- South Korea

- /

- Entertainment

- /

- KOSDAQ:A299900

Market Cool On Wysiwyg Studios Co., Ltd.'s (KOSDAQ:299900) Earnings Pushing Shares 26% Lower

Wysiwyg Studios Co., Ltd. (KOSDAQ:299900) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

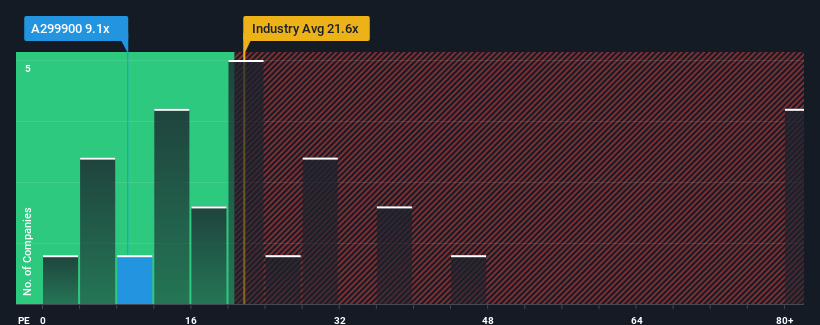

Although its price has dipped substantially, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Wysiwyg Studios as an attractive investment with its 9.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Wysiwyg Studios as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Wysiwyg Studios

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Wysiwyg Studios' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 441% last year. Pleasingly, EPS has also lifted 2,218% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 33% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Wysiwyg Studios is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Wysiwyg Studios' P/E

Wysiwyg Studios' P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Wysiwyg Studios revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Wysiwyg Studios, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wysiwyg Studios might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A299900

Adequate balance sheet very low.

Market Insights

Community Narratives