- South Korea

- /

- Metals and Mining

- /

- KOSE:A103140

Poongsan Corporation's (KRX:103140) Shares Climb 32% But Its Business Is Yet to Catch Up

Despite an already strong run, Poongsan Corporation (KRX:103140) shares have been powering on, with a gain of 32% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

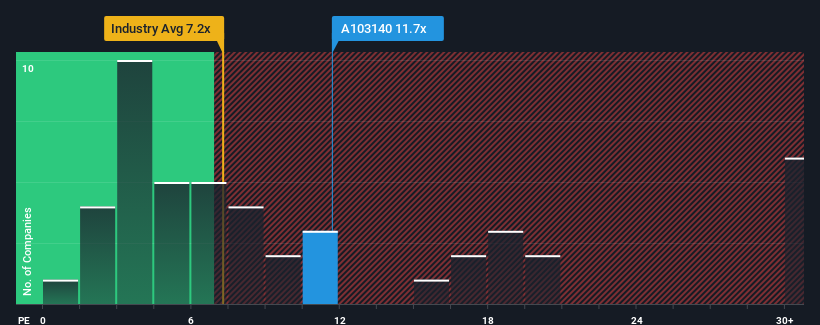

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Poongsan's P/E ratio of 11.7x, since the median price-to-earnings (or "P/E") ratio in Korea is also close to 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Poongsan has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Poongsan

Is There Some Growth For Poongsan?

In order to justify its P/E ratio, Poongsan would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's bottom line. Even so, admirably EPS has lifted 123% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 9.3% each year over the next three years. With the market predicted to deliver 21% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Poongsan is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Poongsan's P/E?

Poongsan's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Poongsan's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Poongsan that we have uncovered.

If you're unsure about the strength of Poongsan's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A103140

Poongsan

Develops, manufactures, markets, exports, and sells fabricated non-ferrous metal, commercial ammunition, and defense products in South Korea and internationally.

Solid track record with excellent balance sheet.