- South Korea

- /

- Entertainment

- /

- KOSDAQ:A322780

COPUS KOREA Co., Ltd. (KOSDAQ:322780) Not Doing Enough For Some Investors As Its Shares Slump 26%

Unfortunately for some shareholders, the COPUS KOREA Co., Ltd. (KOSDAQ:322780) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

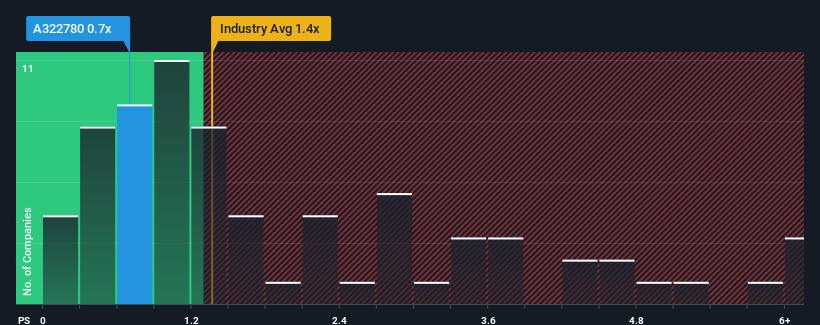

After such a large drop in price, given about half the companies operating in Korea's Entertainment industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider COPUS KOREA as an attractive investment with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for COPUS KOREA

What Does COPUS KOREA's Recent Performance Look Like?

As an illustration, revenue has deteriorated at COPUS KOREA over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on COPUS KOREA will help you shine a light on its historical performance.How Is COPUS KOREA's Revenue Growth Trending?

In order to justify its P/S ratio, COPUS KOREA would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why COPUS KOREA's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

COPUS KOREA's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of COPUS KOREA revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for COPUS KOREA (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on COPUS KOREA, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A322780

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives