- South Korea

- /

- Metals and Mining

- /

- KOSE:A103140

Improved Earnings Required Before Poongsan Corporation (KRX:103140) Stock's 28% Jump Looks Justified

Poongsan Corporation (KRX:103140) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 27%.

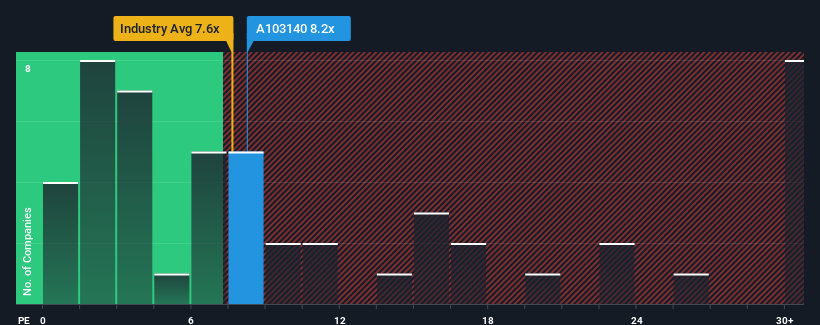

Even after such a large jump in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Poongsan as an attractive investment with its 8.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Poongsan's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

View our latest analysis for Poongsan

Is There Any Growth For Poongsan?

There's an inherent assumption that a company should underperform the market for P/E ratios like Poongsan's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Even so, admirably EPS has lifted 257% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 6.8% over the next year. Meanwhile, the rest of the market is forecast to expand by 35%, which is noticeably more attractive.

With this information, we can see why Poongsan is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Poongsan's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Poongsan maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Poongsan that you need to take into consideration.

If these risks are making you reconsider your opinion on Poongsan, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A103140

Poongsan

Develops, manufactures, markets, exports, and sells fabricated non-ferrous metal, commercial ammunition, and defense products in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives