- South Korea

- /

- Chemicals

- /

- KOSE:A100250

Read This Before Considering Chinyang Holdings Corp. (KRX:100250) For Its Upcoming ₩120 Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Chinyang Holdings Corp. (KRX:100250) is about to go ex-dividend in just 3 days. You can purchase shares before the 29th of December in order to receive the dividend, which the company will pay on the 8th of April.

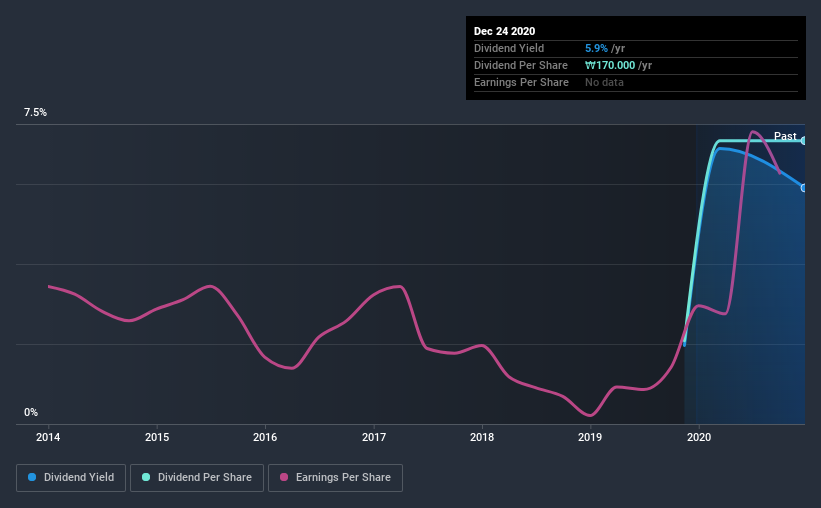

Chinyang Holdings's next dividend payment will be ₩120 per share, on the back of last year when the company paid a total of ₩170 to shareholders. Calculating the last year's worth of payments shows that Chinyang Holdings has a trailing yield of 5.9% on the current share price of ₩2880. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Chinyang Holdings can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Chinyang Holdings

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Chinyang Holdings's payout ratio is modest, at just 29% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Over the past year it paid out 164% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Chinyang Holdings does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

Chinyang Holdings paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Chinyang Holdings to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit Chinyang Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For this reason, we're glad to see Chinyang Holdings's earnings per share have risen 17% per annum over the last five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Unfortunately Chinyang Holdings has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

The Bottom Line

Should investors buy Chinyang Holdings for the upcoming dividend? We're glad to see the company has been improving its earnings per share while also paying out a low percentage of income. However, it's not great to see it paying out what we see as an uncomfortably high percentage of its cash flow. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

So while Chinyang Holdings looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. In terms of investment risks, we've identified 2 warning signs with Chinyang Holdings and understanding them should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Chinyang Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A100250

Chinyang Holdings

Through its subsidiaries, engages in the manufacture and sale of plastic and automotive part products.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives