- Sweden

- /

- Interactive Media and Services

- /

- OM:BETCO

Analyzing High Growth Tech Stocks In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious sentiment driven by the Federal Reserve's recent rate cut and ongoing political uncertainties, smaller-cap indexes have been particularly impacted, reflecting broader concerns about market durability. Amid these fluctuations, identifying high-growth tech stocks that can thrive involves looking for companies with robust innovation capabilities and strong adaptability to economic shifts, which are crucial in maintaining resilience during such volatile times.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1276 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★★☆

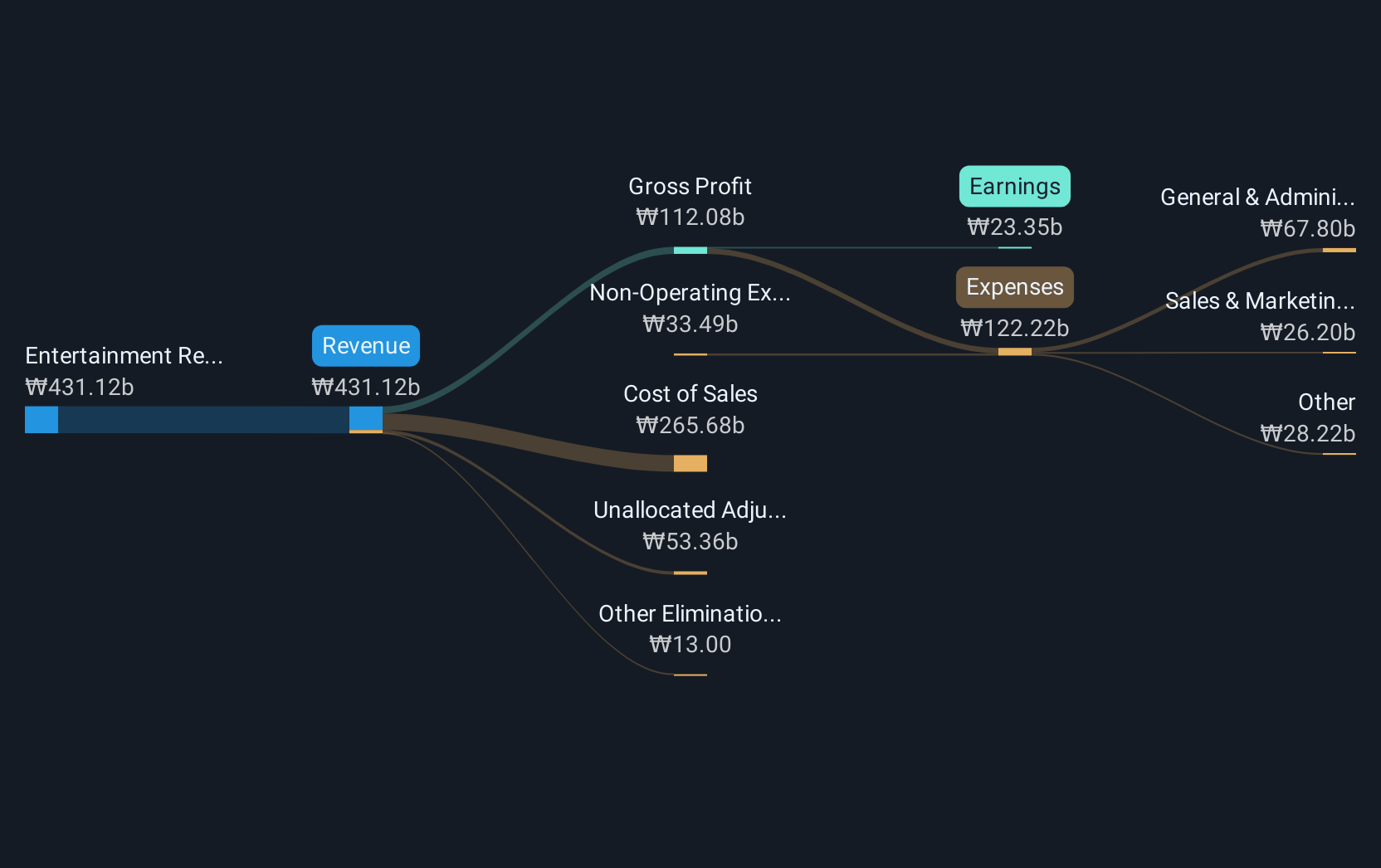

Overview: YG Entertainment Inc. is an entertainment company that operates in South Korea, Japan, and internationally with a market capitalization of approximately ₩850.37 billion.

Operations: YG Entertainment generates revenue primarily from entertainment-related activities, amounting to approximately ₩415.71 billion. The company operates across South Korea, Japan, and other international markets.

YG Entertainment has faced a challenging year with a significant net loss of KRW 1.73 billion, contrasting sharply with the previous year's net income of KRW 57.10 billion. Despite these setbacks, the company's revenue growth forecasts remain optimistic at 24.7% annually, outpacing the broader Korean market's growth rate of 8.9%. Furthermore, earnings are expected to surge by an impressive 98.7% per year over the next three years, highlighting potential for recovery and expansion in its operational sectors despite current financial volatilities and lower profit margins of just 0.7%, down from last year’s 12.2%.

- Get an in-depth perspective on YG Entertainment's performance by reading our health report here.

Understand YG Entertainment's track record by examining our Past report.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

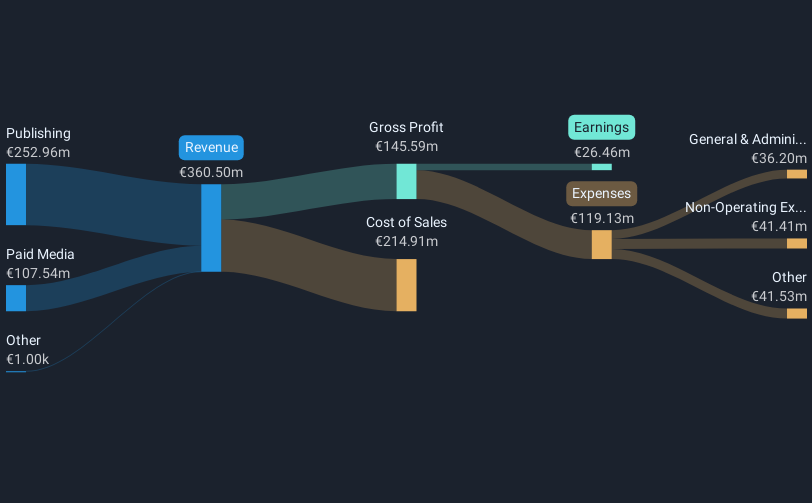

Overview: Better Collective A/S, along with its subsidiaries, operates as a digital sports media company across Europe, North America, and internationally, with a market cap of SEK 6.81 billion.

Operations: The company generates revenue primarily through its Publishing and Paid Media segments, with Publishing contributing €252.96 million and Paid Media €107.54 million.

Better Collective's recent performance reveals challenges and opportunities within the high-tech sector. Despite a dip in net income from EUR 3.11 million to EUR 1.12 million in Q3 and a downward revision in annual revenue forecasts, the company's sales grew to EUR 275.31 million over nine months, up from EUR 241.49 million year-over-year, indicating resilience in revenue generation. This growth is coupled with an ambitious earnings forecast, expecting a significant annual increase of 41.8%. However, amidst this growth trajectory, it's crucial to note the increased volatility in share price and a high debt level that could influence future operations and investor sentiment.

- Navigate through the intricacies of Better Collective with our comprehensive health report here.

Assess Better Collective's past performance with our detailed historical performance reports.

SEIKOH GIKEN (TSE:6834)

Simply Wall St Growth Rating: ★★★★☆☆

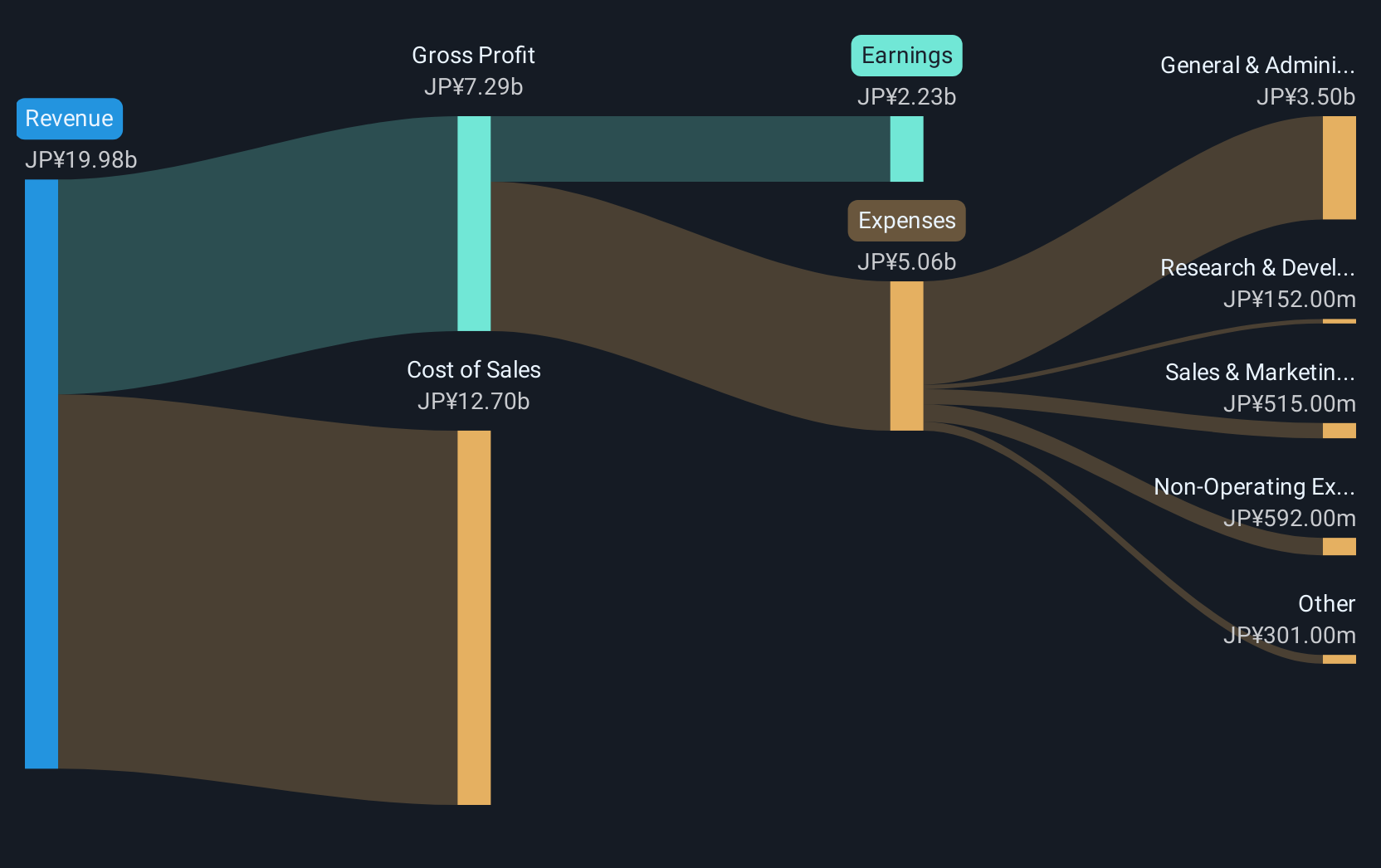

Overview: SEIKOH GIKEN Co., Ltd. is involved in the design, manufacture, and sale of optical components, lenses, and radio over fiber products both in Japan and internationally, with a market cap of ¥47.71 billion.

Operations: SEIKOH GIKEN generates revenue primarily from two segments: Optical Products Related, contributing approximately ¥8.23 billion, and Precision Machine Related, with around ¥8.78 billion in sales. The company focuses on both domestic and international markets for its optical components and precision machinery offerings.

SEIKOH GIKEN has demonstrated robust growth, with earnings surging by 67.8% over the past year, significantly outpacing the electronic industry's average decline of 2.2%. This performance is underpinned by a revenue increase forecasted at 10.8% annually, which is more than double the Japanese market prediction of 4.2%. The company's strategic focus on capital efficiency was highlighted in its recent actions to repurchase shares for ¥1,315 million, enhancing shareholder value and adapting to dynamic business conditions. This aggressive approach towards growth and operational flexibility positions SEIKOH GIKEN favorably in a competitive tech landscape.

- Dive into the specifics of SEIKOH GIKEN here with our thorough health report.

Examine SEIKOH GIKEN's past performance report to understand how it has performed in the past.

Where To Now?

- Dive into all 1276 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Better Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETCO

Better Collective

Operates as a digital sports media company in Europe, North America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion