- South Korea

- /

- Chemicals

- /

- KOSE:A083420

We Think You Should Be Aware Of Some Concerning Factors In Green Chemical's (KRX:083420) Earnings

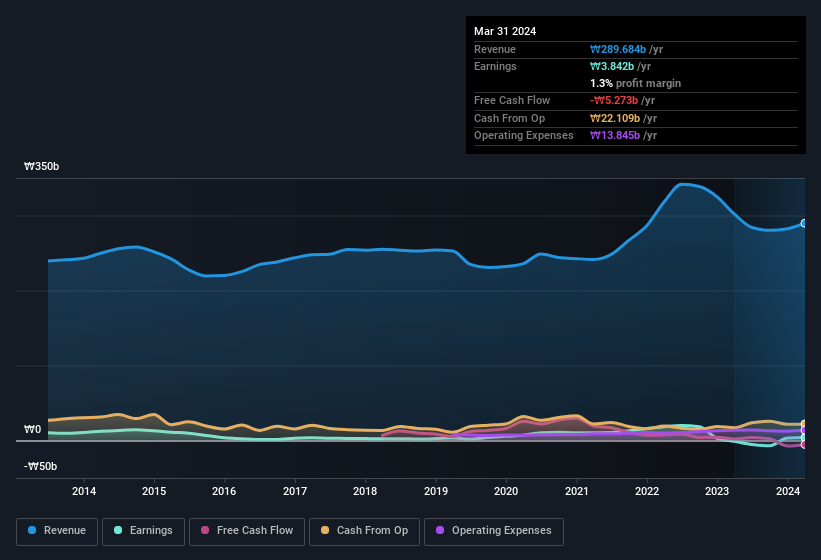

The market for Green Chemical Co., Ltd.'s (KRX:083420) stock was strong after it released a healthy earnings report last week. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

Check out our latest analysis for Green Chemical

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Green Chemical's profit was reduced by ₩591m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Green Chemical doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Green Chemical.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Green Chemical received a tax benefit of ₩1.9b. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Green Chemical's Profit Performance

In the last year Green Chemical received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Having said that, it also had a unusual item reducing its profit. Based on these factors, we think it's very unlikely that Green Chemical's statutory profits make it seem much weaker than it is. If you want to do dive deeper into Green Chemical, you'd also look into what risks it is currently facing. Our analysis shows 4 warning signs for Green Chemical (1 is potentially serious!) and we strongly recommend you look at them before investing.

Our examination of Green Chemical has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

If you're looking to trade Green Chemical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A083420

Green Chemical

Produces and sells ethylene oxide adducts (EOA), ethanolamines, dimethyl carbonates, and acrylate monomers in South Korea.

Excellent balance sheet with proven track record.