- South Korea

- /

- Media

- /

- KOSDAQ:A066790

Revenues Not Telling The Story For Korea Cable T.V Chung-Buk System Co., Ltd. (KOSDAQ:066790) After Shares Rise 142%

The Korea Cable T.V Chung-Buk System Co., Ltd. (KOSDAQ:066790) share price has done very well over the last month, posting an excellent gain of 142%. The last 30 days were the cherry on top of the stock's 851% gain in the last year, which is nothing short of spectacular.

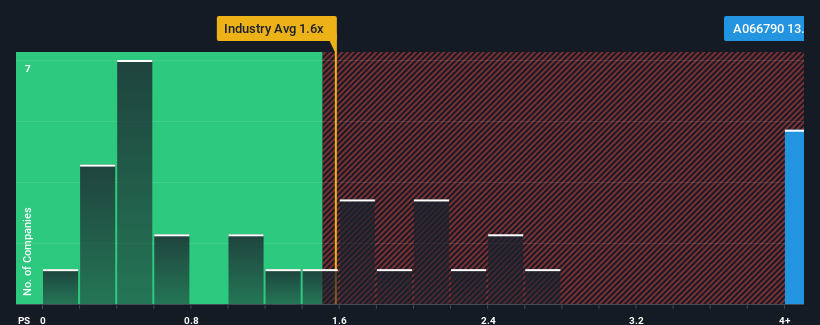

After such a large jump in price, you could be forgiven for thinking Korea Cable T.V Chung-Buk System is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.4x, considering almost half the companies in Korea's Media industry have P/S ratios below 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Korea Cable T.V Chung-Buk System

What Does Korea Cable T.V Chung-Buk System's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Korea Cable T.V Chung-Buk System, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Korea Cable T.V Chung-Buk System's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Korea Cable T.V Chung-Buk System would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 3.8% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

In contrast to the company, the rest of the industry is expected to grow by 4.7% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Korea Cable T.V Chung-Buk System's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Shares in Korea Cable T.V Chung-Buk System have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Korea Cable T.V Chung-Buk System currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Korea Cable T.V Chung-Buk System (1 is concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Korea Cable T.V Chung-Buk System might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A066790

Korea Cable T.V Chung-Buk System

Korea Cable T.V Chung-Buk System Co., Ltd.

Adequate balance sheet low.