- South Korea

- /

- Biotech

- /

- KOSDAQ:A228760

High Growth Tech Stocks in South Korea for October 2024

Reviewed by Simply Wall St

In the last week, the South Korean market has been flat, but over the past 12 months, it has risen by 7.3%, with earnings forecasted to grow by 29% annually. In this context of steady growth and promising earnings potential, identifying high-growth tech stocks requires a focus on companies that demonstrate robust innovation and scalability within this dynamic sector.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation is a South Korean company that develops mobile games for both domestic and international markets, with a market cap of ₩378.98 billion.

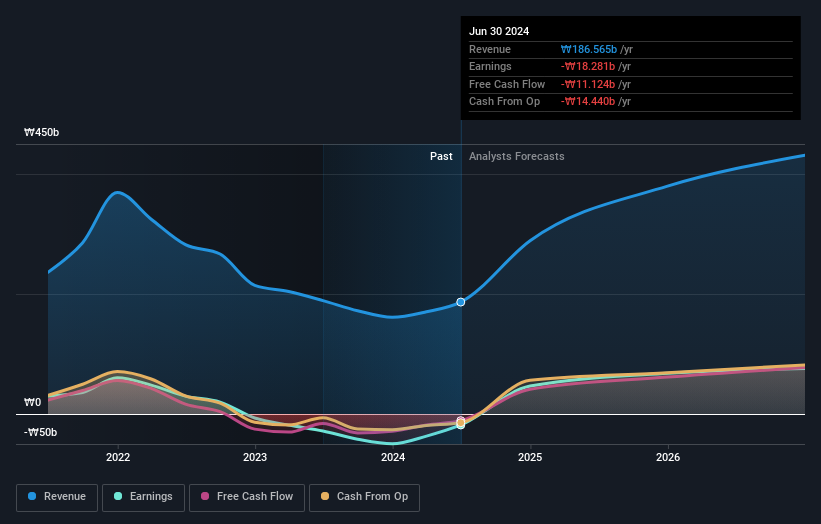

Operations: The company generates revenue primarily from its computer graphics segment, which contributed ₩186.57 billion. The focus on mobile game development caters to both domestic and international markets.

Devsisters has demonstrated a robust turnaround, with Q2 sales soaring to KRW 51.82 billion, up from KRW 36.46 billion the previous year, and net income reversing from a loss of KRW 12.28 billion to a gain of KRW 6.27 billion. This performance is underpinned by an aggressive R&D strategy that not only fuels innovation but also aligns with projected revenue growth rates of 29.1% annually, significantly outpacing the broader South Korean market's growth rate of 10.2%. Looking ahead, Devsisters is expected to pivot into profitability within three years, with earnings potentially growing by an impressive 63% per year, highlighting its potential in an increasingly competitive tech landscape.

- Navigate through the intricacies of Devsisters with our comprehensive health report here.

Examine Devsisters' past performance report to understand how it has performed in the past.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★★★

Overview: NEXON Games Co., Ltd. is a game developer with a market capitalization of approximately ₩916.13 billion.

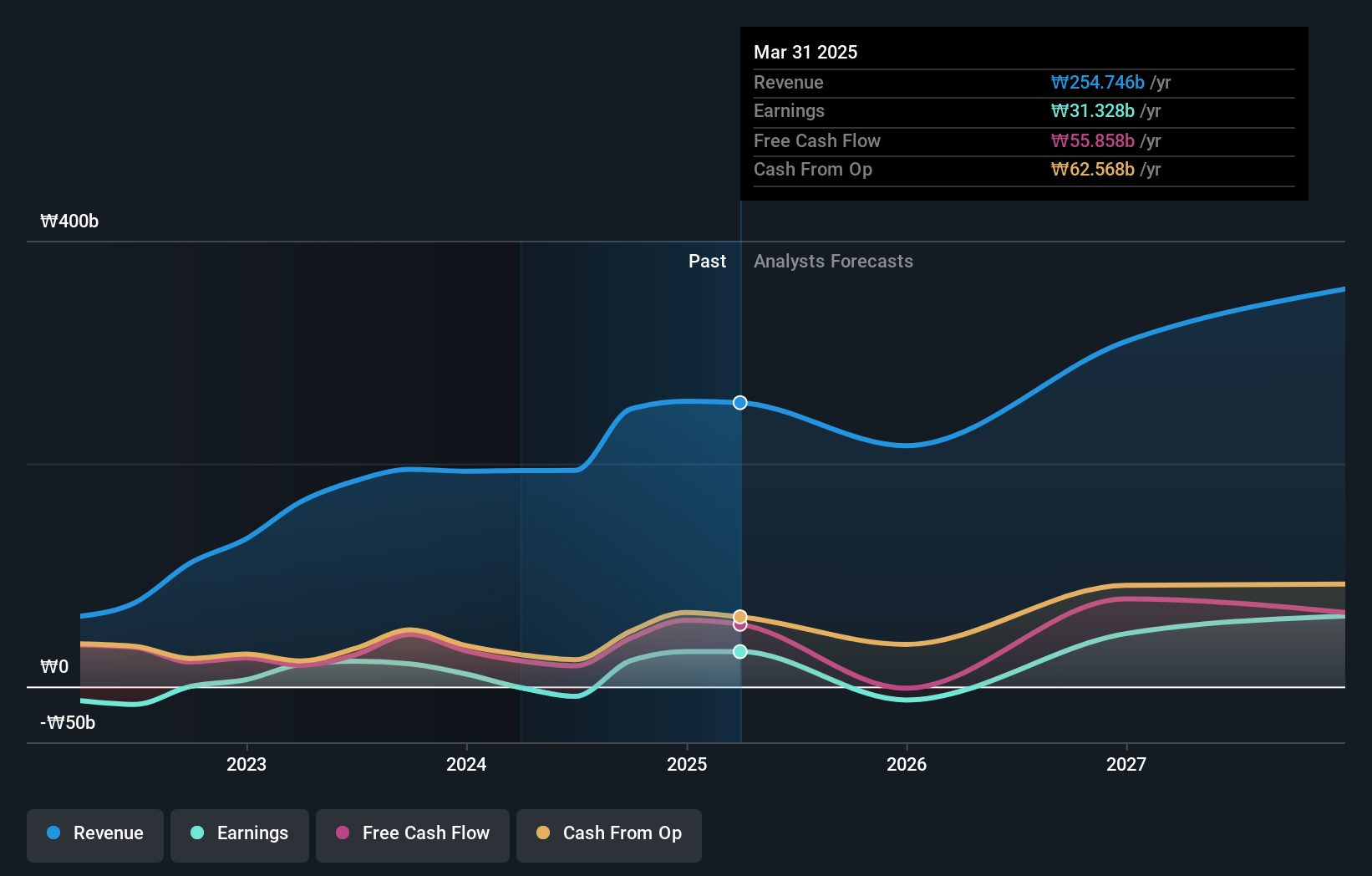

Operations: The company generates revenue primarily through game sales, amounting to ₩190.97 billion, with additional income from rental activities contributing ₩2.42 billion.

NEXON Games, with its focus on dynamic online gaming platforms, has strategically increased its R&D expenditure to 67.0% of its revenue, underscoring a commitment to innovation and market adaptability. This investment has fueled a robust pipeline of new content and technological advancements, contributing to an anticipated revenue growth rate of 29.6% annually. Despite current unprofitability, the company's aggressive financial strategy positions it well for future profitability, with projected earnings growth significantly outpacing the broader South Korean tech industry's average.

- Get an in-depth perspective on NEXON Games' performance by reading our health report here.

Gain insights into NEXON Games' past trends and performance with our Past report.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genomictree Inc. is a biomarker-based molecular diagnostics company that develops and commercializes products for detecting cancer and infectious diseases, with a market cap of ₩407.69 billion.

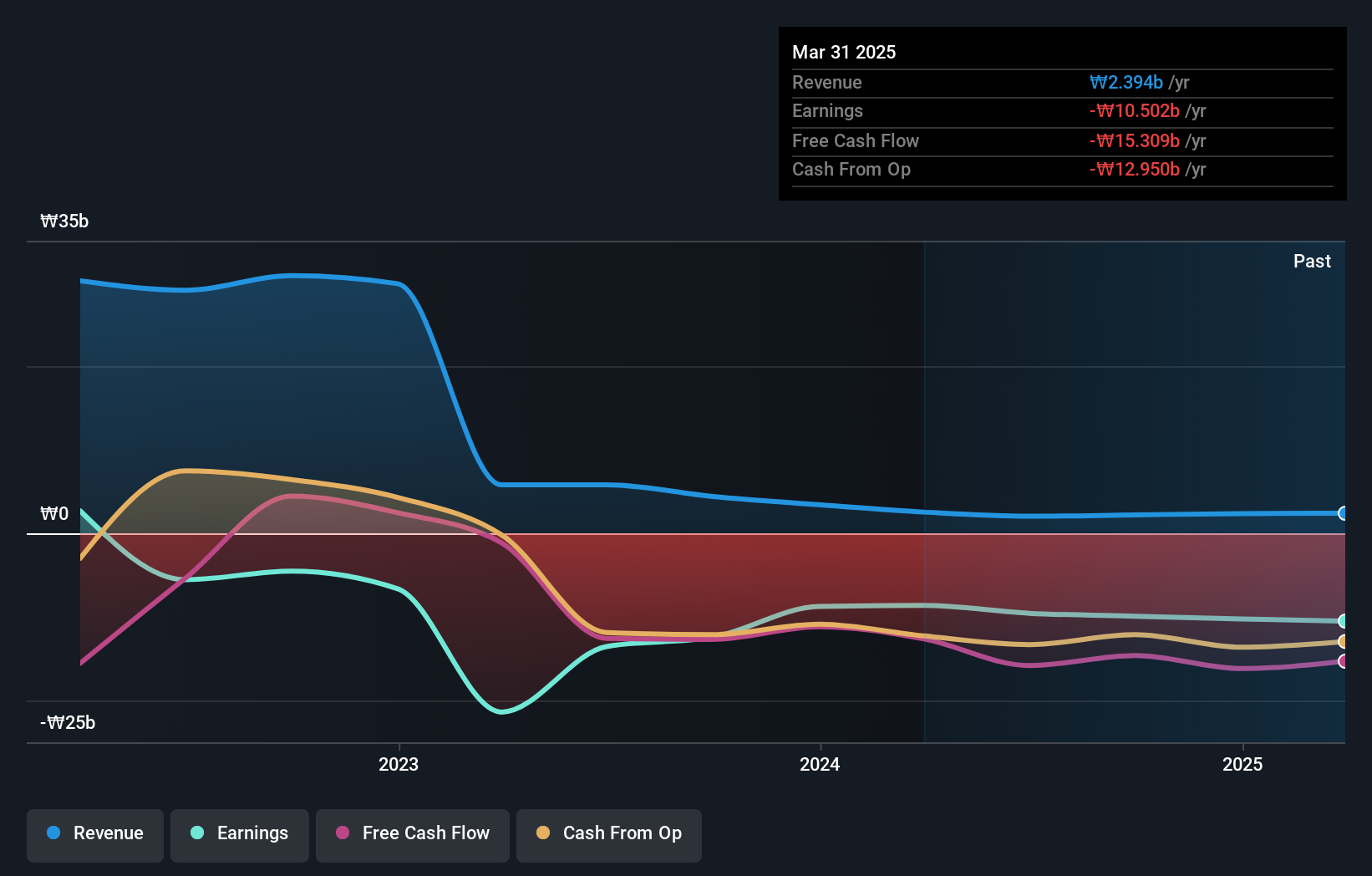

Operations: The company generates revenue primarily from its Cancer Molecular Diagnosis Business, contributing ₩1.93 billion, while the Genomic Analysis segment adds ₩109.21 million.

Genomictree, a player in the South Korean biotech landscape, is navigating through its growth phase with notable financial dynamics. Despite lacking meaningful revenue at ₩2B, the company's projected revenue growth stands at an impressive 90.5% per year, outpacing the broader KR market's forecast of 10.2% annually. This surge is supported by an anticipated earnings increase of 107.8% per year as it moves towards profitability within three years—a stark contrast to its current unprofitable status and volatile share price trends over recent months. These figures reflect a strategic emphasis on R&D which could potentially reshape its market standing and influence future industry standards in biotechnology.

- Click to explore a detailed breakdown of our findings in Genomictree's health report.

Review our historical performance report to gain insights into Genomictree's's past performance.

Seize The Opportunity

- Gain an insight into the universe of 47 KRX High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A228760

Genomictree

A biomarker-based molecular diagnostics company, develops and commercializes molecular diagnostic products for the detection of cancer and various infectious diseases.

High growth potential with adequate balance sheet.