- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3040

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex mix of economic signals including stronger-than-expected U.S. labor data and persistent inflation concerns, which have contributed to recent declines in major indices like the Nasdaq Composite and Russell 2000. As markets remain volatile with mixed performances across regions, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on discrepancies between market price and intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.11 | CN¥34.17 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.32 | TRY78.59 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.89 | 49.9% |

| Helens International Holdings (SEHK:9869) | HK$1.93 | HK$3.85 | 49.9% |

| Elekta (OM:EKTA B) | SEK61.10 | SEK122.02 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.93 | CN¥43.78 | 49.9% |

| Meriaura Group Oyj (OM:MERIS) | SEK0.49 | SEK0.98 | 50% |

| Constellium (NYSE:CSTM) | US$10.32 | US$20.58 | 49.9% |

| W5 Solutions (OM:W5) | SEK47.20 | SEK93.96 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

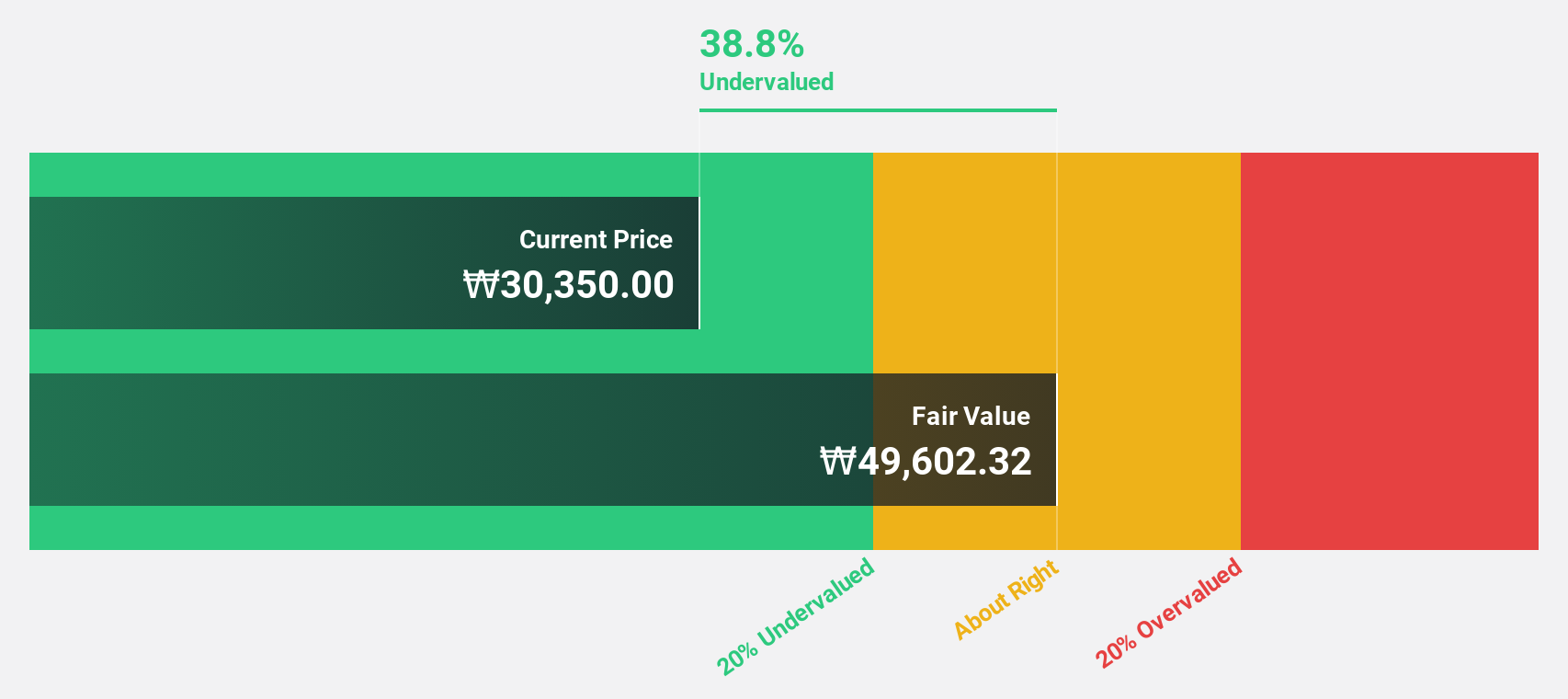

BHI (KOSDAQ:A083650)

Overview: BHI Co., Ltd. develops, manufactures, and supplies power plant equipment globally with a market cap of ₩531.59 billion.

Operations: Revenue Segments (in millions of ₩):

Estimated Discount To Fair Value: 29.9%

BHI Co., Ltd. is trading at ₩17,180, which is 29.9% below its estimated fair value of ₩24,511.3, suggesting it may be undervalued based on cash flows. Despite recent volatility in share price and interest payments not being well covered by earnings, the company reported significant earnings growth over the past year and forecasts indicate revenue will grow 23.1% annually—outpacing market expectations—and earnings are expected to rise significantly over the next three years.

- Our growth report here indicates BHI may be poised for an improving outlook.

- Click here to discover the nuances of BHI with our detailed financial health report.

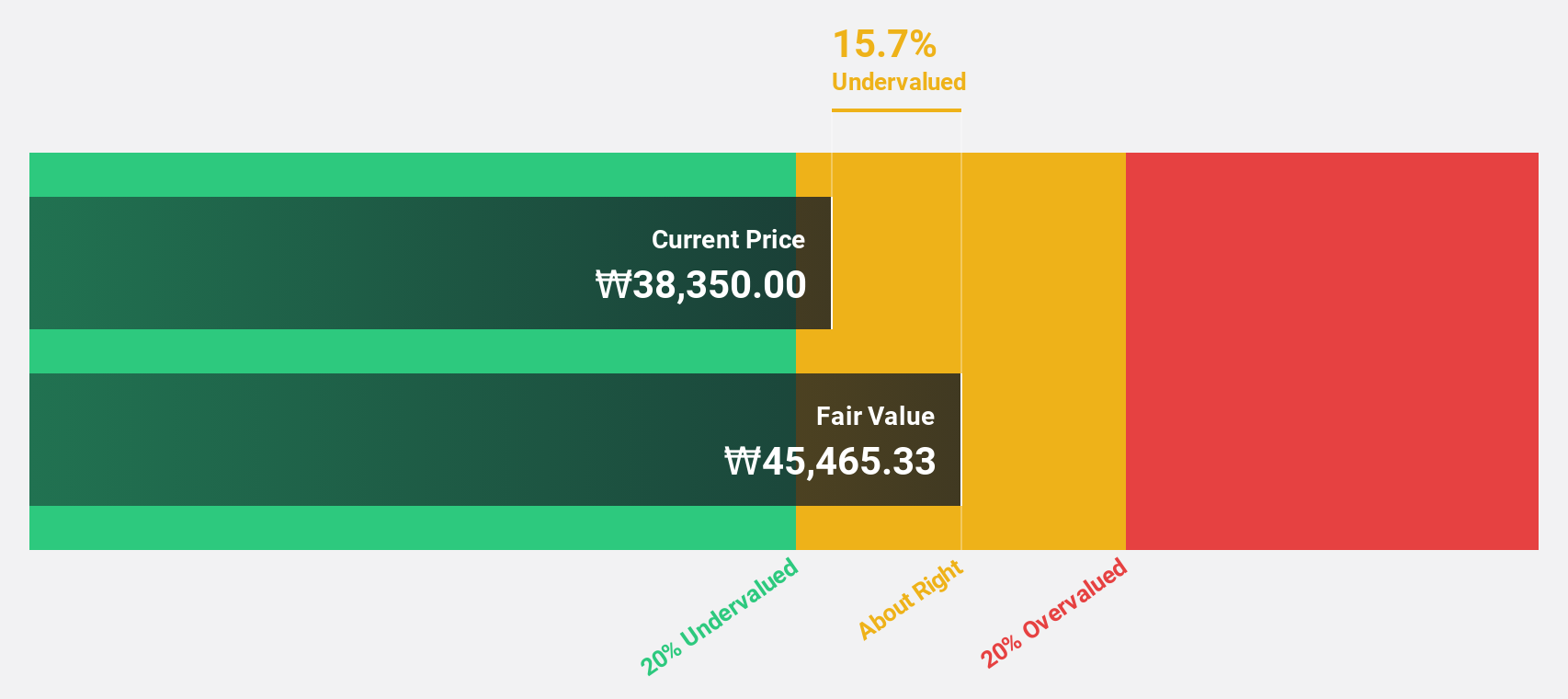

WemadeLtd (KOSDAQ:A112040)

Overview: Wemade Co., Ltd. is a company that develops and publishes games both in South Korea and internationally, with a market cap of ₩1.28 trillion.

Operations: The company's revenue is primarily derived from its Gaming Business segment, which generated ₩663.58 billion.

Estimated Discount To Fair Value: 27%

Wemade Ltd. is trading at ₩38,200, below its estimated fair value of ₩52,363.25, highlighting potential undervaluation based on cash flows. Recent earnings showed a stable net income for Q3 2024 despite a decrease in sales compared to the previous year. The company is forecasted to grow revenue faster than the Korean market at 12.2% annually and achieve profitability within three years with high expected earnings growth of 117.74% per year.

- According our earnings growth report, there's an indication that WemadeLtd might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of WemadeLtd.

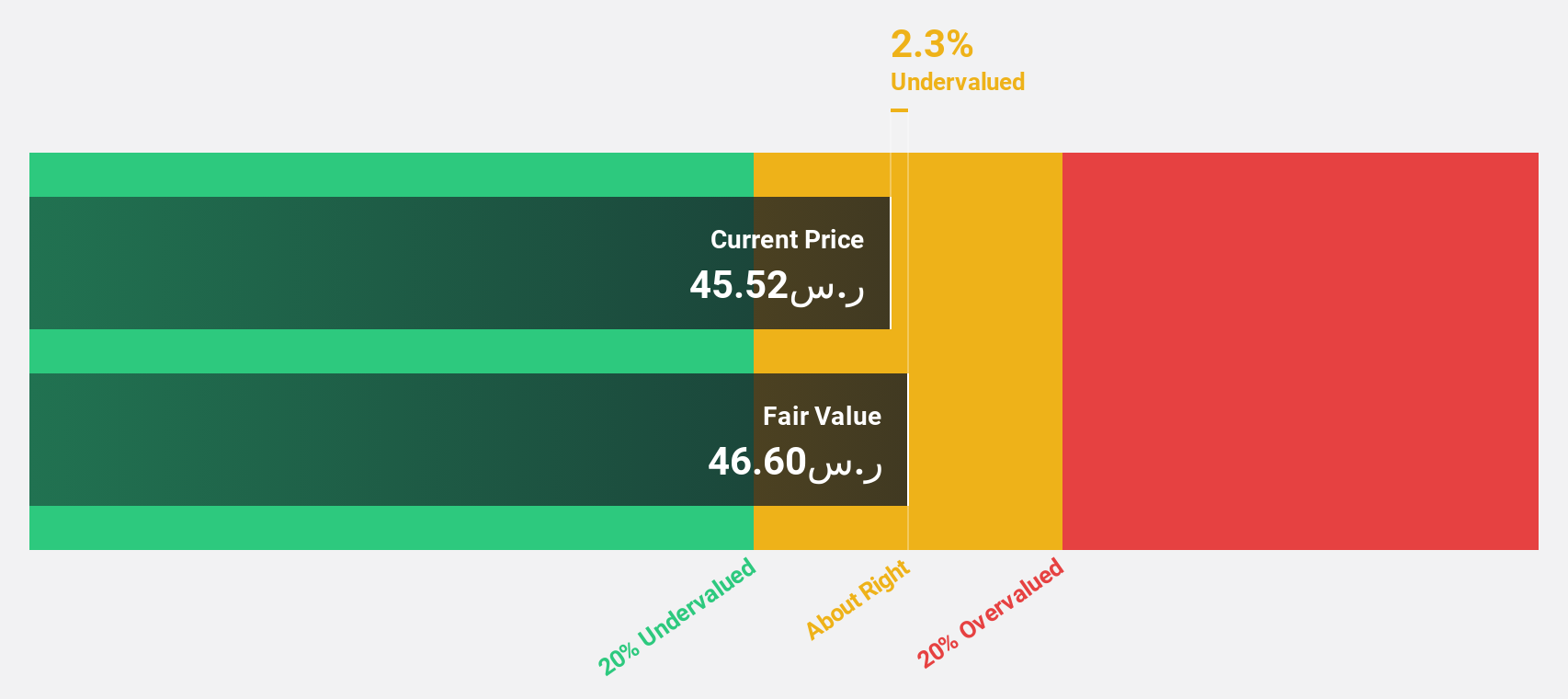

Qassim Cement (SASE:3040)

Overview: Qassim Cement Company manufactures and sells cement in the Kingdom of Saudi Arabia, with a market capitalization of SAR5.73 billion.

Operations: The company generates revenue primarily through its operating segment, amounting to SAR816.06 million.

Estimated Discount To Fair Value: 31.6%

Qassim Cement is trading at SAR52.2, significantly below its estimated fair value of SAR76.29, suggesting potential undervaluation based on cash flows. Despite recent shareholder dilution and a dividend not fully covered by free cash flows, the company shows robust growth prospects with earnings expected to rise 26.3% annually over the next three years. Revenue is also forecasted to grow faster than the Saudi market at 7.6% per year, supporting its investment appeal.

- Our comprehensive growth report raises the possibility that Qassim Cement is poised for substantial financial growth.

- Get an in-depth perspective on Qassim Cement's balance sheet by reading our health report here.

Summing It All Up

- Explore the 870 names from our Undervalued Stocks Based On Cash Flows screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qassim Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3040

Qassim Cement

Engages in the manufacture and selling of cement in the Kingdom of Saudi Arabia.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives