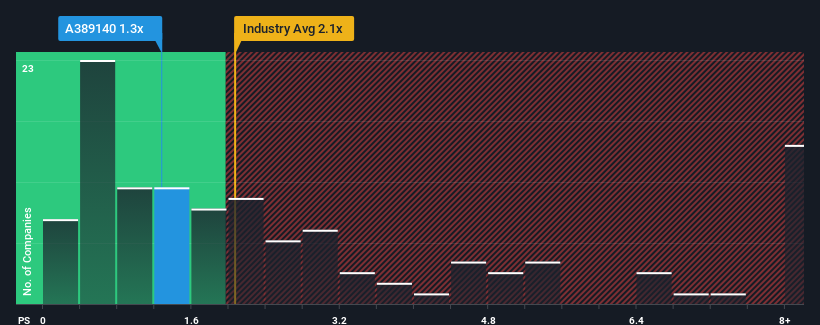

Since its price has dipped substantially, it would be understandable if you think 4by4 is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.3x, considering almost half the companies in Korea's Interactive Media and Services industry have P/S ratios above 2.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for 4by4

How 4by4 Has Been Performing

Revenue has risen firmly for 4by4 recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for 4by4, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like 4by4's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 9.3% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that 4by4's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

4by4's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of 4by4 revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You need to take note of risks, for example - 4by4 has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A389140

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026