- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

Exploring Three High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and monetary policy adjustments, the technology-heavy Nasdaq Composite has defied broader declines by reaching record highs, underscoring the continued strength of growth stocks over value counterparts. In this dynamic environment, identifying high-growth tech stocks with robust potential can be a strategic move for investors seeking to enhance their portfolios amidst shifting market sentiments and economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1314 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CJ ENM (KOSDAQ:A035760)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CJ ENM CO., Ltd. operates in media, film, music, convention, performing arts, and commerce sectors in South Korea with a market capitalization of approximately ₩1.28 trillion.

Operations: The company generates revenue from various segments, with the Movie Drama Business and Media Platform Business contributing significantly at ₩1.56 trillion and ₩1.54 trillion, respectively. The Commerce Business also plays a substantial role, bringing in approximately ₩1.48 trillion.

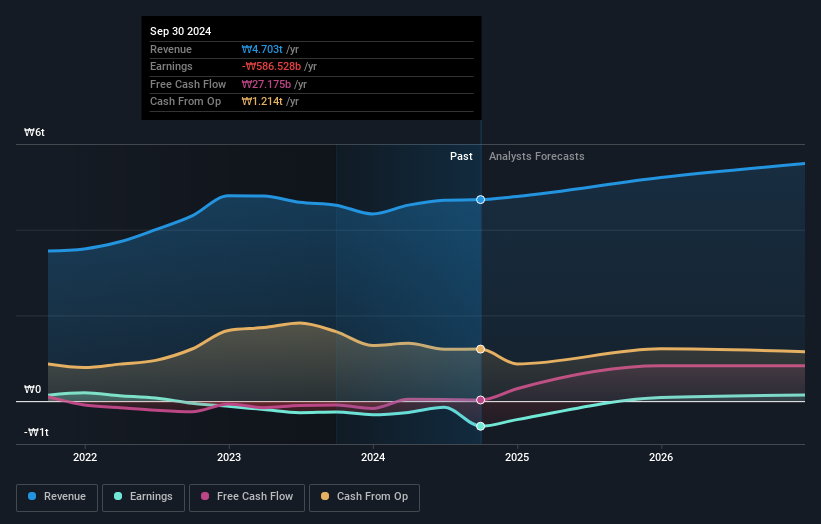

CJ ENM's recent financial performance reveals a challenging landscape, with third-quarter sales increasing to KRW 556.66 million from KRW 486.26 million year-over-year, yet the company faced a significant net loss of KRW 482.85 billion compared to KRW 40.65 billion in the same period last year. Despite these hurdles, forecasts suggest an optimistic future with expected revenue growth at an annual rate of 7.6%, outpacing the Korean market's average of 5.2%. Moreover, CJ ENM is projected to transition from its current unprofitable status to profitability within three years, coupled with an anticipated earnings growth of 109.16% annually. This potential turnaround is underpinned by positive free cash flow and strategic adjustments aimed at enhancing operational efficiency and market competitiveness.

- Take a closer look at CJ ENM's potential here in our health report.

Gain insights into CJ ENM's historical performance by reviewing our past performance report.

Samsung Electro-Mechanics (KOSE:A009150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samsung Electro-Mechanics Co., Ltd. is a global manufacturer and seller of electronic components, operating across regions including Korea, China, Southeast Asia, Japan, the Americas, and Europe with a market capitalization of approximately ₩9.33 trillion.

Operations: The company generates revenue through three main segments: Component Solution, Package Solution, and Optical Communication Solution, with the Component Solution segment contributing the highest at ₩4.36 trillion.

Samsung Electro-Mechanics has demonstrated robust growth with a notable increase in sales to KRW 302.25 billion over nine months, up from KRW 220.18 billion the previous year, reflecting a dynamic market presence. Despite a dip in net income this quarter to KRW 115.20 billion from KRW 155.53 billion, the company's strategic innovations, particularly in developing ultra-compact all-solid-state batteries for wearables, underscore its commitment to leading-edge technology. These batteries match the energy density of traditional lithium-ion counterparts but offer enhanced safety and design flexibility—key attributes as devices shrink and consumer demand for reliable, portable power solutions intensifies. This focus on miniaturization and safety through advanced R&D could significantly shape future tech trends in personal electronics.

- Click to explore a detailed breakdown of our findings in Samsung Electro-Mechanics' health report.

Assess Samsung Electro-Mechanics' past performance with our detailed historical performance reports.

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elite Material Co., Ltd. is involved in the production and sale of copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across Taiwan, China, and international markets with a market cap of NT$212.31 billion.

Operations: Elite Material Co., Ltd. generates revenue primarily from its domestic segment and foreign departments, with the latter contributing significantly more at NT$54.56 billion compared to NT$14.61 billion from domestic operations. The company is a key player in producing copper clad laminates and electronic components, serving both local and international markets.

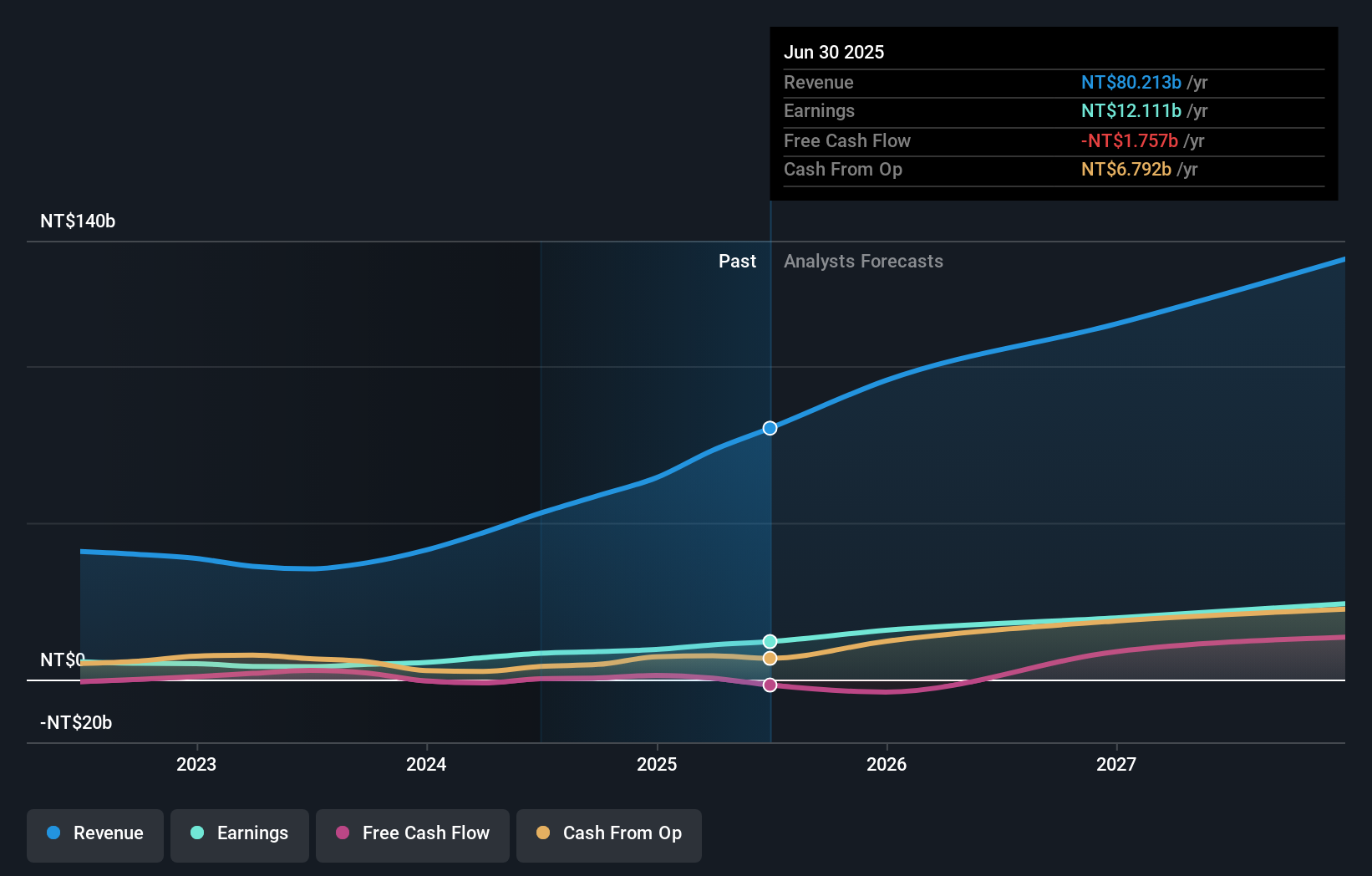

Elite Material Co., Ltd. has shown remarkable performance with a 61% increase in sales to TWD 45.81 billion over nine months, up from TWD 28.41 billion in the previous period, reflecting strong market adoption and strategic positioning. The company's commitment to innovation is evident as R&D expenses surged by 20%, supporting advancements in high-performance materials crucial for next-generation electronics. This focus on research has not only fueled substantial revenue growth of 13.4% annually but also an impressive earnings increase of 14.6% per year, outpacing the broader Taiwanese market significantly. With recent presentations at major investment forums and technology conferences, Elite Material is actively engaging with global investors and industry peers, showcasing its leadership in material science for tech applications—a key driver expected to sustain its growth trajectory into the future.

- Delve into the full analysis health report here for a deeper understanding of Elite Material.

Gain insights into Elite Material's past trends and performance with our Past report.

Summing It All Up

- Discover the full array of 1314 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives