- South Korea

- /

- Media

- /

- KOSDAQ:A214270

Not Many Are Piling Into FSN Co., Ltd. (KOSDAQ:214270) Stock Yet As It Plummets 31%

The FSN Co., Ltd. (KOSDAQ:214270) share price has fared very poorly over the last month, falling by a substantial 31%. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

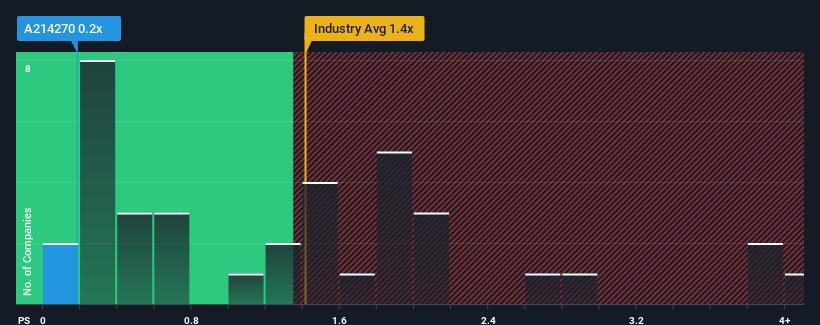

Following the heavy fall in price, considering around half the companies operating in Korea's Media industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider FSN as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for FSN

How FSN Has Been Performing

With revenue growth that's exceedingly strong of late, FSN has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on FSN will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for FSN, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is FSN's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as FSN's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 42% last year. As a result, it also grew revenue by 7.8% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 0.3% shows it's noticeably more attractive.

With this in mind, we find it intriguing that FSN's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

FSN's recently weak share price has pulled its P/S back below other Media companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see FSN currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for FSN (1 is significant!) that you should be aware of.

If you're unsure about the strength of FSN's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A214270

FSN

Provides mobile marketing services, business solution development and supply, and Internet and other content development and supply in South Korea, Southeast Asia, the United States, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.