As global markets experience broad-based gains with U.S. indexes approaching record highs, investor sentiment is buoyed by strong labor market reports and stabilizing economic conditions. In this environment, growth companies with high insider ownership are particularly intriguing as they often indicate confidence from those closest to the business, potentially aligning well with the current market optimism.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's uncover some gems from our specialized screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various regions including Europe and the United States, with a market cap of approximately €1.33 billion.

Operations: The company generates revenue primarily from its oncology segment, amounting to €154.75 million.

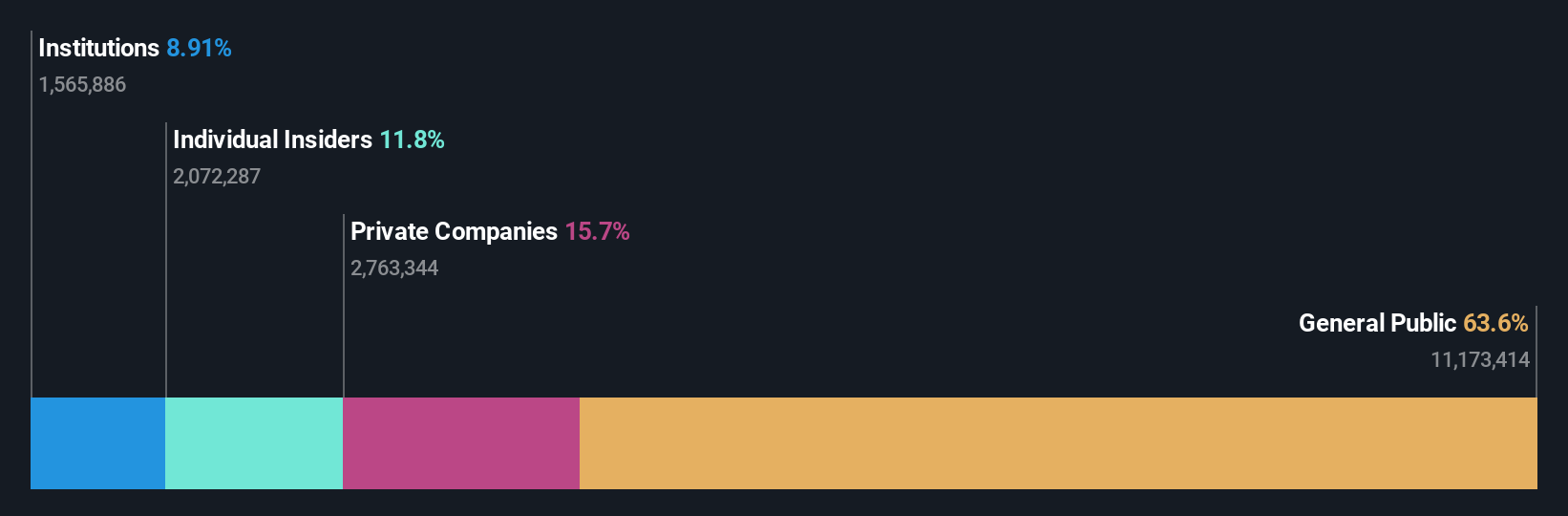

Insider Ownership: 11.8%

Pharma Mar's revenue is forecast to grow at 26% annually, outpacing the Spanish market's 4.9%. Despite a drop in profit margins from 8.3% to 0.4%, earnings are expected to grow significantly over the next three years, with a high return on equity projected at 35.4%. Recent positive clinical trial results for Zepzelca® could bolster future growth prospects. The stock trades at a substantial discount to its estimated fair value, though it remains highly volatile.

- Click here to discover the nuances of Pharma Mar with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Pharma Mar's current price could be quite moderate.

Foosung (KOSE:A093370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foosung Co., Ltd., along with its subsidiaries, manufactures and sells chemical products for the automotive, iron and steel, semiconductor, construction, and environmental industries in South Korea, with a market cap of approximately ₩612.43 billion.

Operations: The company's revenue segments consist of Chemical Equipment generating approximately ₩167.17 million and Fluorine Compounds contributing around ₩300.83 million.

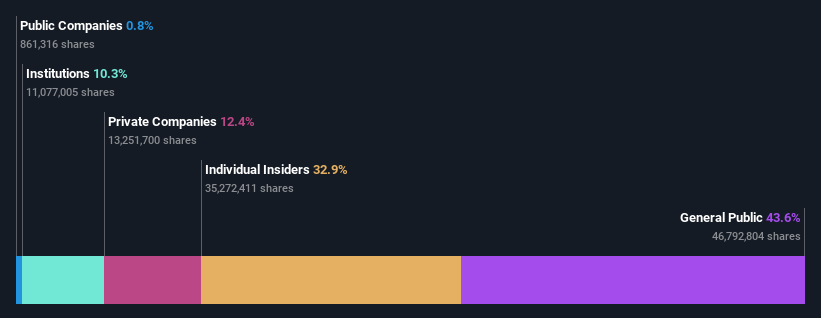

Insider Ownership: 32.9%

Foosung's recent earnings reveal significant improvement, with nine-month net income of KRW 6.54 billion compared to a substantial loss last year. Revenue is expected to grow at 15.5% annually, outpacing the Korean market average of 9.1%. However, the company's debt coverage by operating cash flow remains inadequate and its return on equity is forecasted to be low at 6.9% in three years. Despite no recent insider trading activity, profitability is anticipated within three years.

- Click here and access our complete growth analysis report to understand the dynamics of Foosung.

- Our valuation report unveils the possibility Foosung's shares may be trading at a premium.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions and special electronics for the security and defense sectors, with a market cap of SEK4.58 billion.

Operations: The company's revenue is primarily derived from its Computer Hardware segment, which generated SEK1.14 billion.

Insider Ownership: 16.9%

MilDef Group is experiencing robust growth, with revenue expected to increase by 34.1% annually, outpacing the Swedish market. Recent contracts with the Swedish and Central European defense sectors enhance its strategic position. However, despite a promising earnings growth forecast of 61.7% per year, MilDef's return on equity is projected to remain modest at 15.8%. The company completed a significant SEK 499.99 million follow-on equity offering to support its expansion initiatives without substantial recent insider trading activity.

- Take a closer look at MilDef Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that MilDef Group's share price might be on the expensive side.

Make It Happen

- Embark on your investment journey to our 1520 Fast Growing Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, engages in the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, Italy, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with adequate balance sheet.