- South Korea

- /

- Entertainment

- /

- KOSDAQ:A253450

Exploring Three High Growth Tech Stocks for Your Portfolio

Reviewed by Simply Wall St

In the wake of recent U.S. elections, global markets have experienced notable shifts, with major benchmarks like the S&P 500 and Russell 2000 showing impressive gains as investors anticipate potential economic growth driven by policy changes. Amidst this backdrop, identifying high-growth tech stocks that align with evolving market dynamics can be a prudent strategy for investors looking to capitalize on technological advancements and potential regulatory shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Studio Dragon (KOSDAQ:A253450)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Studio Dragon Corporation is a drama studio that creates and distributes content for both traditional and new media platforms, with a market capitalization of ₩1.19 billion.

Operations: The company generates revenue primarily through television programming and distribution, amounting to ₩580.60 million.

Studio Dragon, a player in the entertainment sector, is navigating a complex growth trajectory. Despite experiencing a significant earnings drop of 85.6% over the past year, forecasts are optimistic with expected annual earnings growth of 42.6%, outpacing the South Korean market's 29.3%. This contrast highlights potential recovery and expansion phases ahead. Revenue projections also look promising at an annual increase of 14.5%, surpassing the market average of 10.1%. However, challenges remain evident as profit margins have contracted from last year’s 4.9% to just 0.9%. The company's commitment to innovation is underscored by its strategic R&D investments which are crucial for sustaining long-term competitiveness in this fast-evolving industry landscape.

- Click to explore a detailed breakdown of our findings in Studio Dragon's health report.

Evaluate Studio Dragon's historical performance by accessing our past performance report.

NOTE (OM:NOTE)

Simply Wall St Growth Rating: ★★★★☆☆

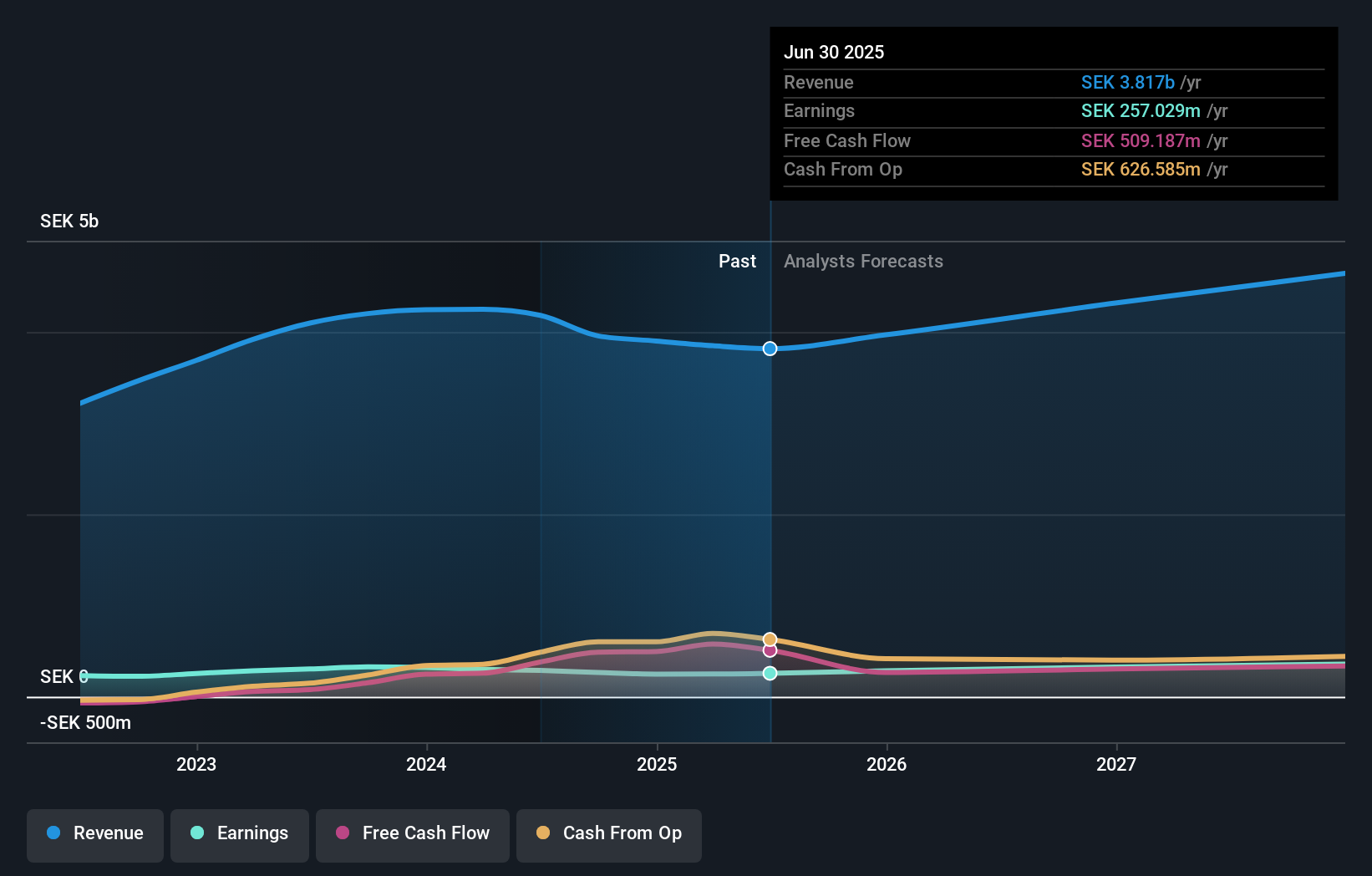

Overview: NOTE AB (publ) is a company that offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets with a market capitalization of SEK3.81 billion.

Operations: NOTE AB generates revenue primarily from its electronics manufacturing services, with significant contributions from Western Europe (SEK3.02 billion) and the Rest of the World (SEK988.44 million).

NOTE AB, despite a challenging year with earnings declining by 19%, is setting a robust growth trajectory with projected revenue increases of 11.5% per year, outpacing the Swedish market's near-stagnant growth rate of 0.06%. This performance is bolstered by significant R&D investments aimed at fostering innovation and competitiveness in the tech sector. Moreover, earnings are expected to surge by an impressive 20.1% annually, signaling potential for substantial operational improvements and market share gains in upcoming years. These figures underscore NOTE’s commitment to leveraging its technological capabilities to navigate through current industry challenges effectively.

- Click here and access our complete health analysis report to understand the dynamics of NOTE.

Examine NOTE's past performance report to understand how it has performed in the past.

China Leadshine Technology (SZSE:002979)

Simply Wall St Growth Rating: ★★★★★☆

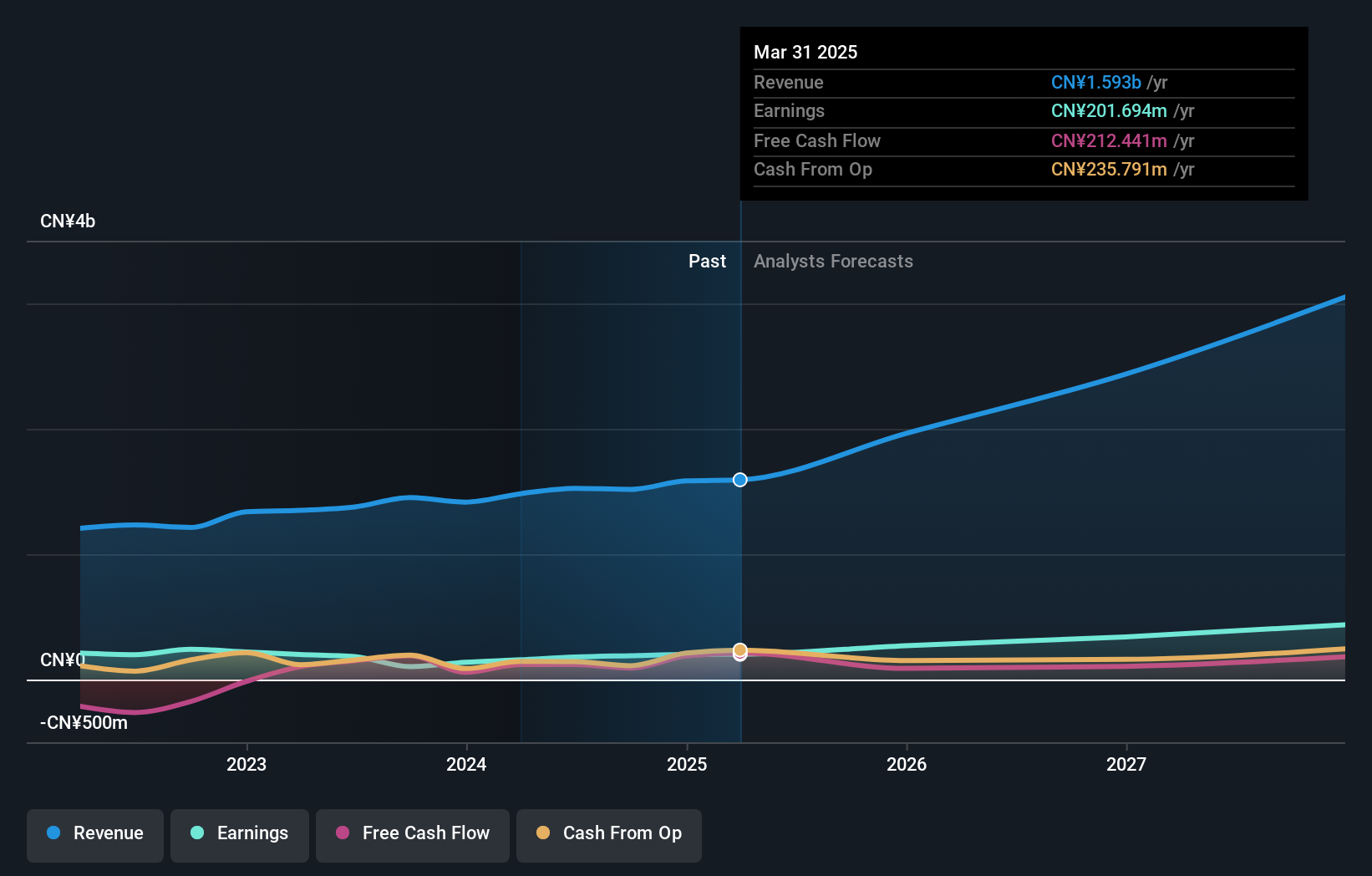

Overview: China Leadshine Technology Co., Ltd. designs, manufactures, and sells motion control equipment and components in China with a market capitalization of CN¥8.99 billion.

Operations: Leadshine Technology focuses on the design, manufacturing, and sale of motion control equipment and components within China. The company generates revenue primarily through these products, contributing significantly to its financial performance.

China Leadshine Technology has demonstrated robust financial performance, with a notable increase in net income to CNY 144.28 million from CNY 92.28 million year-over-year, reflecting an earnings surge of 56.3%. This growth is underpinned by a strategic emphasis on R&D, crucial for maintaining technological leadership and innovation in the competitive tech landscape. The company's commitment to reinvestment in its core capabilities is evident from its R&D expenditure trends, aligning with its revenue growth of 21.1% per year, which significantly outpaces the broader CN market's growth rate of 14.1%. Moreover, with earnings forecasted to grow at an impressive rate of 28.6% annually, China Leadshine is positioning itself as a dynamic player within the tech sector, ready to capitalize on emerging opportunities despite not conducting any share repurchases this period.

Taking Advantage

- Embark on your investment journey to our 1271 High Growth Tech and AI Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A253450

Studio Dragon

A drama studio, produces and provides drama contents worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives