- South Korea

- /

- Entertainment

- /

- KOSDAQ:A194480

High Growth Tech Stocks Including None With Promising Potential

Reviewed by Simply Wall St

As global markets experience a dynamic period marked by the U.S. stock indexes climbing toward record highs and small-cap stocks lagging behind their larger counterparts, investors are closely monitoring inflation trends and interest rate expectations that could influence future market movements. In this environment, identifying high-growth tech stocks with promising potential involves looking for companies that can navigate economic uncertainties while capitalizing on technological advancements and innovation to drive growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Xspray Pharma | 127.78% | 104.91% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

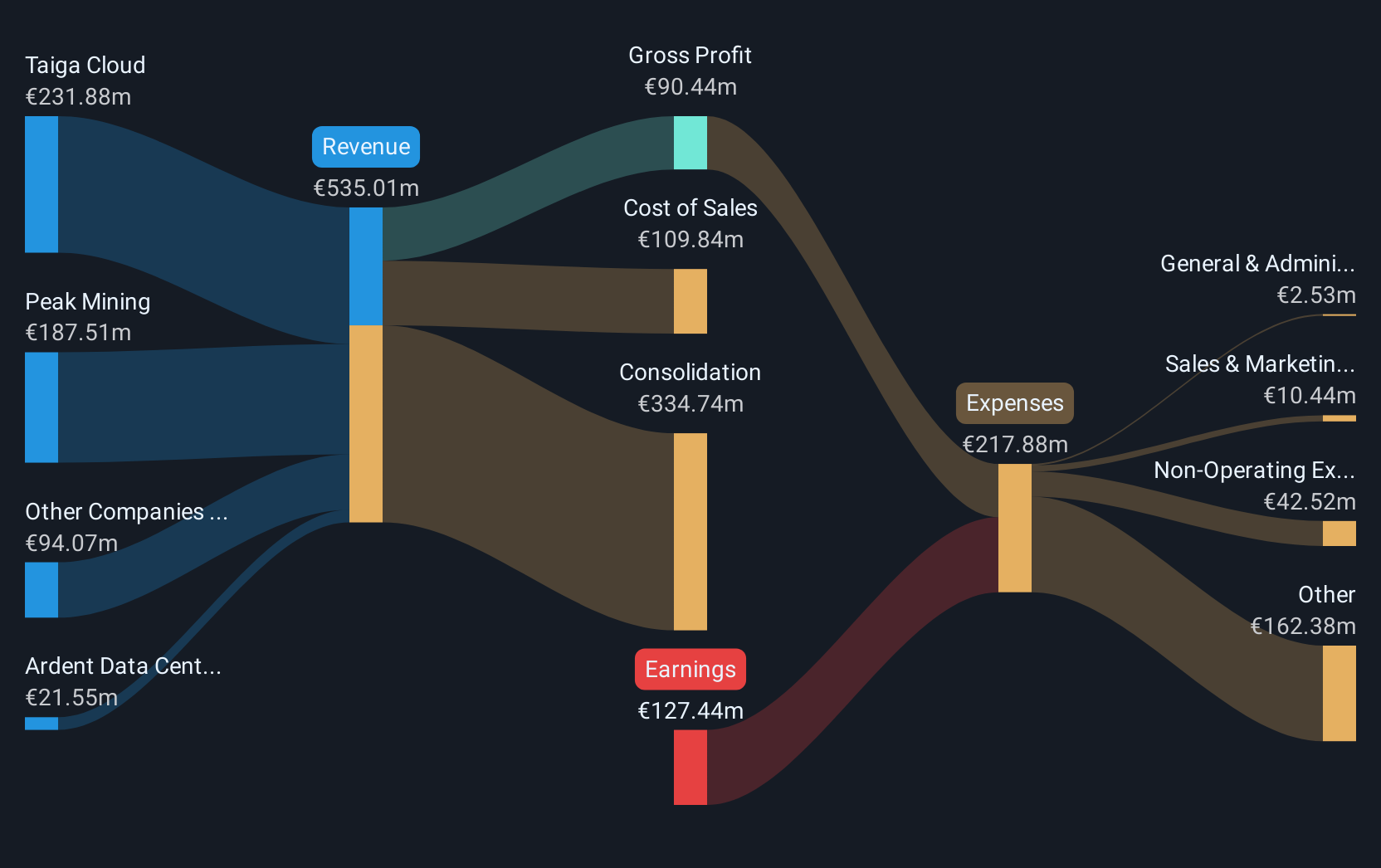

Overview: Northern Data AG specializes in providing high-performance computing infrastructure solutions to businesses and research institutions globally, with a market capitalization of €3.01 billion.

Operations: The company generates revenue primarily through its Peak Mining segment (€156.13 million) and Ardent Data Centers (€31.46 million), with additional contributions from Taiga Cloud (€22.13 million).

Northern Data's recent appointment of John Hoffman as COO, with his two decades of experience, underscores the company's commitment to steering its AI and High-Performance Computing (HPC) solutions towards global expansion. This strategic move aligns with their impressive forecasted revenue growth of 23.8% annually, significantly outpacing the German market's average of 5.9%. Despite current unprofitability and a volatile share price, projections indicate a shift to profitability within three years, supported by an anticipated earnings surge at an annual rate of 91.3%. This potential turnaround is critical as it mirrors broader industry trends where tech firms increasingly pivot towards scalable and innovative business models to capture emerging market opportunities.

- Navigate through the intricacies of Northern Data with our comprehensive health report here.

Explore historical data to track Northern Data's performance over time in our Past section.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

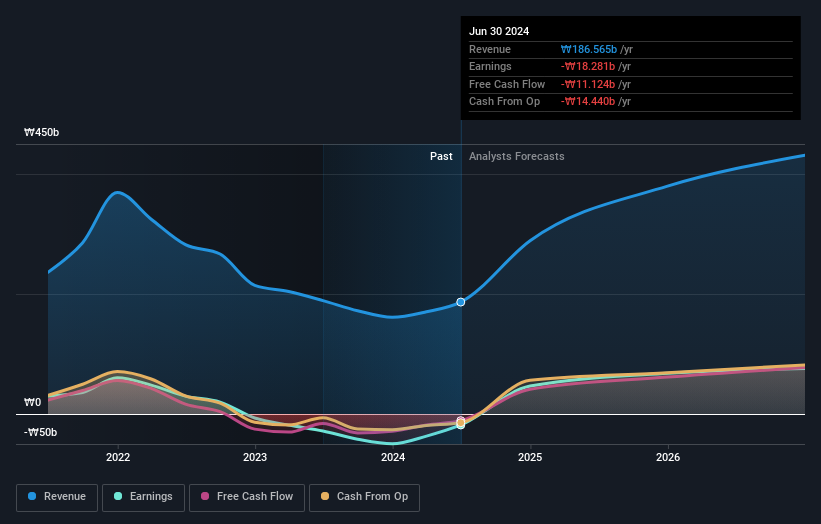

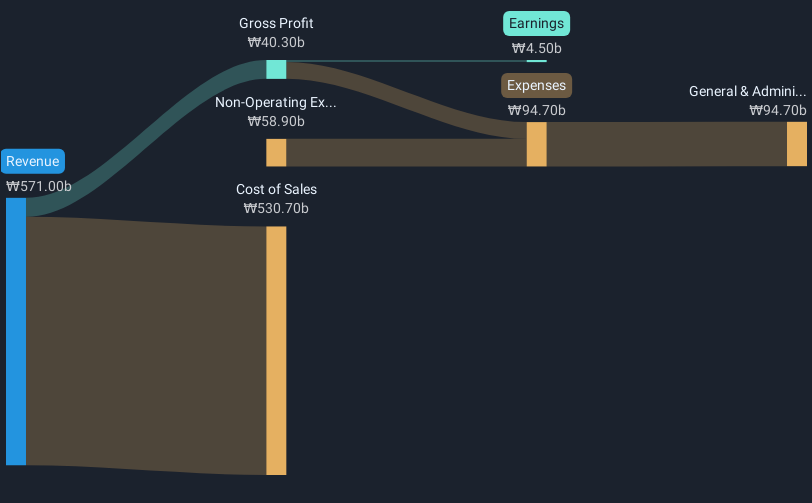

Overview: Devsisters Corporation is a South Korean company that develops mobile games for both domestic and international markets, with a market cap of ₩370.60 billion.

Operations: The company generates revenue primarily from its computer graphics segment, contributing ₩223.84 million.

Devsisters, navigating through a transformative year, has pivoted effectively to profitability, a stark contrast to its previous financial struggles marked by a significant one-off loss of ₩21.8 billion. This turnaround is underscored by an impressive annual revenue growth rate of 24.2%, outperforming the Korean market average of 9%. The company's strategic focus on innovation is evident from its R&D investment, aligning with industry shifts towards more sustainable and scalable business models. Moreover, with earnings projected to surge by 57.7% annually, Devsisters is poised for robust future growth, leveraging recent strategic discussions from their shareholder and analyst calls to refine their operational strategies further.

Solus Advanced Materials (KOSE:A336370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solus Advanced Materials Co., Ltd. offers materials and solutions across South Korea, Europe, and international markets with a market cap of ₩772.23 billion.

Operations: Solus Advanced Materials Co., Ltd. engages in the production and distribution of advanced materials, catering to diverse markets across South Korea, Europe, and beyond. The company operates with a market capitalization of ₩772.23 billion.

Solus Advanced Materials has demonstrated notable adaptability in a challenging tech landscape, with its revenue expected to grow by 18.2% annually, outpacing the Korean market's average of 9%. Despite a recent dip in earnings growth by -97.5% over the past year, projections are optimistic with an anticipated surge in earnings by approximately 63% annually. This growth is supported by strategic investor relations initiatives aimed at enhancing transparency and understanding among investors, reflecting a proactive approach to navigating market dynamics and bolstering investor confidence.

- Get an in-depth perspective on Solus Advanced Materials' performance by reading our health report here.

Gain insights into Solus Advanced Materials' past trends and performance with our Past report.

Next Steps

- Dive into all 1207 of the High Growth Tech and AI Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A194480

Devsisters

Engages in the development of mobile games in South Korea and internationally.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives