- South Korea

- /

- Media

- /

- KOSDAQ:A216050

The Incross (KOSDAQ:216050) Share Price Is Up 81% And Shareholders Are Holding On

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Incross Co., Ltd. (KOSDAQ:216050) shareholders have seen the share price rise 81% over three years, well in excess of the market return (21%, not including dividends).

Check out our latest analysis for Incross

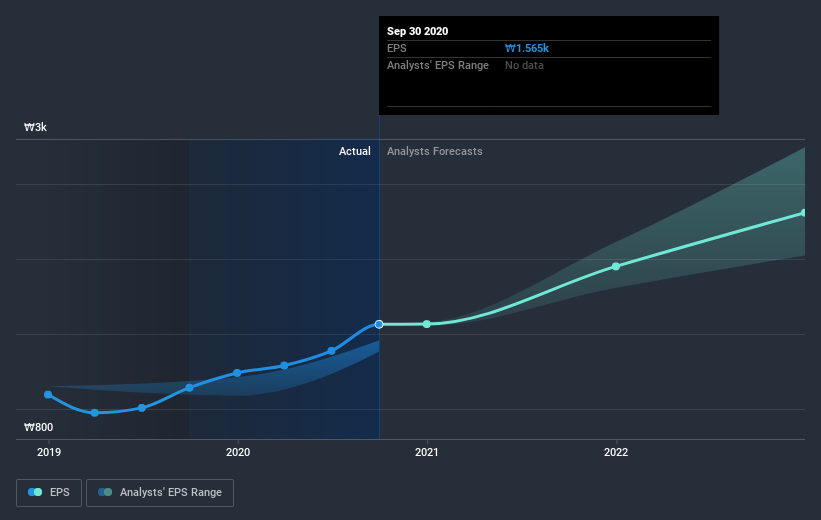

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Incross was able to grow its EPS at 18% per year over three years, sending the share price higher. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 22% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Quite to the contrary, the share price has arguably reflected the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Incross has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

Pleasingly, Incross' total shareholder return last year was 67%. That gain actually surpasses the 22% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Incross on your watchlist. Before deciding if you like the current share price, check how Incross scores on these 3 valuation metrics.

But note: Incross may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Incross, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A216050

Flawless balance sheet and good value.

Market Insights

Community Narratives