- South Korea

- /

- Media

- /

- KOSDAQ:A363260

Mobidays Inc. (KOSDAQ:363260) Looks Just Right With A 32% Price Jump

Mobidays Inc. (KOSDAQ:363260) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

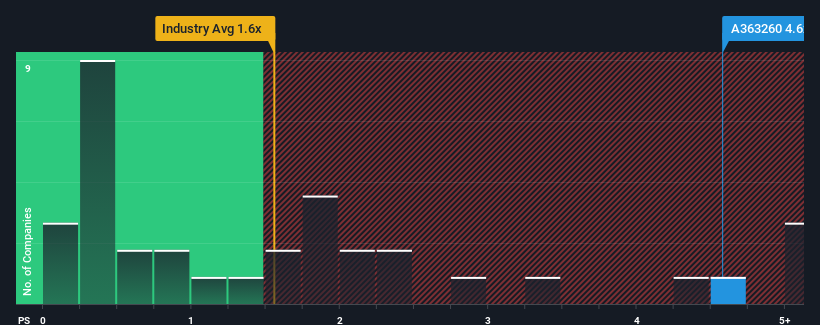

After such a large jump in price, when almost half of the companies in Korea's Media industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Mobidays as a stock not worth researching with its 4.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Mobidays

What Does Mobidays' P/S Mean For Shareholders?

Mobidays certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Mobidays, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Mobidays' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 49%. The strong recent performance means it was also able to grow revenue by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 6.6% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Mobidays' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Mobidays' P/S

Shares in Mobidays have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Mobidays maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Mobidays (1 is a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Mobidays, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A363260

Mobidays

Mobidays, Inc. provides mobile marketing services which connects and mediates domestic and international advertisers, advertising agencies, and general media representative with major mobile mediums.

Adequate balance sheet low.

Market Insights

Community Narratives