- Hong Kong

- /

- Semiconductors

- /

- SEHK:968

Asian Insider Picks For Growth August 2025

Reviewed by Simply Wall St

As global markets navigate through a complex landscape of trade policies and economic shifts, Asian markets have shown resilience, with China's strong export data underscoring its robust position despite ongoing trade tensions. In this evolving environment, growth companies with high insider ownership can offer unique insights into potential market opportunities, as insiders often have a deep understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 61% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.9% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 95.5% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 32.2% |

| Fulin Precision (SZSE:300432) | 12.8% | 43.7% |

Here's a peek at a few of the choices from the screener.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company operating in South Korea, Japan, and internationally with a market cap of approximately ₩1.93 trillion.

Operations: The company generates revenue primarily from its entertainment-related activities, amounting to approximately ₩431.12 billion.

Insider Ownership: 23.1%

YG Entertainment's revenue is projected to grow at 17.6% annually, outpacing the Korean market's 7.3%. Earnings are expected to rise significantly by 27.9% per year, surpassing the market average of 22.4%. Despite a low forecasted return on equity of 11.2%, recent earnings showed substantial improvement with net income increasing from ₩351 million to ₩5,180.81 million in Q1 2025, reflecting strong operational performance without significant insider trading activity recently observed.

- Click to explore a detailed breakdown of our findings in YG Entertainment's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of YG Entertainment shares in the market.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products across Mainland China, the rest of Asia, North America, Europe, and internationally with a market cap of HK$30.14 billion.

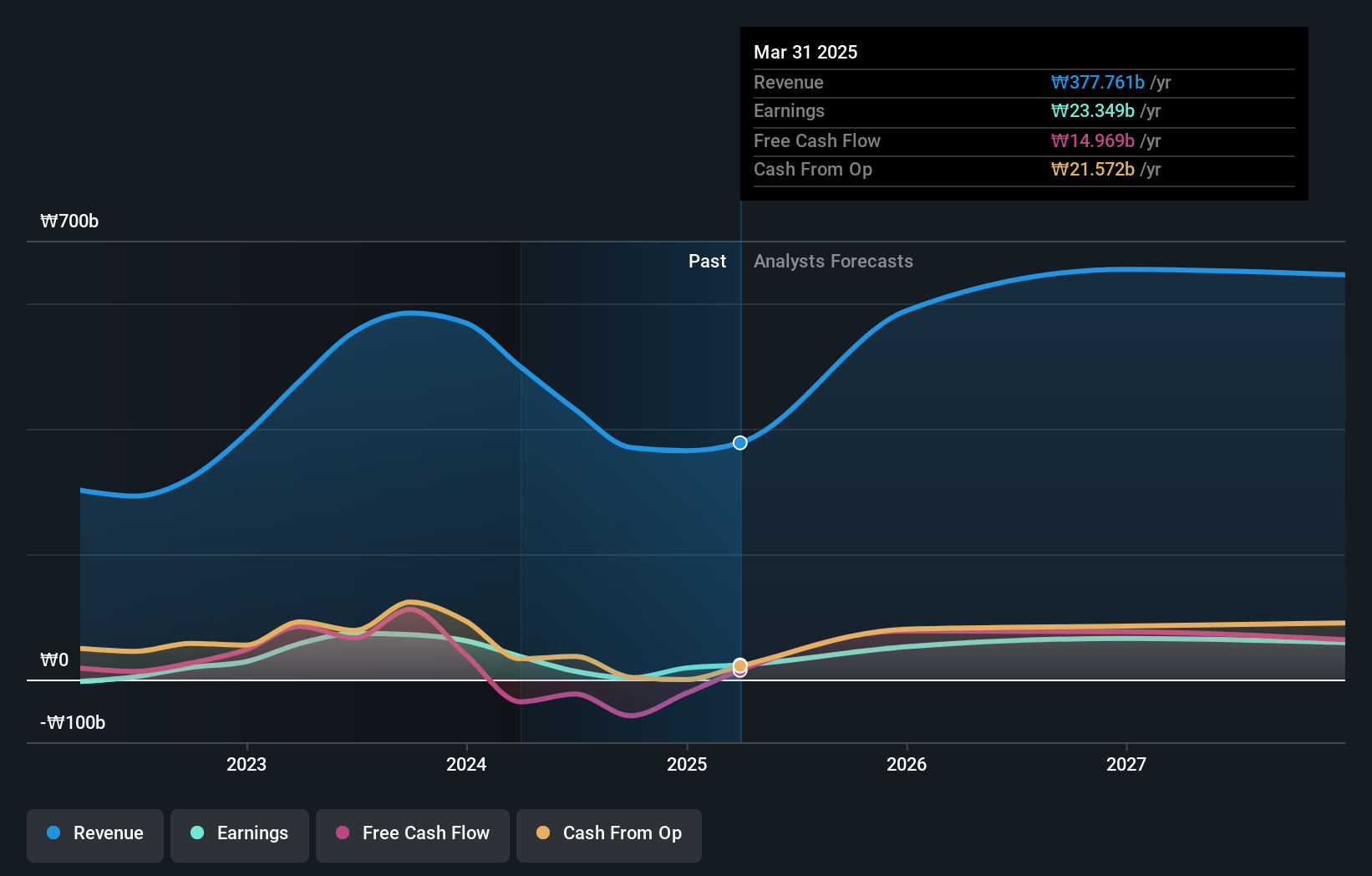

Operations: The company's revenue is primarily derived from the sales of solar glass, amounting to CN¥18.07 billion, and its solar farm business, including EPC services, which generates CN¥3.03 billion.

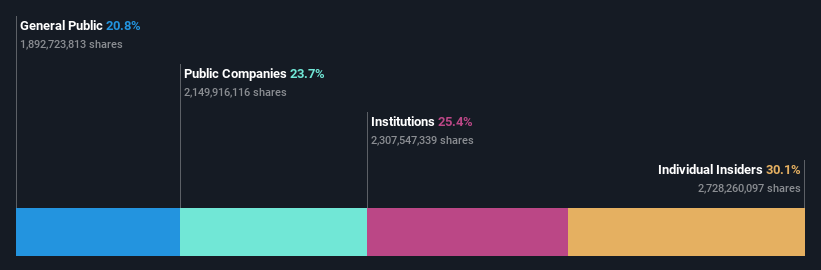

Insider Ownership: 26.8%

Xinyi Solar Holdings is expected to achieve profitability in three years, with earnings forecasted to grow by 57.09% annually. Despite trading at a good value compared to peers, the company's return on equity is projected to remain low at 7.5%. Recent results showed a decline in net income from CNY 1,810.81 million to CNY 745.76 million due to decreased solar glass prices and impairment losses, while revenue growth of 8.5% outpaces the Hong Kong market's average.

- Dive into the specifics of Xinyi Solar Holdings here with our thorough growth forecast report.

- According our valuation report, there's an indication that Xinyi Solar Holdings' share price might be on the cheaper side.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. focuses on the R&D, production, and sale of intelligent equipment and its components in China, with a market cap of CN¥20.56 billion.

Operations: Estun Automation generates revenue primarily from its Instrument and Meter Manufacturing segment, which amounts to CN¥4.25 billion.

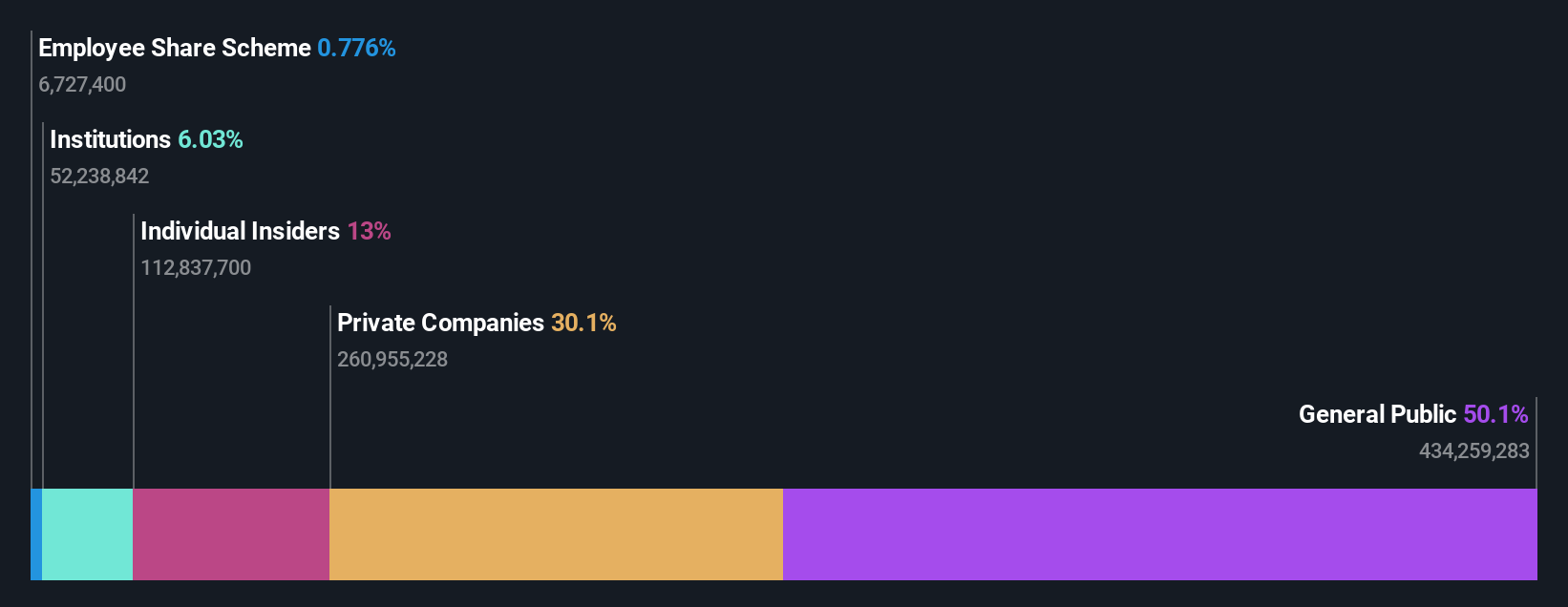

Insider Ownership: 13%

Estun Automation is poised for substantial growth, with earnings projected to increase by 74.78% annually and revenue expected to outpace the Chinese market at 13.8% per year. Despite low forecasted return on equity of 12.1%, insider ownership remains strong, with no significant insider trading activity recently reported. Recent amendments in company bylaws and the election of new independent directors suggest a strategic focus on governance improvements, potentially enhancing investor confidence in its growth trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Estun Automation.

- The analysis detailed in our Estun Automation valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Navigate through the entire inventory of 594 Fast Growing Asian Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:968

Xinyi Solar Holdings

An investment holding company, produces, sells, and trades in solar glass products in Mainland China, rest of Asia, North America, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives