- South Korea

- /

- Biotech

- /

- KOSDAQ:A096530

Exploring Three High Growth Tech Stocks For Potential Portfolio Strength

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by central bank rate cuts and mixed economic indicators, the technology-heavy Nasdaq Composite has reached new heights, contrasting with the underperformance of smaller-cap indices like the Russell 2000. In this environment, identifying high-growth tech stocks that can potentially fortify a portfolio involves looking for companies with robust innovation capabilities and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1316 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. is a global manufacturer and seller of molecular diagnostics products with a market cap of approximately ₩1.08 trillion.

Operations: Seegene, Inc. focuses on the production and distribution of molecular diagnostics products globally. The company generates revenue through its diverse range of diagnostic solutions, catering to various healthcare needs worldwide.

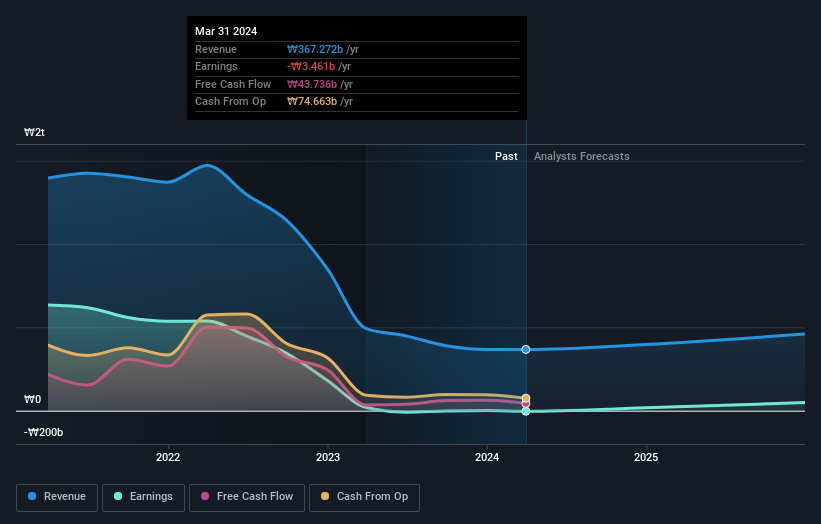

Seegene has pivoted from a challenging past to a promising future, marked by a significant turnaround in profitability and robust earnings growth. Recently, the company reported an impressive surge in sales to KRW 108.82 billion for Q3 2024, up from KRW 91.89 billion year-over-year, alongside a swing to net income of KRW 1.67 billion from a net loss previously. This performance is underpinned by strategic alliances like the recent partnership with Werfen, aimed at expanding its innovative syndromic real-time PCR technology across Europe’s IVD markets. Such moves not only enhance Seegene's market reach but also solidify its standing in high-growth sectors driven by advanced diagnostics and disease prevention technologies.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★☆☆

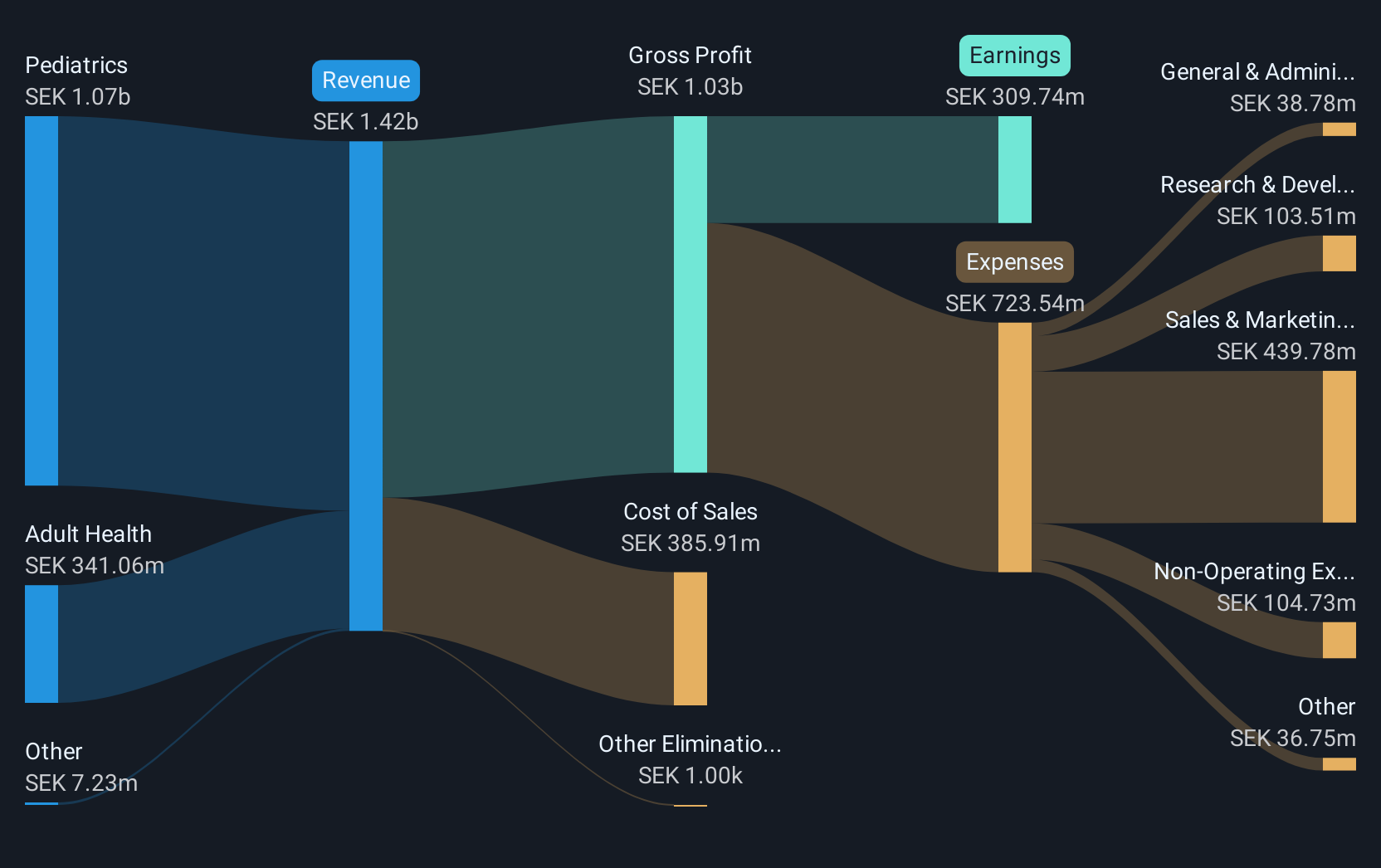

Overview: BioGaia AB (publ) is a healthcare company that develops and sells probiotic products globally, with a market capitalization of approximately SEK11.12 billion.

Operations: The company generates revenue primarily through its Pediatrics and Adult Health segments, with Pediatrics contributing significantly more at SEK1.04 billion compared to SEK306.08 million from Adult Health.

BioGaia's recent strides in the biotech sector underscore its commitment to innovation and market expansion, particularly with the launch of BioGaia® Gastrus® PURE ACTION, catering to sensitive stomachs. This product enhancement is backed by robust clinical research, indicating significant relief from IBS symptoms and improved quality of life for users. Financially, while Q3 2024 saw a dip in net income to SEK 36.6 million from SEK 101.5 million year-over-year, annual projections remain positive with revenue growth at 11.1% per year outpacing the Swedish market's 1.3%. Moreover, BioGaia's earnings are expected to surge by an annual rate of 16.6%, reflecting a strong trajectory in profitability despite current fluctuations.

- Unlock comprehensive insights into our analysis of BioGaia stock in this health report.

Explore historical data to track BioGaia's performance over time in our Past section.

Japan Business Systems (TSE:5036)

Simply Wall St Growth Rating: ★★★★☆☆

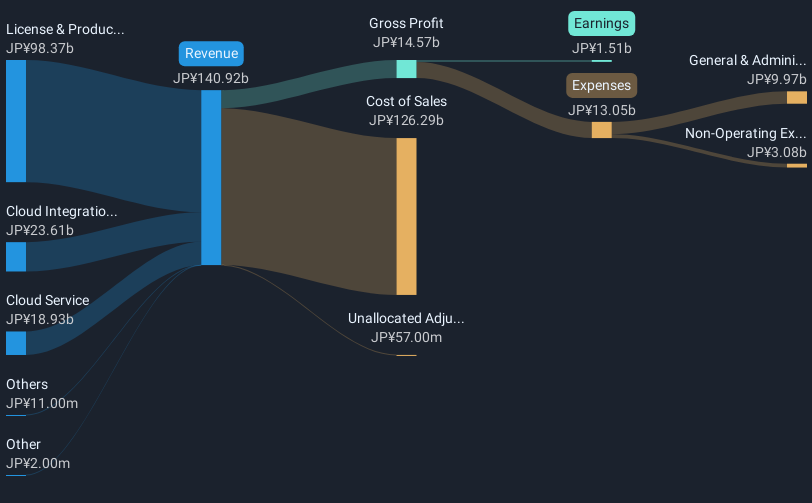

Overview: Japan Business Systems, Inc. specializes in cloud integration and related services with a market capitalization of ¥39.71 billion.

Operations: The company generates revenue primarily from cloud integration and related services, with significant contributions from license and product sales totaling ¥98.37 billion. Cloud service revenues amount to ¥18.93 billion, while cloud integration services contribute ¥23.61 billion.

Japan Business Systems recently opposed shareholder proposals aimed at increasing dividends, arguing that such changes could undermine long-term value by sacrificing necessary growth investments. This stance highlights their focus on sustainable financial strategies rather than short-term gains. Despite a challenging year with a 54.8% decline in earnings, the company is poised for recovery with expected revenue and earnings growth rates of 6.3% and 24.6% per year, respectively, outpacing the broader Japanese market projections of 4.2% and 7.9%. Moreover, their commitment to innovation is underscored by significant R&D investments aimed at fostering future growth within the tech sector.

- Take a closer look at Japan Business Systems' potential here in our health report.

Understand Japan Business Systems' track record by examining our Past report.

Make It Happen

- Reveal the 1316 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A096530

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives