- China

- /

- Construction

- /

- SZSE:003013

Identifying Undiscovered Gems on None in November 2024

Reviewed by Simply Wall St

As global markets continue to experience broad-based gains, with smaller-cap indexes outperforming large-caps, investors are increasingly turning their attention to the potential of small-cap stocks. In this dynamic environment, identifying undiscovered gems requires a keen understanding of market trends and an eye for companies that demonstrate resilience and growth potential amidst economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

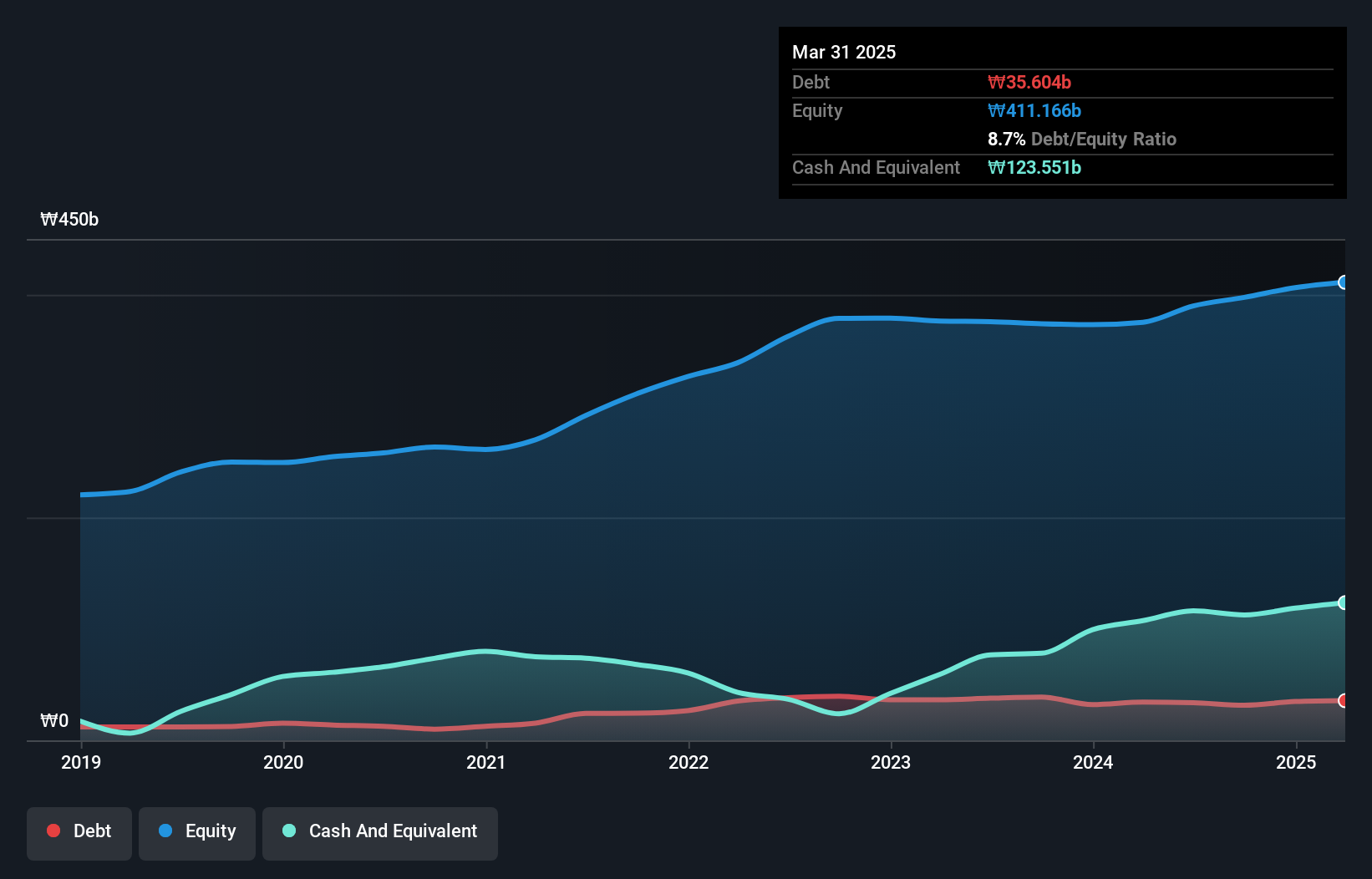

Miwon Specialty Chemical (KOSE:A268280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Miwon Specialty Chemical Co., Ltd. focuses on producing and supplying basic raw materials for UV/EB curing systems both in Korea and internationally, with a market cap of ₩668.50 billion.

Operations: The company generates revenue primarily from the production and supply of raw materials for UV/EB curing systems. Its market cap stands at ₩668.50 billion.

Miwon Specialty Chemical has shown impressive earnings growth of 236.6% over the past year, outpacing the chemicals industry average of 21.4%. Despite a debt-to-equity ratio increase from 5% to 7.9% over five years, it holds more cash than total debt, ensuring financial stability. The company recently announced a share repurchase program to enhance shareholder value and stabilize stock prices, planning to buy back up to 20,000 shares by January 2025. With positive free cash flow and high-quality earnings reported, Miwon seems well-positioned in its niche market segment for future opportunities.

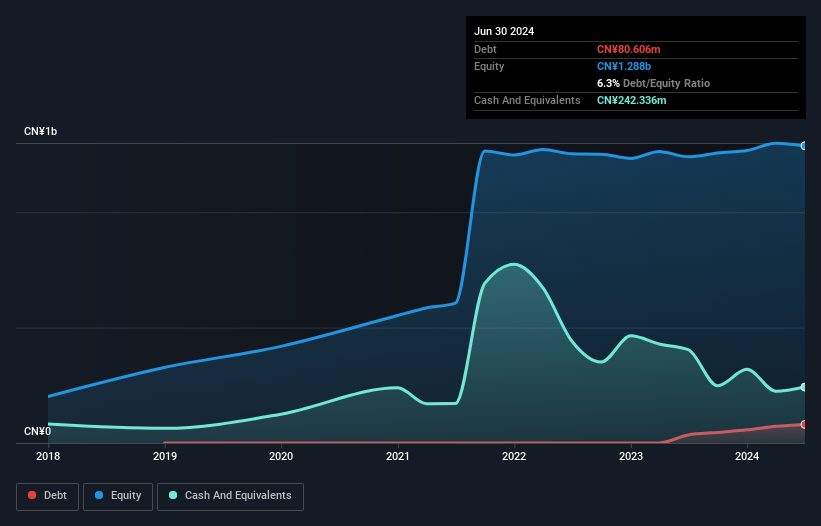

Guangdong Hongxing Industrial (SZSE:001209)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangdong Hongxing Industrial Co., Ltd. is a company that focuses on the manufacturing and sale of knitted apparel in China, with a market capitalization of approximately CN¥1.88 billion.

Operations: The company's primary revenue stream is from its textile and apparel segment, generating approximately CN¥1.64 billion. The net profit margin shows a trend worth noting, reflecting the company's financial efficiency in converting revenue into actual profit.

Guangdong Hongxing Industrial, a smaller player in the market, has shown impressive earnings growth of 125.4% over the past year, outpacing the Luxury industry’s 3.3%. Despite an increase in its debt-to-equity ratio from 0% to 6.3% over five years, it holds more cash than total debt, suggesting a solid financial footing. The company recently completed a share buyback of approximately 2.93 million shares for ¥41.92 million (about US$5.74 million). With net income rising to ¥62.76 million (around US$8.60 million) for the first half of 2024 compared to last year’s figures, this entity seems poised for continued performance improvement within its sector.

- Click here to discover the nuances of Guangdong Hongxing Industrial with our detailed analytical health report.

Learn about Guangdong Hongxing Industrial's historical performance.

Guangzhou Metro Design & Research Institute (SZSE:003013)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Metro Design & Research Institute Co., Ltd. (SZSE:003013) specializes in engineering services with a market capitalization of CN¥6.37 billion.

Operations: The company generates revenue primarily from engineering services, totaling CN¥2.63 billion.

With a price-to-earnings ratio of 14.4x, Guangzhou Metro Design & Research Institute stands out against the broader CN market average of 35.2x, suggesting it trades at a more attractive valuation. Over the past year, earnings grew by 3.4%, surpassing the construction industry's -4.1% performance, indicating robust sector positioning. Despite an increase in debt to equity from 0% to 23.6% over five years, the company remains financially sound with more cash than total debt and positive free cash flow recently reported at CNY 9 million for September 2024. Recent board changes may also herald strategic shifts enhancing future prospects.

Make It Happen

- Discover the full array of 4638 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003013

Guangzhou Metro Design & Research Institute

Guangzhou Metro Design & Research Institute Co., Ltd.

Excellent balance sheet with proven track record.