David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Green Chemical Co., Ltd. (KRX:083420) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Green Chemical

How Much Debt Does Green Chemical Carry?

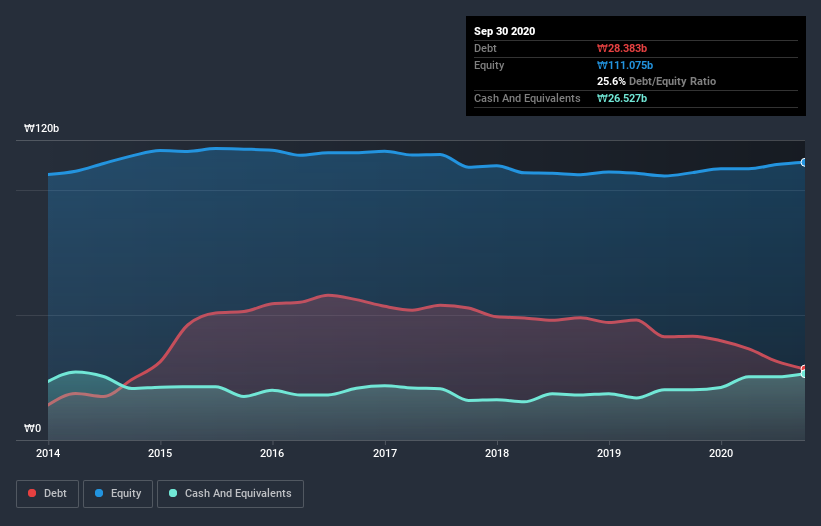

As you can see below, Green Chemical had ₩28.4b of debt at September 2020, down from ₩41.5b a year prior. However, because it has a cash reserve of ₩26.5b, its net debt is less, at about ₩1.86b.

How Strong Is Green Chemical's Balance Sheet?

According to the last reported balance sheet, Green Chemical had liabilities of ₩52.2b due within 12 months, and liabilities of ₩12.4b due beyond 12 months. Offsetting these obligations, it had cash of ₩26.5b as well as receivables valued at ₩32.5b due within 12 months. So its liabilities total ₩5.56b more than the combination of its cash and short-term receivables.

Of course, Green Chemical has a market capitalization of ₩145.9b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. But either way, Green Chemical has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With debt at a measly 0.06 times EBITDA and EBIT covering interest a whopping 32.4 times, it's clear that Green Chemical is not a desperate borrower. So relative to past earnings, the debt load seems trivial. Even more impressive was the fact that Green Chemical grew its EBIT by 196% over twelve months. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Green Chemical will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Green Chemical actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Green Chemical's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! It looks Green Chemical has no trouble standing on its own two feet, and it has no reason to fear its lenders. To our minds it has a healthy happy balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Green Chemical you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Green Chemical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A083420

Green Chemical

Produces and sells ethylene oxide adducts (EOA), ethanolamines, dimethyl carbonates, and acrylate monomers in South Korea.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives