- South Korea

- /

- Entertainment

- /

- KOSDAQ:A205500

Action Square (KOSDAQ:205500) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Action Square CO., LTD. (KOSDAQ:205500) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Action Square

What Is Action Square's Debt?

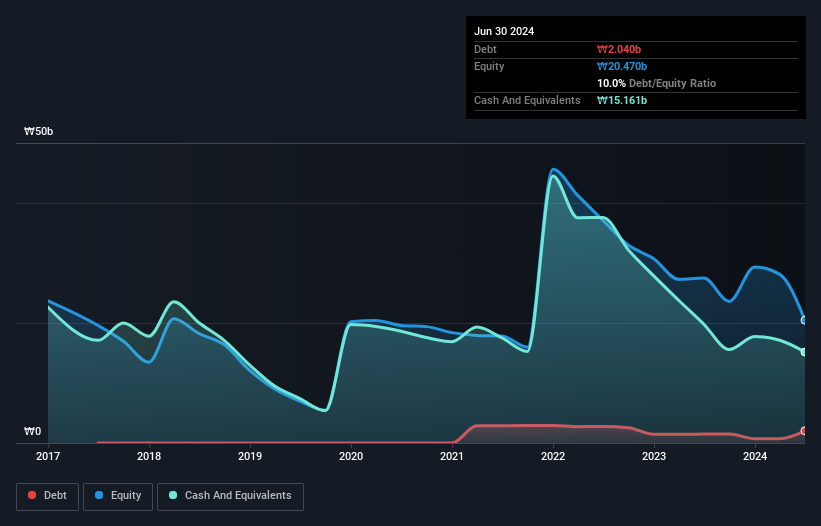

As you can see below, at the end of June 2024, Action Square had ₩2.04b of debt, up from ₩1.48b a year ago. Click the image for more detail. However, it does have ₩15.2b in cash offsetting this, leading to net cash of ₩13.1b.

How Strong Is Action Square's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Action Square had liabilities of ₩7.34b due within 12 months and liabilities of ₩5.43b due beyond that. On the other hand, it had cash of ₩15.2b and ₩393.7m worth of receivables due within a year. So it can boast ₩2.79b more liquid assets than total liabilities.

This short term liquidity is a sign that Action Square could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Action Square boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Action Square will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Action Square had a loss before interest and tax, and actually shrunk its revenue by 34%, to ₩4.0b. That makes us nervous, to say the least.

So How Risky Is Action Square?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Action Square had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of ₩12b and booked a ₩16b accounting loss. But at least it has ₩13.1b on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Action Square is showing 5 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if NEXUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A205500

Slight risk with worrying balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026